DUBAI: According to all the orthodox economic and financial indicators, 2021 was a year of strong recovery from the “lockdown recession” of the previous year.

But despite surging growth forecasts, soaring stock markets and strong commodity prices, as the year drew to a close two shadows loomed over economic prospects — the threat from the omicron variant that appeared in November and rising global inflation trends that threatened to throw economic policymakers’ calculations into confusion.

Gita Gopinath, the chief economist of the International Monetary Fund, highlighted the push-pull nature of the global economic outlook.

“As the global economy recovers from the pandemic, a great deal of uncertainty remains about the new COVID-19 variants and increased inflation pressures in many countries,” she said.

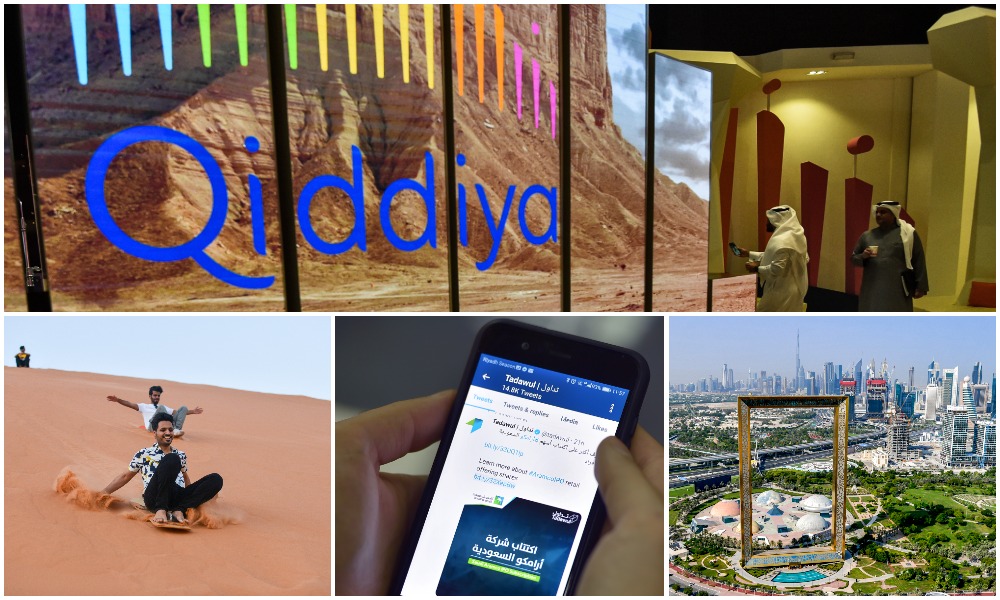

While the global economy continues to show signs of recovery from the pandemic, uncertainty remains new COVID-19 variants and increased inflation pressures. (AFP/File Photos)

“If allowed to spread uncontrolled, omicron could lead to large-scale hospitalizations and further restrictions on mobility and travel, which will again have a negative impact on global economies, both advanced and emerging.”

Regional economists echoed her caution. Nasser Saidi, Middle East economic expert, said: “Unless the vaccination pace improves drastically (especially in low-income nations) and the new variant is rapidly brought under control, the global economy could see brakes applied on growth at least in the first quarter of next year.”

However, the reservations caused by the new variant cannot hide the fact that the world economy recovered strongly in 2021. The IMF estimated that global gross domestic product grew 5.9 percent in the course of the year — a big turnaround from the 3.1 percent decline that total GDP suffered in 2020 when the pandemic hit and all countries went into lockdown.

For the world’s biggest economy, the US, the reversal was even more notable — from a 3.4 percent decline in 2020, in 2021 the economy is forecast to grow by 6 percent. A healthy American economy pulls the rest of the world along with it.

If soaring prices in energy and other commodities are a worry for the big advanced economies, they are the opposite for the Middle East. (AFP/File Photos)

The election of President Joe Biden, committed to an aggressive policy of antivirus measures coupled with multi-trillion dollar initiatives to invest in infrastructure, gave the economy and financial markets a big boost in the year.

American stock markets — boosted by the Biden spending packages and continued support from US financial authorities — had one of their best years. The S&P 500, the most reliable index of American equity health, was nearly 30 percent up on the year.

But there were still warning signs in the US that made the policymakers twitchy. In particular, inflationary pressures continue to rise. The official inflation rate was reported at 6.8 percent in December, its highest level for nearly four decades.

Federal Reserve chairman Jay Powell insisted for much of the year that the rise in prices was “transitory,” but continued to sound a cautious note on whether the Fed would “taper” its support for financial markets into 2022 and slowly increase interest rates.

Regional economies, especially in the big oil-exporting countries in the Gulf, have enjoyed a year of solid expansion and recovery from the 2020 lockdowns. (AFP/File Photos)

“Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation. These problems have been larger and longer lasting than anticipated, exacerbated by waves of the virus,” Powell said.

For that other great engine of global economic growth, China, the year was distinctly mixed. The IMF forecast GDP growth of 8 percent in 2021 — almost back to the staggering levels that drove world economic progress in the first two decades of the century — but “the momentum is slowing,” the IMF warned, projecting a GDP growth rate of 5.6 percent in 2022.

Fears about the potential for the Chinese economy to drag the rest of the world upwards centered on some serious structural defects — such as the weakness of the property market as exemplified by the virtual collapse of real estate group Evergrande.

There were also concerns that the Chinese economy was retreating from its role as a global economic stimulus. Experts such as Ian Bremmer, president of the Eurasia Group consultancy, warned that China’s retreat from US stock markets and other forms of commercial cooperation in technology with the US and the rest of the world were problematic for the global economy.

American stock markets — boosted by the Biden spending packages — had one of their best years, but experts have concerns that China’s retreat from US stock markets and other forms of commercial cooperation in technology with the US and the rest of the world would be problematic. (AFP/File Photos)

“The dangers of President Xi getting it wrong are grave — for his own prestige and the semiconductor industry that China is reliant on,” Bremmer said.

The third major economic force in the world, Europe, also witnessed strong economic recovery in 2021, with IMF forecasts showing GDP growth of 5 percent in the Euro currency area and 6.8 percent in the post-Brexit UK.

While these projections are encouraging for European policymakers, they also disguise the reality of severe restrictions as a result of the omicron variant in many countries, and a looming winter energy crisis for many on the continent.

Gas and coal prices have soared to all-time highs in Europe as shortages in global energy markets are exacerbated by political tensions with the main supplier of gas, Russia. Oil prices, too, are strong, adding to European’s inflationary fears.

The long-suffering Dubai Financial Market witnessed 27 percent growth, while the Abu Dhabi Securities Exchange saw a spectacular 67 per cent jump in share values. (AFP/File Photo)

But if soaring prices in energy and other commodities are a worry for the big advanced economies, they are the opposite for the Middle East. Regional economies, especially in the big oil-exporting countries in the Gulf, have enjoyed a year of solid expansion and recovery from the 2020 lockdowns.

In Saudi Arabia, the rising price of crude oil in 2021, along with expansion in the non-oil sectors of the Kingdom’s economy, mean that the forecast of 2.8 percent GDP growth made by the IMF is likely to be beaten.

The Saudi budget, announced in December, showed that policymakers expect to be able to report a surplus in 2022 for the first time in nearly a decade, as strong oil prices and post-pandemic recovery work their way through the Kingdom’s economy.

Finance minister Mohamed Al-Jadaan said: “We are telling our people and the private sector or economy at large that you can plan with predictability. Budget ceilings are going to continue in a stable way regardless of how the oil price or revenues are going to happen.”

In Saudi Arabia, the rising price of crude oil in 2021, along with expansion in the non-oil sectors of the Kingdom’s economy, mean that the forecast of 2.8 percent GDP growth made by the IMF is likely to be beaten. (AFP/File Photo)

The specter of inflation hanging over the global economy is not seen as a significant threat to the Saudi economy, with forecasts of between 1 and 2 percent in 2022 much lower than international comparisons. Nonetheless, the experts predict Saudi Arabia and other dollar-pegged economies in the region will have to follow the Federal Reserve if it raises interest rates in 2022.

One common feature of regional economies in 2021 which looks certain to continue in 2022 has been the spectacular growth in financial markets, fed by booming share prices and an explosion of initial public offerings in the main investment centers.

On the Saudi Tadawul market, share prices rose nearly 30 percent year-on-year, culminating in the successful and oversubscribed IPO of the Tadawul itself. More IPOs are in the pipeline for 2022, investment analysts predict.

In the UAE, there was a similar explosion in stock markets, boosted by a series of government-related IPOs. The long-suffering Dubai Financial Market witnessed 27 percent growth, while the Abu Dhabi Securities Exchange saw a spectacular 67 per cent jump in share values.

Tarek Fadlallah, chief executive of Nomura Asset Management in the Middle East, told Arab News: “The Middle East has enjoyed a good year in terms of economic and financial markets. The region is getting a reputation as a safe haven in these troubled COVID times for investors, business people and tourists alike.”