RIYADH: Following the consequence of the Russian-Ukrainian conflict and the GCC import ban, Lebanon is keen on restoring trade ties with Saudi Arabia that in 2020 amounted to over $200 million in exports.

In an interview with Arab News, Lebanese Minister of Economy and Trade Amin Salam said he is “working diligently to improve economic relations with the GCC countries, particularly with Saudi Arabia.”

The country has been stuck in an economic sandstorm that has clouded the region because of the inflationary climate and the impoverished import-export situation.

It has been in dire straits since the economic crisis of 2019 that led to the devaluation of the Lebanese pound and soaring consumer goods prices, making it one of the world’s worst economic crises, found the World Bank.

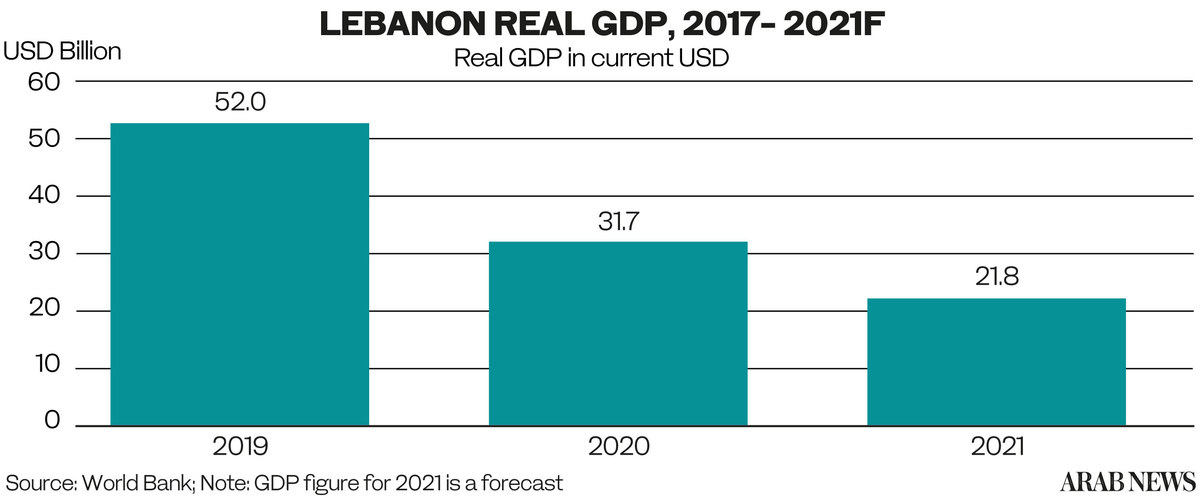

In value terms, Lebanon’s GDP fell from about $52 billion in 2019 to $33.38 billion in 2020 and an estimate of $21.8 billion in 2021, the most significant decrease among 193 nations.

This meltdown, coupled with the Beirut port blast of August 2020, described as the world’s largest non-nuclear explosion, impacted 56 percent of the private businesses in Beirut and slowed down the operations of Beirut port, announced a Human Rights Watch, HRW, study.

According to the World Bank’s Lebanon Economic Monitor, the country’s intended downturn was also fueled by the country’s elite, who have long seized power and profited from the nation’s economic rents.

Lebanese-GCC economic ties

Besides Lebanese politicians enduring several global sanctions, the country also lost trade ties with the GCC following attempts to smuggle drugs, particularly Captagon, into the region. To wipe out its chequered past, it is now on a revival mission to restore these economic partnerships.

The Lebanese authorities have been actively combating drug smuggling to the GCC and Saudi Arabia. Last January, Internal Security Forces in Lebanon foiled an attempt to smuggle large numbers of Captagon tablets via Jordan in a coffee cargo bound for Saudi Arabia.

The beleaguered country knows that it can only resume trade with Saudi Arabia and other Gulf countries after earning the legitimacy of a drug-free and terror-free nation.

Lebanese Minister of Economy and Trade also highlighted the importance of Saudi Arabia in Lebanon’s import-export trade balance.

“While comparing bilateral trade, Saudi Arabia is probably the only country with a perfect trade balance with Lebanon,” he added.

The mechanism for improving these trade ties, according to Salam, is “an ongoing exercise because there’s a trust element that needs to be earned.”

“We are very optimistic that on the economy front, we will manage to get through this. And we will get back on track with Saudi Arabia,” he added.

Depleting food basket

The international forex trade has been highly volatile and southbound following the Russian-Ukrainian war and increased oil and commodities prices.

What makes the issue more grave is the current wheat reserves of Lebanon can only last for 45-60 days as 60 percent of the country’s wheat imports came from Ukraine, pointed out Salam.

However, he appealed to the Lebanese citizens to not get afraid of the shortage, assuring them that his ministry is importing 50,000 tons of wheat, which the ministry is working on concluding next week.

“There’s no need to go into panic mode on food shortage,” assured Salam.

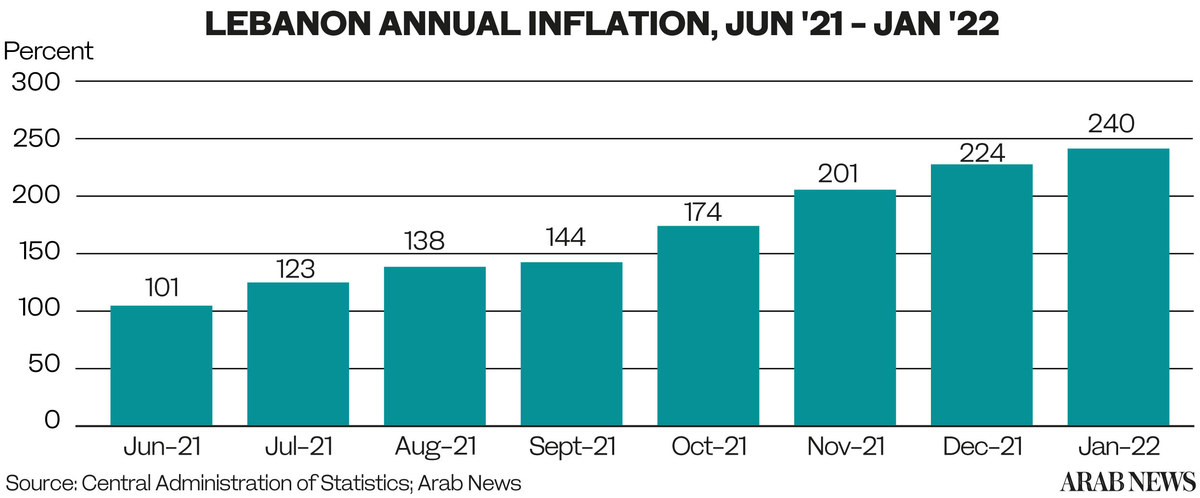

The country has seen a heavy deficit in the government’s and the central bank’s reserves. Citizens are still fearful of the unprecedented higher prices as the government can no longer subsidize these essential commodities.

The minister, however, explained that they “are not relying on reserves of the central bank or the Ministry of Finance.”

“We are working on multiple avenues, including support from the World Bank, providing potential financing to our security needs, in addition to support in donation form that we are requesting from several countries,” he elaborated.

A food security crisis is not the only catastrophe the Lebanese are afraid of in the near future.

Early this month, official fuel prices soared in the country. A 20-liter canister of gasoline reached over 400,000 Lebanese pounds, or $20. A 20-liter diesel canister cost 375,000 Lebanese pounds.

This price rise led to citizens queuing up on gas stations panicking over fuel shortage and potential hyperinflation of prices.

Strangely, gasoline prices continue to rise in Lebanon, given that global fuel prices have fallen sharply over the past few days.

This price stagnancy is mainly because monopolized, government-protected exclusive agencies generally set the prices higher than market rate. Last month, Lebanon’s parliament passed the long-awaited competition bill that scrapped the exclusive dealership programs.

However, the issue in Lebanon is the execution of such laws and not their drafting. Minister Amin Salam emphasized that their next mission is to execute this competition law.

“It has been valued by all the international organizations, particularly the IMF, because it’s the first set of reforms that meets the prerequisites of the IMF and the WTO,” added Salam while elaborating on the competition law.

The minister also explained how this could improve the pricing system in Lebanon as it will regularise the supply and demand situation. “Lifting the protection of the exclusive agencies of the government will have a big positive impact on the economy, bringing down prices by 20 to 40 percent,” he said.

The last resort

Lebanon is also signing investment agreements with French shipping giant CMA CGM and several other companies to restore Beirut’s port and improve economic activity.

The country is also keen on attracting more investors to improve its economic performance gradually.

“France is really in the forefront of those investment opportunities. And they are already on board for several projects. So, we are hoping to see more involvement from other countries,” explained Salam.

The IMF is planning on visiting Lebanon at the end of March or early April. They have been in weekly discussions with the Lebanese committee, and the state is working on meeting the requirements needed to receive monetary aid.

“Some of their priorities are finalizing the budget and the audits of the central bank,” said Salam.

With inflation, poverty, unemployment and immigration rates reaching all-time highs, Saudi Arabia, UAE and France are working on a joint mechanism to financially support several sectors in Lebanon through direct donations to local initiatives.