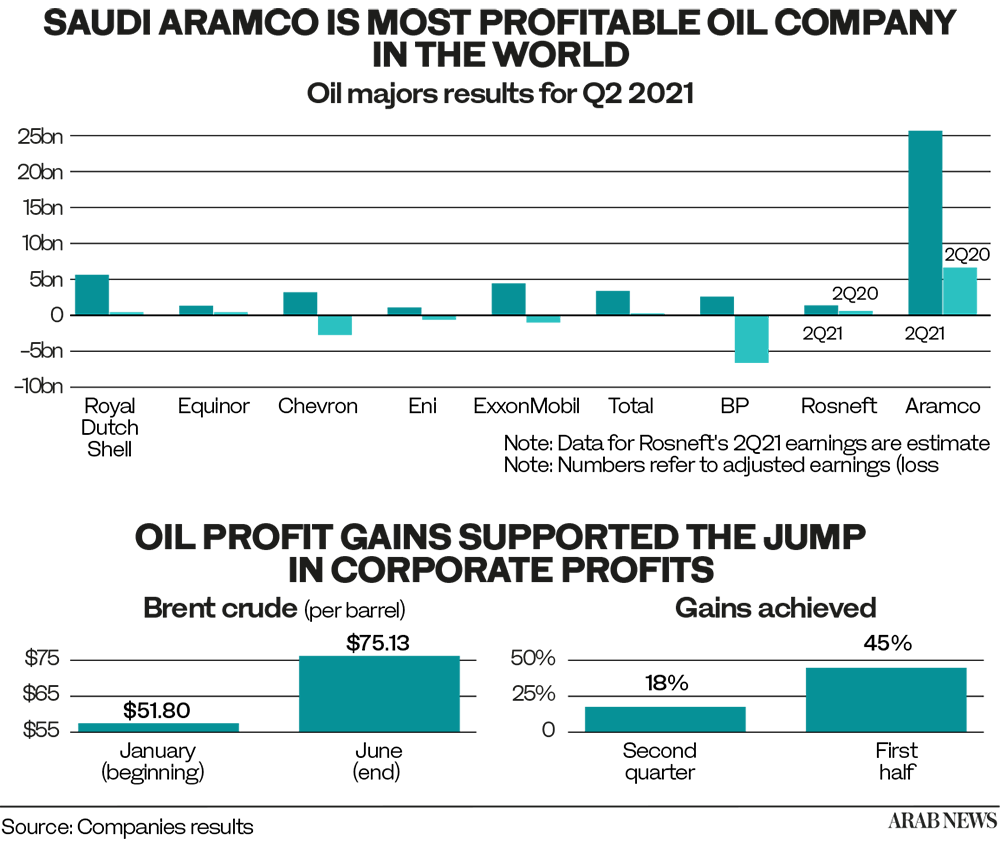

DUBAI/RIYADH: Saudi Aramco is the most profitable oil company in the world with net profit towering above all other Big Oil companies and exceeding all analysts’ expectations from Al-Rajhi Capital to JPMorgan.

Saudi Aramco profits rose from a year earlier to SR95.47 billion ($25.46 billion) in the second quarter as a recovering global economy pushed up oil prices and allowed the Kingdom to pump more crude.

It represents a 288 percent increase, and was affiliated with higher oil prices and a recovery in global demand, supported by the easing of COVID-19 restrictions, vaccination campaigns, stimulus measures, and accelerating activity in key markets, the oil giant said in a Tadawul filing.

This was slightly above the median of economists' estimate of $24.7 billion — Bank of America predicted $24 billion; JPMorgan estimated $23.7 billion, while Al-Rajhi Capital had the highest forecast of $25.3 billion.

“The oil giant has achieved results beyond Al-Rajhi Capital’s expectations,” said Mazen Al-Sudairi, head of research.

“Our second quarter results reflect a strong rebound in worldwide energy demand and we are heading into the second half of 2021 more resilient and more flexible, as the global recovery gains momentum,” Aramco CEO Amin Nasser said.

“While there is still some uncertainty around the challenges posed by COVID-19 variants, we have shown that we can adapt swiftly and effectively to changing market conditions,” he added.

Oil demand is improving with the reopening of major economies and more vaccines roll out, with crude up around 40 percent this year. In the past two weeks, oil companies such as BP PLC, Chevron Corp. and Royal Dutch Shell PLC have said they will increase share buybacks and payouts, confident the worst of the pandemic is over. Still, the pandemic is “clearly far from over,” Nasser said later on a call with reporters.

Oil prices witnessed its worst week since October last year as the spread of the delta variant, especially in China, added downside risk to short-term demand outlook. Brent crude fell 7 percent to $70.70 a barrel. Global oil demand remains below pre-COVID levels, but should reach near-record levels of 100 million barrels a day next year, Nasser told reporters.

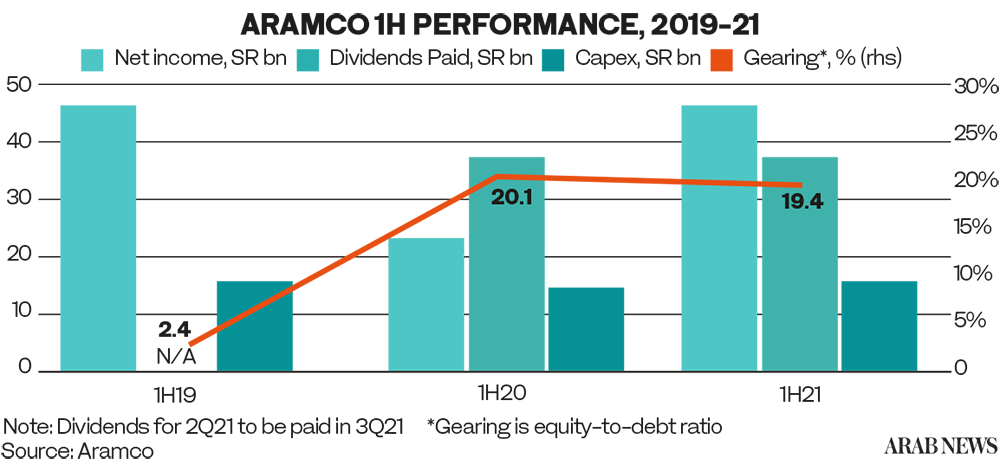

Despite the sound profitability and cash position, the company trails other Big Oil as it declared a dividend of SR70.33 billion. Aramco’s indicated dividend yield is roughly 4 percent, while BP, Chevron and Exxon Mobil Corp. all pay above 5 percent.

The price of a barrel of Brent crude, the international benchmark, has risen about 40 percent this year and closed at $70.70 on Friday after its biggest weekly decline in four months.

The oil giant also benefited from its strategy to optimize its portfolio, announcing billion dollar deals in recent months.

“Our historic $12.4 billion pipeline deal was an endorsement of our long-term business strategy by international investors, representing significant progress in our portfolio optimization program. Our landmark $6 billion sukuk reinforced our robust balance sheet, further diversifying our funding sources and expanding our investor base. And, once again, we delivered a dividend of $18.8 billion for our shareholders,” Nasser said.

He said the company will move forward on a number of strategic programs, particularly focusing on sustainability and low-carbon fuels.

Commenting on the company’s new strategy to sell assets and re-leasing them, Nasser told Asharq Business TV that this type of investment enhances the role that Saudi Aramco plays in attracting large foreign investments in the Kingdom.

Nasser was referring to the sale of 49 percent of Aramco’s oil pipeline business in June to a consortium that includes Washington, DC-based EIG Global Energy Partners for $12.4 billion.

Aramco’s capital expenditure was $7.5 billion in the second quarter, an increase of 20 percent from a year earlier.