King Abdullah University of Science and Technology is working on expanding Saudi Arabia’s seaweed and algae stocks to boost the Kingdom’s fisheries industry.

The postgraduate research and teaching facility, located 100 km north of Jeddah, is developing projects to feed into the Kingdom’s goal of attracting over $4 billion (SR15 billion) of foreign and local investment into Saudi Arabia’s fishing industry, as part of the Kingdom’s Vision 2030 scheme to diversify the economy.

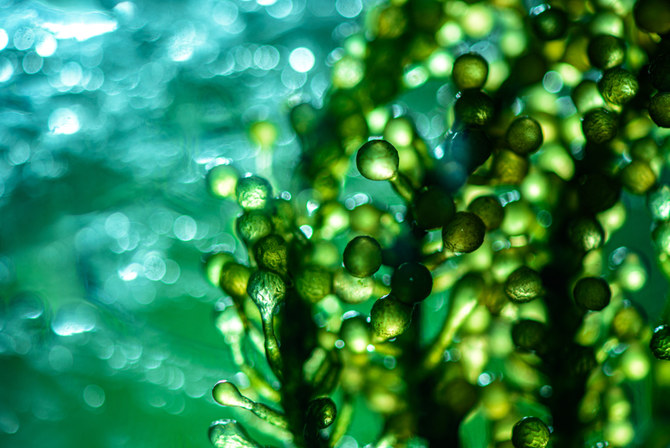

Claudio Grünewald, a microalgae expert and a project director with KAUST, told Arab News: “We are on a mission to establish algae and seaweed biotechnology in the Kingdom.”

What use do slimy green plants play in the development of a multibillion-dollar industry?

Grünewald said: “Algae and seaweed are widely used in pharma products, cosmetics, fertilizers and food for both animals and humans. For example, in the gel used for canning meat and in the natural coloring of energy drinks. We all consume seaweed and algae-based ingredients every day, but hardly anybody is aware of that.”

The value of global algae and seaweed production stood at around $40 billion in 2020, with anticipated growth of 9.6 percent between 2021 and 2027, according to research firm Global Market Insights

A leading producer in this area is China, but Grünewald believes Saudi Arabia could catch up with and even become the market leader within the next five years. KAUST is carrying out academic research for the private sector to make that happen.

“The Kingdom has plenty of sun, flatland and clean seawater,” Grünewald added, “all of which are the essential factors for the production of marine plants.”

He noted there is little human impact on the Red Sea in terms of sewage and heavy construction, compared to the Mediterranean.

But this raises the question. If the Kingdom’s development of its Red Sea coast brings large numbers of tourists, will this not undermine the pristine quality of its seawater and potential for growing marine stocks?

Grünewald noted: “Tourist development can be done sustainably. For example, wastewater can be used to supply the nutrients necessary to produce algae.

“Similarly, date farming produces a lot of sugar in its waste materials, which are a potential organic carbon and energy source for the production of algae. All of this will contribute to a circular economy.”

KAUST is working with the private sector to turn its research into commercial ventures.

“We have strategic partnership with various companies”, Grünewald added, “for example Naqua (Saudi Arabia’s National Aquaculture Group). And we’re talking to other stakeholders such as the plastics industry, the electricity industry and thermal power plants.”

All these stakeholders will be needed to establish a sustainable marine farming sector in the Kingdom using local materials, resources and workers. KAUST is training young Saudis in seafood farming, from bachelor to postgraduate level, while also hiring locally — 50 percent of the staff across its marine farming projects are Saudi, with women making up half of this figure.

“KAUST is also incubating startup companies”, Grünewald added. “In fact, the Beacon Development Company (a Saudi consultancy providing specialist advice in environment, marine and food projects) began as a startup and is now a KAUST department with 150 staff.”

He said: “We have a mandate from the government to diversify the economy by 2030. In terms of food security, the Kingdom cannot rely on imports.

“We need to produce our own raw materials and do our own processing and adding of value. And this must be sustainable and with high impact social welfare. I think Saudi Arabia can be a leader in algae technology and aquaculture by the end of this decade.”