RIYADH: Saudi Arabia dominated the startup investment market in the Middle East and North Africa (MENA) region during May, figures have revealed.

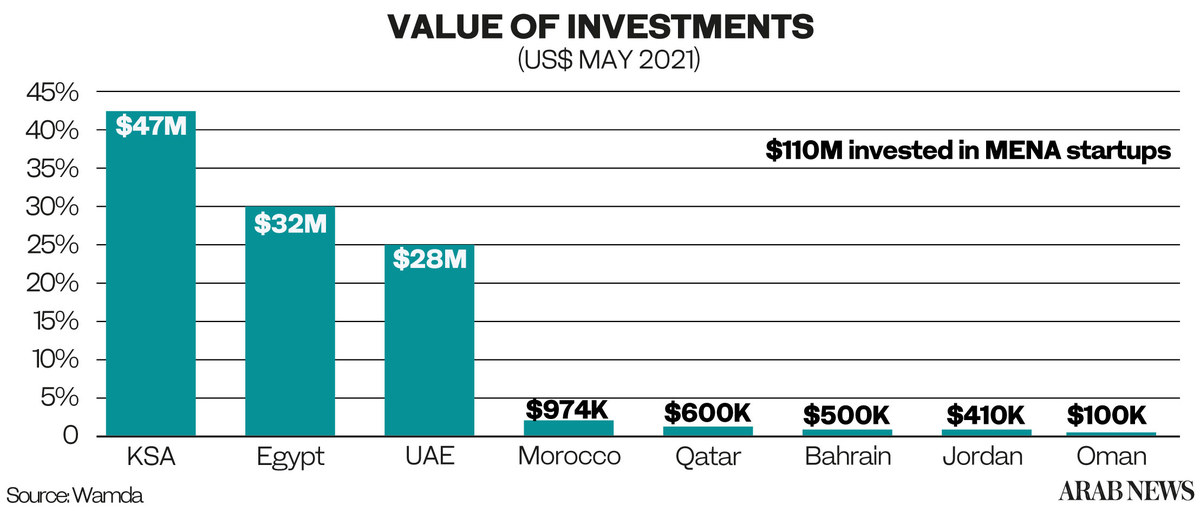

Around $110 million was raised across 35 deals over the month, according to data from entrepreneurship platform Wamda.

And the majority came from Saudi Arabia where nine startups raised $46.6 million, most through the $30.5 million Series B funding by Sary, a business-to-business (B2B) marketplace that connects small firms and wholesalers.

Wassim Basrawi, the managing director of Wa’ed, the entrepreneurship arm of Saudi Aramco, told Arab News: “It is not surprising that venture capital deal making is picking up in the Saudi market. We’ve been observing that now for months as the Kingdom emerges from (the coronavirus disease) COVID-19 pandemic.”

So far, during the second quarter of this year, Wa’ed has announced venture capital investments in Saudi firms such as blockchain artificial intelligence company IR4LAB, drone maker FalconViz, and hydroponic technology business Red Sea Farms.

“Public sector support for Saudi entrepreneurs has actually increased during the pandemic, and many Saudi startups, like Red Sea Farms, are starting to also attract international investors,” Basrawi added.

The B2B e-commerce sector generated the most interest, raising $37.6 million throughout the MENA region. Second-most popular among investors was financial technology (fintech) with $18.5 million, while logistics raised $10 million, education technology $6.9 million, and tourism $6 million.

Hussain Al-Alawi, international partner and member of the global advisory board at Zurich-headquartered mergers and acquisitions firm Millenium Associates, told Arab News: “Saudi Arabia’s dominance in raising capital for startups comes as no surprise.

“What we’re seeing in the region and globally is that investment – especially from VCs (venture capitalists) – is being led by technology companies, with fintech, med-tech and agri-tech being particularly in-demand.”

He said the technology sector had been the driving force for around 70 percent of the company’s deals this year across all markets, with this also being true in Saudi Arabia.

“Saudi Arabia’s commitment to technology is clear and being led from the very top which is helping to drive both tech startup culture, and investment in the sector.

It is not surprising that venture capital deal making is picking up in the Saudi market. We’ve been observing that now for months as the Kingdom emerges from (the coronavirus disease) COVID-19 pandemic.

Wassim Basrawi, Managing director of Wa’ed

“Projects like NEOM and the great work being done by the Public Investment Fund to help realize Vision 2030, act as a spur to startups looking to disrupt and innovate, with backing from progressive funds supporting local entrepreneurs as well as individuals and institutions.

“The Kingdom’s young and highly connected population, as well as the evolution of the sector driven by the COVID-19 pandemic, are also driving both opportunity and investment,” Al-Alawi added.

Saudi Arabia was also the source of the month’s only investment in a female-led startup, the $6 million backing for Gathern, a Saudi platform similar to Airbnb. This compared to more than $100 million invested in male-led startups throughout the MENA region.

“This is not just a regional issue – it’s global. Women-led startups received just 2.6 percent of VC funding in 2019, according to Crunchbase, despite typically outperforming their male counterparts.

“But I do believe that this is changing. We’re already seeing a significant increase in women-led businesses including startups. In successful family businesses, and especially in e-commerce, we’re seeing females establishing their own companies, but many of these are self-funded or family-funded rather than seeking VC investment,” Al-Alawi said.

He added that a number of his clients in Saudi Arabia were female entrepreneurs from family offices who were starting to look beyond their own businesses and at potential investment opportunities in female-led startups.