LONDON: Saudi Aramco’s award of $10 billion worth of contracts on its giant Jafurah project has finally fired the starting gun to develop what is thought to be the world’s biggest shale gas field outside of the US.

Having battled with America’s shale oil producers for market share over the last decade, the Kingdom is now adopting the advanced low-cost techniques of its fracking rivals and is set to spend up to $100 billion on Jafurah to rapidly increase its domestic gas production.

The Kingdom is estimated to be sitting on the fifth largest shale gas reserves in the world.

Saudi Energy Minister Prince Abdulaziz bin Salman earlier said the Jafurah gas field will place the Kingdom third in the world in natural gas production by 2030.

But does Saudi Arabia really have the potential to replicate the soaring success of US shale gas development?

Saudi Aramco Chief Executive Amin Nasser certainly thinks so. Announcing the contracts this week, he said: “It is a breakthrough that few outside the Kingdom thought was possible and which has positive implications for energy security, economic development and climate protection.”

Production is scheduled to begin within the next three years. The field will supply cleaner natural gas for domestic use in the Kingdom, along with feedstock for both petrochemical production, and crucially, low carbon hydrogen power.

Jafurah is expected to contribute to Saudi Arabia’s goal of producing half of its electricity from gas and half from renewables as it pursues its 2060 net-zero target. Indeed, Jafurah alone is forecast to replace up to 500,000 barrels of oil a day that would otherwise be used for domestic consumption.

All this serves the goals of the Kingdom’s Vision 2030 program to diversify the economy from crude oil and sharply reduce its carbon footprint, even if the scheme will enable the Kingdom to increase its crude exports.

The Kingdom, however, has no plans to export the gas from Jafurah as Prince Abdulaziz told reporter on Nov. 29 in Dhahran following the announcement of the new contracts to develop the basin.

We will keep our gas to ourselves

Saudi Energy Minister Prince Abdulaziz bin Salman

But it was thought that fracking in Saudi Arabia will be more expensive than it is in the US, not least because the Kingdom is not renowned with an abundance of natural water, a critical component in the fracking process.

The fracking process requires pumping water, sand and chemicals into the fields at high pressure which fractures the shale rock and allows the hydrocarbons to escape.

“We managed to reduce drilling cost by 70 percent and stimulation cost by 90 percent since the 2014 cost benchmark, while increasing well productivity six-fold compared with the start of the program,” Nasser said on Monday.

Aramco plans to use seawater for fracking at Jafurah. Earlier this year, the company also invited bids for a water desalination plant at the field. Desalinated water is used in gas processing plants. An earlier bidding process was abruptly canceled last year and the current tender process has reduced the capacity of the desalination plant by around 20 percent.

Sadad Al Husseini, former EVP of Aramco

However, former Aramco Executive VP Sadad Husseini insists the “water issue” is a red herring.

He told Arab News: “The water issue was resolved years ago. We have aquifers that hold saline water and the Saudi oil industry has a long history of using this water for drilling.”

Husseini also dismissed cost comparisons with the US shale industry.

He said: “The cost of fracking depends on the depth of the reservoir. In the US, they work with shallower reservoirs, around 3,000 to 4,000 feet deep, which makes fracking less costly. In Saudi Arabia, the reservoirs will be 9,000 to 10,000 feet deep. It’s technically more challenging, but unlike the US, those deep wells are not just producing gas, they’re also producing a lot of condensates, most notably ethane, along with gas, and that is profitable and makes the economics of this field work. Ethane feeds the petrochemical industry.”

He added: “It’s a challenging development but it wouldn’t have advanced if the issues hadn’t been resolved.

Developing shale gas reserves outside the US has not been particularly successful, partly due to environmental concerns - particularly in large population centers in Europe, a lack of infrastructure, and difficulties accessing and disposing of water used in the process.

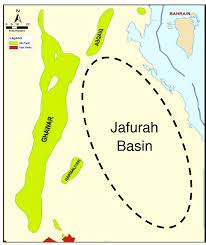

However, Jafurah is close to the Gulf coast with relatively easy access to seawater, and is also adjacent to the world’s largest oilfield, Ghawar, and its substantial energy infrastructure.

Production at Jafurah is expected to commence in 2024 and is forecast to reach up to 2 billion cubic feet per day of sales gas, 418 million cubic feet per day of ethane and about 630,000 barrels per day of gas liquids and condensates by 2030. Investment over that period will amount to $68 billion, but is expected to total more than $100 billion overall.

Domestic employment, another key plank of the Kingdom’s Vision 2030, is also central to the scheme. It is understood that along with fields under development in North Arabia and South Ghawar, the Jufarah project will create more than 200,000 direct and indirect jobs in the Kingdom.

The scheme will also incorporate new technology, most notably using industrial internet of things and video analytics.

The Jafurah project will not only aid the Kingdom’s environmental ambitions but will also support its petrochemicals industry. “Its ethane and liquified natural gas are highly valuable feedstocks for the Kingdom’s petrochemical’s industry,” the Aramco chief said.

What makes Jafurah field unique?#Aramco

Find out more

— Aramco (@Aramco) November 29, 2021