JEDDAH: Rozan Bawazir started his company, Rozeye, during his last year of college. While studying at the University of Business and Technology, the 22-year-old also worked with the university to create a virtual tour for its official website.

The catalyst for the start of his career came a few years ago as he observed his father, who works in the IT sector. “He worked with a real estate company, and they hired me to build a virtual tour for them,” Bawazir said.

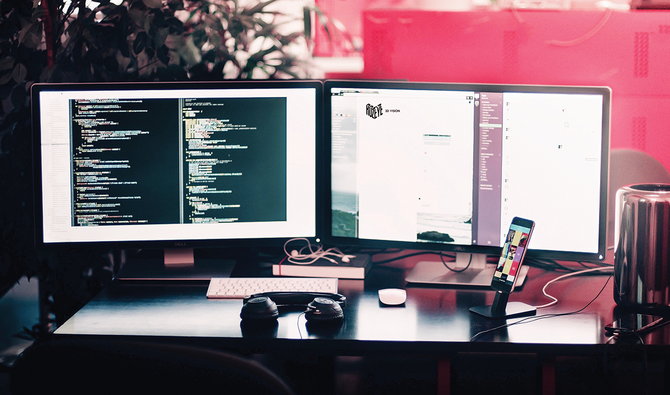

Applying his experience, Bawazir launched Rozeye, which helps display and promote different locations — from offices and hotels to universities and restaurants — in a unique way.

The startup offers virtual tours that combine a series of 360-degree images into a single experience, allowing visitors to navigate around a specific location.

“This not only enables the customer to go through the property but also speeds up the purchasing process,” Bawazir said.

The time-saving feature of these tours has been a selling point for Rozeye.

“We have had projects before in which we worked with luxury properties,” he said. “The people buying these properties are often busy. With Rozeye, however, they don’t have to take the time to visit the locations themselves.”

The pandemic played a big role in Bawazir’s business. He had the idea before the outbreak, but with people stuck at home, demand grew and accelerated the project’s development.

“I did projects for the municipality of Jeddah and for various other Saudi websites when the pandemic started,” Bawazir told Arab News.

He said that the most challenging projects for the startup are universities.

“They have different sections with multiple buildings, so we have to build different files, sew them together and create the tour. The real work begins when we are done shooting. We need to edit the shots in the most realistic way possible to give our clients the best results,” he explained.

From the glare of the sun to the angles of the objects shown in the virtual tours, everything feels as if the viewer is there in real life, Bawazir said.

Since Rozeye started working with international real estate companies, the startup has been able to build a strong customer base, giving it the necessary exposure.

“We are using the best resolution available in the market,” Bawazir said. “It can be accessed through the virtual reality headsets, and then the clients can view the space as if they were actually present on the property.”