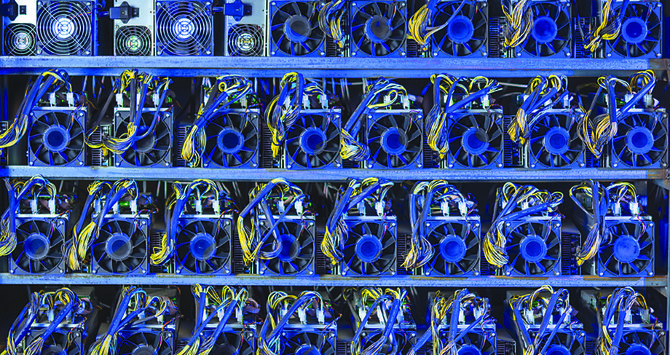

LONDON: Banks must set aside enough capital to cover losses on any bitcoin holdings in full, global banking regulators proposed on Thursday, in a “conservative” step that could prevent widescale use of the cryptocurrency by major lenders.

The Basel Committee on Banking Supervision, made up of regulators from the world’s leading financial centers, proposed a twin approach to capital requirements for crypto assets held by banks in its first bespoke rule for the nascent sector.

El Salvador has become the world’s first country to adopt bitcoin as legal tender even though central banks globally have repeatedly warned that investors in the cryptocurrency must be ready to lose all their money.

Major economies including China and the US have signalled in recent weeks a tougher approach, while developing plans to develop their own central bank digital currencies.

The Swiss-based Basel committee said in a public consultation paper that while bank exposures to crypto assets are limited, their continued growth could increase risks to global financial stability if capital requirements are not introduced.

Bitcoin and other cryptocurrencies are currently worth around $1.6 trillion globally, which is still tiny compared with bank holdings of loans, derivatives and other major assets.

Basel’s rules require banks to assign “risk weightings” to different types of assets on their books, with these totted up to determine overall capital requirements.

For crypto assets, Basel is proposing two broad groups.

The first includes certain tokenized traditional assets and stablecoins which would come under existing rules and treated in the same way as bonds, loans, deposits, equities or commodities.

This means the weighting could range between 0 percent for a tokenized sovereign bond to 1,250 percent or full value of asset covered by capital.

The value of stablecoins and other group 1 crypto-assets are tied to a traditional asset, such as the dollar in the case of Facebook’s proposed Diem stablecoin.

Nevertheless, given crypto assets are based on new and rapidly evolving technology like blockchain, this poses a potentially increased likelihood of operational risks which need an “add-on” capital charge for all types, Basel said.

The second group includes cryptocurrencies like Bitcoin that would be subject to a new “conservative prudential treatment” with a risk-weighting of 1,250 percent because of their “unique risks.”

Bitcoin and other cryptocurrencies are not linked to any underlying asset.

Under Basel rules, a 1,250 percent risk weight translates into banks having to hold capital at least equal in value to their exposures to Bitcoin or other group 2 crypto assets.

“The capital will be sufficient to absorb a full write-off of the crypto asset exposures without exposing depositors and other senior creditors of the banks to a loss,” it added.

Few other assets that have such conservative treatment under Basel’s existing rules, and include investments in funds or securitizations where banks do not have sufficient information about their underlying exposures.

The value of Bitcoin has swung wildly, hitting a record high of around $64,895 in mid-April, before slumping to around $36,834 on Thursday.

Banks’ appetite for cryptocurrencies varies, with HSBC saying it has no plans for a cryptocurrency trading desk because the digital coins are too volatile. Goldman Sachs restarted its crypto trading desk in March.

Basel said that given the rapidly evolving nature of crypto assets, a further public consultation on capital requirements is likely before final rules are published.

Central bank digital currencies are not included in its proposals.

Bank regulators plan capital rule for bitcoin

https://arab.news/y8pyq

Bank regulators plan capital rule for bitcoin

- Crypto assets could increase risk to global financial stability if capital requirements are not met

Closing Bell: Saudi main index rises to 10,894

RIYADH: Saudi Arabia’s Tadawul All Share Index extended its upward trend for a third consecutive day this week, gaining 148.18 points, or 1.38 percent, to close at 10,893.63 on Tuesday.

The total trading turnover of the benchmark index stood at SR6.05 billion ($1.61 billion), with 144 listed stocks advancing and 107 declining.

The Kingdom’s parallel market Nomu also rose by 81.35 points to close at 23,668.29.

The MSCI Tadawul Index edged up 1.71 percent to 1,460.89.

The best-performing stock on the main market was Zahrat Al Waha for Trading Co., with its share price advancing 10 percent to SR2.75.

Shares of CHUBB Arabia Cooperative Insurance Co. increased 8.27 percent to SR23.04, while Abdullah Saad Mohammed Abo Moati for Bookstores Co. saw its stock climb 6.17 percent to SR50.60.

Conversely, the share price of Naseej International Trading Co. declined 9.90 percent to SR31.48.

On the announcements front, Arabian Drilling Co. said it secured three contract extensions for land rigs with energy giant Saudi Aramco, totaling SR1.4 billion and adding 25 active rig years to its backlog.

In a Tadawul statement, the company said one rig is currently operational, the second will begin operations by the end of January, and the third — currently suspended — is expected to resume operations in 2026.

Since November 2025, Arabian Drilling has secured seven contract extensions amounting to SR3.4 billion, representing 55 committed rig years.

The three contracts have durations of 10 years, 10 years, and five years, respectively.

“Securing a total of SR1.4 billion in new contracts and expanding our backlog by 25 rig-years demonstrates both the trust our clients place in us and our ability to consistently deliver quality and reliability,” said Ghassan Mirdad, CEO of Arabian Drilling, in a statement.

Shares of Arabian Drilling Co. rose 3.15 percent to SR104.70.

Separately, Alkhorayef Water and Power Technologies Co. said it signed a 36-month contract valued at SR43.35 million with National Water Co. to operate and maintain water networks, pumping stations, wells, reservoirs, and related facilities in Tabuk.

In October, Alkhorayef Water and Power Technologies Co. announced it had been awarded the contract by NWC.

In a Tadawul statement, the company said the financial impact of the deal began in the fourth quarter of 2025.

The share price of Alkhorayef Water and Power Technologies Co. declined 0.49 percent to SR120.70.