DUBAI: The reluctance of Gulf states to hike taxes is among the reasons that the region will remain dependent on hydrocarbons for at least a decade, Moody’s said.

Gulf states’ reliance on hydrocarbons will remain the key credit constraint despite ongoing diversification efforts, it said

“Economic diversification away from hydrocarbons remains the most frequently stated policy objective in the region but will likely take many years to achieve,” said Alexander Perjessy, a senior analyst at Moody’s and the author of the report. “The announced plans to boost hydrocarbon production capacity and government commitments to zero or very low taxes make it unlikely that heavy reliance on hydrocarbons will diminish significantly in the coming years.”

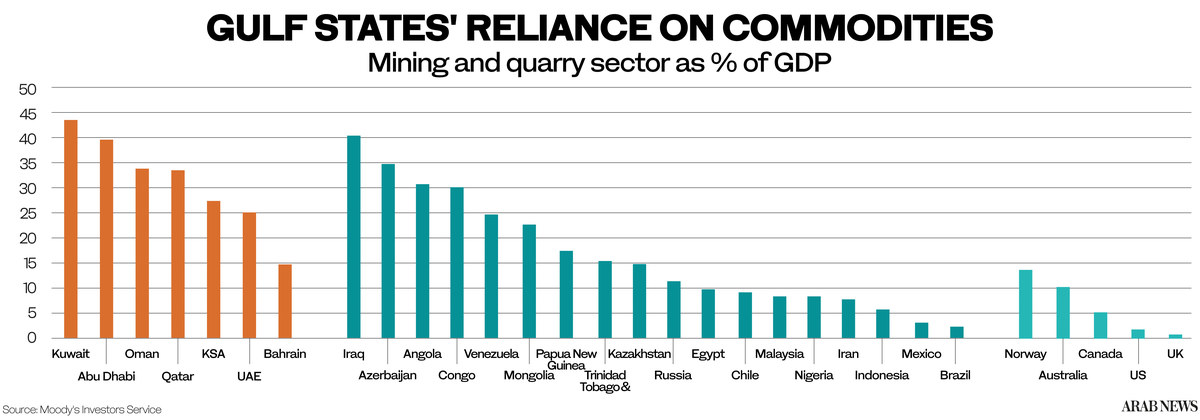

For most Gulf countries, oil and gas still account for at least a fifth of GDP, more than 65 percent of total exports and at least 50 percent of government revenue.

Despite ambitious governments’ plans, diversification efforts since 2014 have yielded only limited results and will be held back by lower oil prices, Moody’s warned.

While diversification momentum may accelerate, it is likely to be held back by the reduced availability of resources to fund projects as well as intra-GCC competition in a narrow range of sectors.

Hydrocarbon revenue, collected in the form of profit taxes, royalties and dividends (paid by the national oil companies), still account for the lion’s share of government income across the region.

Moody’s sees this partly as a consequence of GCC governments’ long-standing commitment to a zero or very low tax environment, “which is part of the implicit social contract between the rulers and the citizens but also reflects the desire to incentivize non-oil sector growth and development.” it said.

It estimates that GCC sovereign states collected non-hydrocarbon tax revenues equivalent, on average, to less than 4 percent of non-shuhydrocarbon GDP in 2019. That compares to an equivalent rate of more than 22 percent for major high-income economies.

Moody’s said that if oil prices average $55 per barrel (around the middle of its medium range forecast) hydrocarbons would likely remain the single largest contributor to GCC sovereigns’ GDP and the main source of government revenue over at least the next decade.