ISLAMABAD: The federal government has started a “formal probe” against 700 Pakistanis whose name appeared in the Pandora Papers last week, Pakistani media reported on Monday.

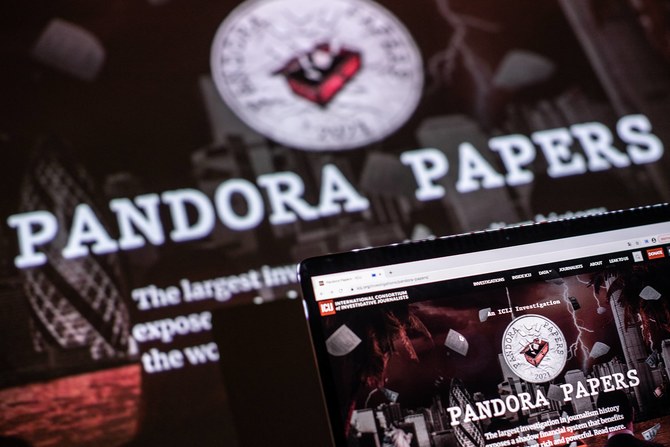

The “Pandora Papers” are a cache of leaked documents that The International Consortium of Investigative Journalists says reveal offshore transactions involving global political and business figures. The documents do not implicate Prime Minister Imran Khan himself but name Water Resources Minister Moonis Elahi and Finance Minister Shaukat Tarin among others in the PM’s inner circle.

A day after the leaks, Khan set up a high-level cell to investigate Pakistanis named in the documents.

Pakistan’s Express Tribune newspaper said on Monday the probe had begun, with the country’s top investigation agencies tasked to investigate the matter and also “seek help from the provincial revenue departments and NADRA,” the national database authority.

“Reports will be provided to the FIA, NAB and FBR so that legal action could be taken against the Pakistanis who invested in the offshore companies according to the Pakistani law,” Tribune reported, naming the Federal Investigation Agency, the National Accountability Bureau and the Federal Board of Revenue.

“The Pandora Papers investigation has been divided into two parts according to which current or former public office holders and the business figures will be investigated separately,” the newspaper said.

Details of businesses, bank accounts and properties in Pakistan along with their daily expenses and children’s education and marriage expenses were being collected in the first phase of investigating those named in the leaks.

“Apart from this, the details of their foreign trips, medical treatment and shopping are also being collected,” Tribune said, as well as “specifics about their public and private bank accounts, mobile data, travel agents and booking details of private hotels.”