AMMAN: Hoping for customers, Ahmad Nassar is dusting and polishing the trinkets and souvenirs in his tourist shop in Madaba, an ancient town in central Jordan known for its early Christian mosaics.

The coronavirus disease (COVID-19) pandemic has been a disaster for Jordan’s tourism industry and for its economy as a whole, which suffered its worst contraction in decades last year.

“I felt despair, there was no income, no work, there was no support for shop owners,” Nassar said.

Now foreign tourists are starting to trickle back, and the situation is looking more hopeful, he said.

The EU last week included Jordan among a dozen new epidemiologically safe countries as of July 1, and government efforts to revive the tourism sector appear to be paying off.

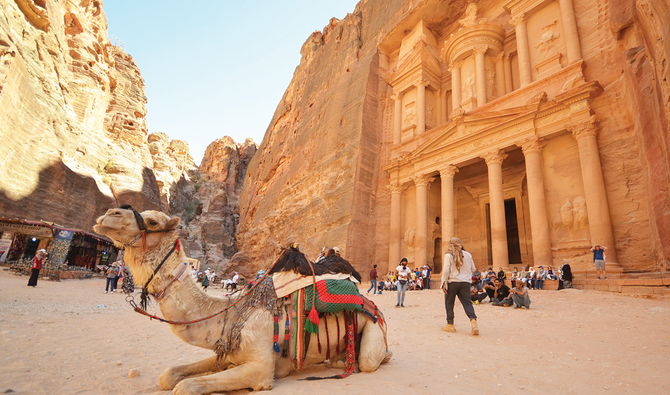

Officials this month announced special measures for Jordan’s “golden triangle,” which includes famous sites such as the ancient city of Petra, Wadi Rum and crusader castles, closing the area off to all but the fully vaccinated.

At the start of July the government also lifted most lockdown measures after a sharp drop in infections, reopening gyms, pools and clubs in hotel facilities.

“At the height of the crisis, hotel occupancy did not exceed 2 percent or 3 percent,” Abdul Hakeem al-Hindi, the head of Jordan Hotels Association, told Reuters.

Now occupancy rates in some of Jordan’s main tourist centers are back up to 40-50 percent in the Dead Sea and the Red Sea port city of Aqaba and around 30 percent in Amman, the latter driven by returning tourists from the Gulf, latest hotel industry figures show.

The government is also taking other steps to get the number of foreign tourists back to the record 3 million visitors Jordan received in 2019, many of whom arrived on low cost European carriers led by Ryanair which resumed flights last month.

It includes subsidizing charter flights with around $60 for every passenger if they stay in Jordan for a week, said Abdelrazzak Arabiyat, director of the Jordan Tourism Board.

He expected the Russian market to grow the fastest in the coming months.

But Hindi said a revival would take time. “We need at least two years to return to what we were,” he said.