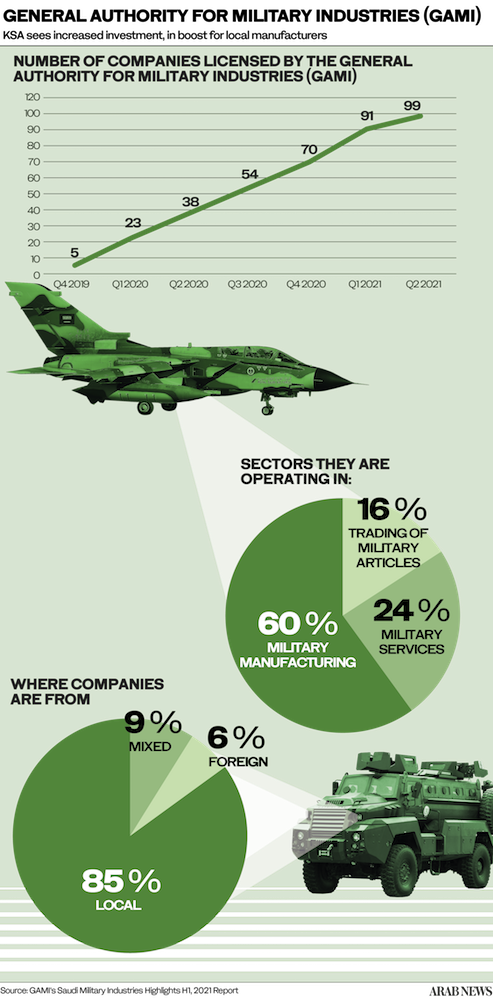

RIYADH: The number of licensed companies in Saudi Arabia’s military sector rose sharply in the first half of the year according to new data from the General Authority for Military Industries (GAMI).

It reported a 41 percent increase in licensed companies to reach a total of 99 — 85 percent of them local companies. More than half (55 percent) were granted to operating companies while military services providers accounted for 24 percent and product suppliers accounting for the rest.

“Through the National Military Industries Sector Strategy we have identified 11 target areas as strategic priorities, developed a research roadmap, adopted an acquisition strategy, and identified how to incentivize the enablers that will help the military industries flourish in the Kingdom,” said GAMI Governor Ahmad Al-Ohali in the organization's half-year report.

Saudi Arabia is investing heavily in its defense industries to reduce reliance on imported military hardware as well as add higher value jobs in the Kingdom.

GAMI was established in 2017 and has helped drive the localization rate within the sector to 8 percent last year from just 2 percent before its formation.

The aim is to increase this to up to 50 percent by 2030.

Among the latest investments to boost local manufacturing is a project to develop armored protected vehicles spearheaded by the Military Industries Corporation.

Zamil Offshore Services and CMN Group have also collaborated on the development of high speed interceptor vessels. Riyadh will next March host the World Defense Exhibition which GAMI hopes will showcase the Kingdom’s burgeoning defense sector.

Some 86 percent of the space has already been allocated to exhibitors that include Lockheed Martin, Embraer and General Dynamics.

The event is expected to attract more than 80,000 visitors and include at least 85 military delegations.

Total global military expenditure rose to $1981 billion last year, up 2.6 per cent in real terms from 2019, according to data from the Stockholm International Peace Research Institute.

The combined military spending of the 11 Middle Eastern states for which SIPRI has data decreased by 6.5 per cent in 2020, to $143 billion.