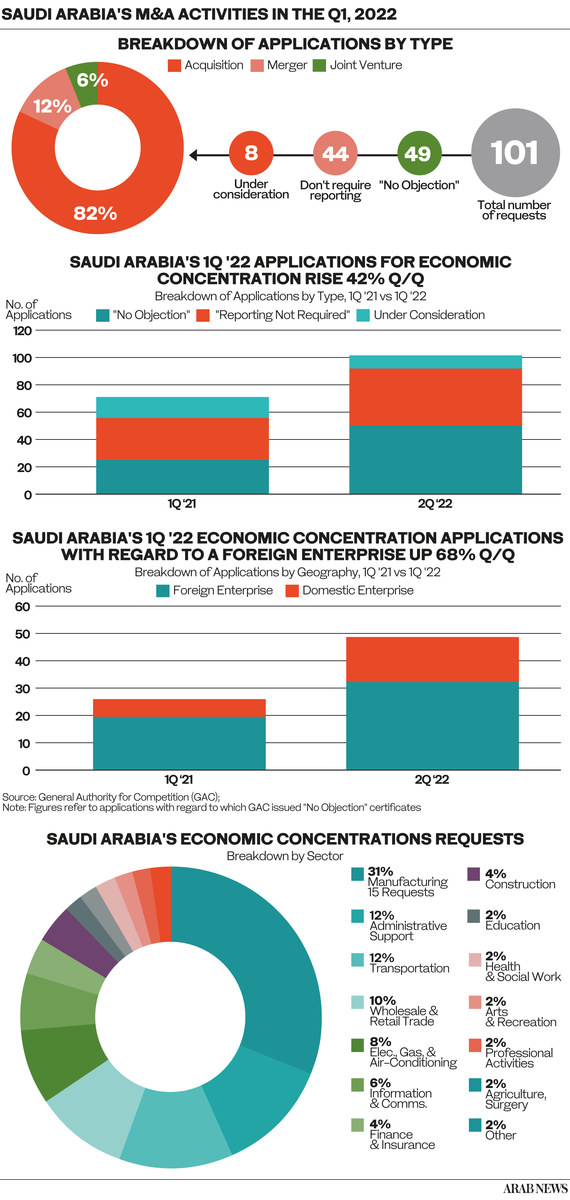

RIYADH: Saudi Arabia’s General Authority for Competition approved 49 applications for mergers and acquisitions in the first quarter of 2022, an 88-percent jump from a year ago.

The authority, known as GAC, received 101 application for economic concentration in the first quarter of 2022. This is 42 percent more than in the same quarter a year ago, it said in a report.

Economic concentrations include mergers and acquisitions and joint ventures.

As the Authority considered the said 101 application during the first quarter of 2022, it issued certificates of “no objection” for 49 applications while it treated 44 applications as “not requiring reporting.”

For the time being, the remaining 8 applications are still being considered by the Authority.

Out of a total 49 certificates of “no objection” issued by GAC during the first quarter of 2022, 40 — or 82 percent of all such certificates — were issued in relation to applications for acquisition.

At the same time, 6 “no objection” certificates were issued in relation to applications for merger, while the remaining 3 certificates in relation to the applications for joint ventures.

Furthermore, 32 applications or 65 percent of all applications with in relation to which GAC issued “no objection” certificates, were applications for the establishment of foreign enterprises.

This is an increase of 68 percent compared to the first quarter of 2021.

The remaining 17 applications — an increase of 142 percent year-on-year — were applications for the establishment of national or domestic enterprises.