RIYADH: The Saudi Arabian oil industry still dominates the country’s economy, but can be used as a springboard for diversification and transformation, the minister of industry and minerals told Arab News.

Bandar Alkhorayef, who is overseeing an expansion of the Kingdom’s industrial base and its vast mineral resources, said: “Definitely, (the expansion) is going to help the industrial sector in developing its capabilities, to ensure that the sector is built in a manner that will help our oil and gas (sector), by supporting the base to make it resilient and providing the local (industry) time (to build up its) oil and gas capabilities.

“It is important to look at how we can use this resource of oil and gas for downstream industries. This is a very important part of our strategy — how to increase and maximize the utilization of our natural resources in oil and gas. (The same applies) now to mining, because mining development is going to be more and more (important).” he said.

Alkhorayef’s comments came as part of a wide-ranging interview on “Frankly Speaking,” the series of video interviews with leading policymakers in business and government.

He also spoke of the Kingdom’s ambitious plans to become the leading economic and industrial hub in the Middle East, the huge potential of its natural mineral resources, and the need to promote local manufacturing under the “Made in Saudi” brand.

Earlier this year, Alkhorayef hosted one of the biggest business gatherings Riyadh has seen with the first Future Minerals Forum, which is to become an annual event. He is enthusiastic about prospects in the Kingdom’s mining industry.

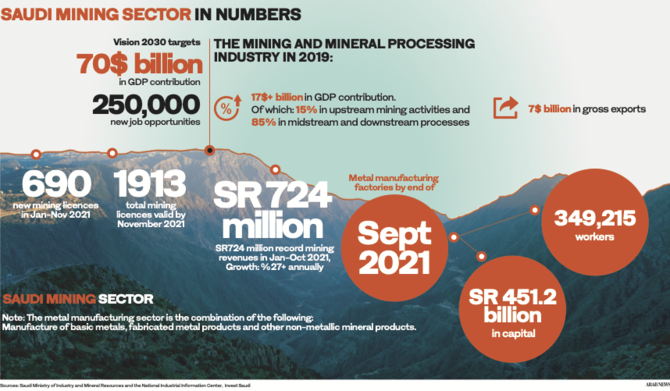

“The mining sector is really very much untapped so far in Saudi Arabia, but what we know today is that our natural resources, by conservative estimates of minerals, is about $1.3 trillion, with huge reserves in the Arabian Shield,” he said, referring to the geological formations running down the Red Sea coast of the Kingdom. “We have a huge program to discover more and more, providing data and analyzing the resources in the country.

“Definitely, we have great quantities of very important elements, like gold, copper, zinc and phosphate. I’m talking about quantities that are commercially viable and economically viable so these quantities are already definite.”

Alkhorayef revealed that the Kingdom is planning a series of global auctions of mineral assets in order to attract international investment into the booming sector.

“We are planning an auction that is coming out next month, just very close to Riyadh. It’s a resource we believe has almost 26 million tons of copper and zinc — these amounts are very interesting for global players to come and be part of these auctions. We have another two coming hopefully by the end of this year,” he said.

Last year, Alkhorayef launched the “Made in Saudi” initiative to encourage local manufacturing and encourage consumers to buy local produce. The response has been “overwhelming,” he said.

“This is really very close to my heart: The Made in Saudi program is something that I’m proud of as a Saudi (not because I am an official). Since we launched the program it has been a great success. The engagement that we have seen from the public is just overwhelming, also from companies who are interested in joining the program. The numbers are very encouraging.”

The National Industrial Development and Logistics Program, launched in 2019 with a view to making the Kingdom an industrial and logistics powerhouse, is progressing according to schedule.

“The program simply is trying to link four sectors that are naturally connected with each other — industry, mining, energy and logistics. These sectors need to operate in synchronization to ensure that we maximize their impact on the economy and also on their competitiveness (individually),” he said.

“So far we have been progressing as you can imagine — these sectors are all heavy when it comes to infrastructure, so there are a lot of infrastructure projects going on as we speak in industrial cities, in gas supply, in renewable projects and in logistics solutions in different areas.”

Part of the NIDLP strategy is the creation of special economic and industrial zones in the Kingdom. Other countries in the Arabian Gulf have also successfully used free zones as part of their development strategy, but Alkhorayef said Saudi Arabia had natural advantages in this regard.

“When it comes to economic development, I believe that every country is different. (This is especially true for) Saudi Arabia, with its size, with its population and local consumption; it has different characteristics when it comes to what are the different tools to move the economy going forward. So our focus has been to build a strong industrial base, which we did, and we can see it today really giving us the right return on the investment.

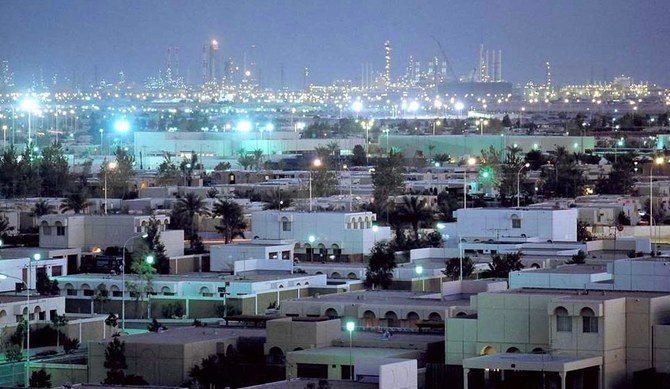

The Saudi industrial city of Jubail, home to Advanced Petrochemical Co, one of the Kingdom's big chemical producers. (Supplied)

“If we look at cities like Yanbu and Jubail, which 50 years ago were just desert, today they are industrial cities, exporting worldwide — petrochemicals and so on — so it is very important for us in Saudi Arabia. It has been in the past, and it will continue to be, to expand our local capabilities,” he said.

Four new special economic zones would be unveiled “very soon,” he said.

His ministry collaborates with mega-projects such as NEOM and Qiddiya, which are flagship initiatives of the Vision 2030 strategy to transform the Saudi economy, he said.

Qiddiya, supported by Saudi Arabia’s Public Investment Fund, is set to become the Kingdom’s capital of entertainment, sports and the arts. (Photo/QIC)

“If we look at NEOM or Qiddiya, there is a very close relationship when it comes to the targets that they have to achieve, in (terms of) local content and (our ability to) ensure that they are able to reach those targets (on the strength of) different projects and (the project outputs),” Alkhorayef said.

Vision 2030 also seeks to encourage Saudi nationals to join private sector employment and to use local industry in the supply chain. “I’m really very optimistic today in manufacturing, especially as advancements in technology are making it much easier than before for re-skilling, for learning, for machine learning. These tools have never been there before and we intend to invest in them to make sure that our labor force is re-skilled in the right way much faster than ever before,” the minister said.

NEOM's Trojena project aims to redefine mountain tourism for the world by creating a place based on the principles of ecotourism. (Supplied)

Last year the Kingdom committed itself to ambitious targets for achieving net zero carbon emissions by 2060 and phasing out oil in its domestic energy generation by 2030 under the Saudi Green Initiative. Alkhorayef is confident those targets will be met.

“I think the targets are very realistic and — to quote Prince Abdul Aziz bin Salman, the energy minister — if technology also helps us in terms of speed, we may achieve these targets much earlier than we said,” he added.

Alkhorayef rejected the suggestion that for Saudi Arabia’s industrial strategy to succeed it would mean taking business away from other regional centers.

“Quite the contrary, really. Today’s winners always make more winners. So our view is very simple. Today we have a great opportunity to work with the region to have a greater impact as a whole.”