NEW YORK: President Joe Biden’s strategy to make the US a powerhouse in electric vehicles will include boosting domestic recycling of batteries to reuse lithium and other metals, according to government officials.

As Biden makes fighting climate change and competing with China centerpieces of his agenda, the administration is set to wrap up a 100-day review of gaps in supply chains in key areas, including electric vehicles (EV).

These gaps include the minerals used in EV batteries and consumer electronics. The administration is also looking for ways to reduce metal usage in new battery chemistries.

Reports from various government agencies will be submitted to the White House, a process Biden ordered in an executive order earlier this year. Parts of the reports could be released publicly as soon as next week.

Democrats are pushing aggressive climate goals to have a majority of US-manufactured cars be electric by 2030 and every car on the road to be electric by 2040.

Securing enough cobalt, lithium and other raw materials to make EV batteries is a major obstacle, with domestic mines facing extensive regulatory hurdles and environmental opposition.

Reuters reported on May 25 that Biden plans to rely on mines in ally countries to supply much of the metals needed to build EVs.

The administration’s options to spur domestic recycling include direct investment in projects and scientific research, as well as spending funds approved by Congress.

Boosting domestic recycling would help the administration further that goal by breaking down older EVs into component parts for new vehicles and thus relying less on mining.

“When you look at the way the US has approached the recycling opportunity, what’s very evident is we need to invest in that capacity, we need to take a more proactive approach,” said one of the administration officials.

“A big part of the lithium opportunity is really recycling, and being a global leader in recycling the lithium from existing batteries and driving that into these new batteries.”

The White House would like to see more recycling plants open in the US, one of the officials said, noting the announcement last fall by China’s Ganfeng Lithium Co. of plans to build a battery recycling plant in Mexico to supply the US EV market.

The administration’s emerging strategy will also include a heavy emphasis on research and development intended to boost the use of already-mined metals, the officials said.

That plan would effectively expand on ongoing research at the US Department of Energy’s Argonne National Laboratory, which has been the focal point for much of the government’s battery recycling research.

Extracting the various mineral components of a battery has proven difficult and costly in the past, and new research focuses on ways to reuse cathodes and other battery parts, according to Argonne researchers.

Washington’s recycling focus comes as other regions are doing the same. The EU is considering clamping down on exports of metal waste to encourage more regional recycling, part of an effort to become climate neutral by 2050.

Global EV sales topped 2.5 million last year, a figure that’s projected to jump 70 percent for 2021 and continue to rise through 2040, according to IHS Markit forecasts.

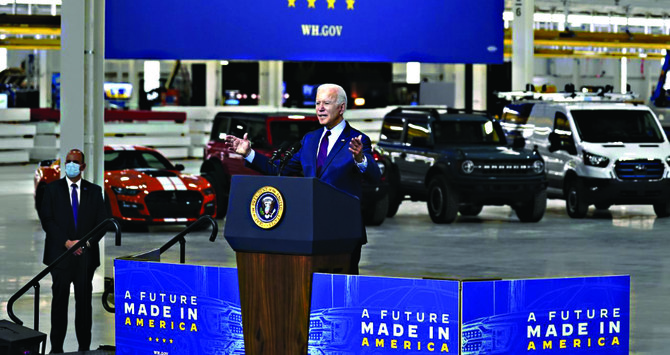

Biden’s electric vehicle plan includes battery recycling push

https://arab.news/53e3z

Biden’s electric vehicle plan includes battery recycling push

- The White House would like to see more recycling plants open in the US: official

- The administration is also looking for ways to reduce metal usage in new battery chemistries

Up to $10bn of inflows could be unlocked by Saudi stock market reforms, experts say

- Changes aimed at supporting investment inflows and enhancing market liquidity will take effect on Feb.1.

- Move marks a pivotal evolution in the Kingdom’s economic transformation

RIYADH: Saudi Arabia’s decision to open its financial markets to all foreign investors could unlock $10 billion of inflows and place the nation on an equal footing with other competitive emerging exchanges, experts told Arab News.

The Kingdom’s Capital Market Authority announced the sweeping changes on Jan. 6, including the removal of restrictions such as the Qualified Foreign Investor framework, which required a minimum of $500 million in assets under management, and abolishing swap agreements.

The changes, aimed at supporting investment inflows and enhancing market liquidity, will take effect on Feb.1.

The move aligns with Saudi Arabia’s Vision 2030 program, which aims to diversify the Kingdom’s economy by reducing its reliance on crude revenues.

Speaking to Arab News, Hamza Dweik, head of trading at Saxo Bank for the Middle East and North Africa, said: “This reform is expected to unlock an estimated $9 billion to $10 billion in new inflows, adding to the SR519 billion ($138 billion) already held by foreign investors in the main market as of the third quarter of 2025.

“Greater participation will deepen liquidity in a market valued at over SR3 trillion and increase Saudi Arabia’s weighting in global emerging-market indices from approximately 3.2 percent to 4.7 percent.”

Kapil Chadda, partner at Arthur D. Little, Financial Services Practice, said the move is expected to make the Saudi market more attractive, improve liquidity, and enhance valuations due to increased demand for shares.

“Opening the Saudi market to all foreign investors allows both institutional and private investors to access listed Saudi companies directly. This puts Saudi Arabia on a more equal footing with other competitive emerging markets such as Brazil, India, and China, which are already easily accessible,” said Chadda.

He added: “A broader investor base means more foreign capital can enter the market, which should support higher liquidity and trading volumes, while simplifying access by removing complex qualification requirements.”

To strengthen the capital market in the Kingdom in recent years, Saudi Arabia has established exchange-traded funds with Asian partners in Japan and Hong Kong.

In 2025, Saudi Arabia also opened the door for foreigners to buy listed firms that own real estate in Makkah and Madinah, without changing restrictions on direct land ownership.

Rapid FDI expected

To facilitate foreign investment, CMA has introduced several changes, which include abolishing the QFI framework and asset requirements, eliminating swap agreements, and simplifying account opening for current and former Gulf Cooperation Council residents.

Tony Hallside, CEO of STP Partners, said the move marks a pivotal evolution in the Kingdom’s economic transformation.

He believes the CMA decision is a clear signal to the world that the Kingdom is now building the most accessible, liquid, and globally integrated financial markets in the region.

Hallside added: “This reform reflects Saudi Arabia’s deep commitment to unlocking new sources of capital, supporting innovation, and accelerating its Vision 2030 agenda.”

Vijay Valecha, chief investment officer at Century Financial, echoed similar views and said Saudi Arabia is expected to witness a rapid inflow of foreign direct investment into the Kingdom.

“Looking at the possible benefits Saudi Arabia could gain from opening its capital markets, it will now increase FDI flows. Empirical evidence suggests that FDI has played an ambiguous role in contributing to economic growth,” said Valecha.

The Century Financial official added that the CMA decision will also play a crucial role in materializing Saudi Arabia’s foreign direct investment ambitions.

“One of the three main pillars of Vision 2030 is building a thriving economic environment that supports growth by expanding the private sector and increasing FDI. This step is directly feeding into this by encouraging global investors to participate in Saudi Arabia’s growth story and gain exposure to a rapidly emerging market,” added Valecha.

Amol Shitole, head of fixed income at Mashreq Capital, told Arab News the near-term sentiment of this move should be positive, but the scale of inflows will depend on future adjustments to foreign ownership limits, which regulators plan to review later this year.

“Initially, demand will likely concentrate on index heavyweights such as Saudi Aramco and leading banks, given their liquidity and benchmark relevance. Over time, sustained performance will hinge on fundamentals including government spending, diversification progress, and sector earnings rather than access mechanics alone,” said Shitole.

Investment sectors

According to Saxo Bank’s Dweik, foreign investors are expected to focus on sectors aligned with Vision 2030 priorities, including technology and digital transformation, renewable energy and green hydrogen, mining and metals, logistics and infrastructure.

He added that inflows will also happen in booming sectors in Saudi Arabia, which include tourism, healthcare, and entertainment.

“These sectors offer strong growth potential, with petrochemical profits projected to rise by 74 percent in 2025 and healthcare by 23 percent. Infrastructure and private-sector expansion have already driven non-oil private investment to SR 1.3 trillion in gross fixed capital formation,” said Dweik.

STP Partners’ Hallside said that he expects heightened interest across sectors such as infrastructure, advanced manufacturing, healthcare, and tourism, where foreign capital and expertise can play a catalytic role.

“For global investors, this move presents a compelling opportunity to participate in a rapidly modernizing economy that is strategically positioned at the crossroads of East and West,” added Hallside.

According to Valecha, the most significant boost from foreign ownership changes would be toward large-cap banks with high adjusted free floats, as previous limitations were constraining a greater MSCI weighting, mainly for financial institutions such as Al Rajhi, SNB, and Alinma.

The Century Financial official added that energy giant Saudi Aramco will also benefit greatly from the move, as international funds can buy its shares directly.

“There are several international mega events planned for the Kingdom, including the 2029 Asian Winter Games, the 2030 World Expo, and the 2034 FIFA World Cup. The companies which are direct beneficiaries may attract long-term capital and foreign portfolio interest,” added Valecha.

Expected bull trend

According to Valecha, the Saudi market is set for a “systemic bull trend” in 2026 as foreign liberalization removes deep-rooted pricing impediments in the exchange.

The bull thesis is supported by market activity recorded the day after the changes were announced. All 20 sector indexes moved higher, with 212 of the listed stocks advancing, while 49 retreated.

“The banking sector is at the essence of the story of foreign inflows, with the acceleration of non-oil GDP growth and Vision 2030 megaproject financings placing the financial sector at the forefront of foreign entry and multiple expansions. Mid-year ownership cap decisions will catalyze a second wave of passive foreign inflows,” said Valecha.

Dweik expressed similar views and said the Saudi stock market is expected to perform positively following this opening.

“After a nearly 13 percent decline in 2025, analysts forecast mid-single-digit earnings growth and a 5–10 percent increase in trading volumes in 2026, supported by $10 billion to $15 billion of incremental foreign inflows. Increased liquidity and global investor confidence should stabilize pricing and drive sustainable growth over the long term,” added the Saxo Bank official.

Potential challenges and combat measures

Amid significant scope for positive future outcomes, experts also highlighted some of the potential challenges that could arise in the future.

“Foreign investors who position early in liquid strategically aligned sectors stand to benefit the most, though challenges around regulatory clarity, governance standards, and valuation discipline remain key considerations,” said Shitole.

Chadda shared identical views and said that transparency and governance should be held at the highest level to reap the maximum benefits of the move.

He added that the rights of minority and foreign shareholders are equally represented, which is crucial for developing confidence in the market.

“The key challenges that foreign investors face when investing in Saudi Arabia are to be assured that the level of transparency and governance is being held to a high standard and that they are not surprised by hidden risks such as insider trading, lack of suitable independence at boards to allow for the right controls between management and shareholders,” added Chadda.

Dweik said that foreign investors must navigate ownership caps, currently 10 percent per investor and 49 percent aggregate foreign holding limits— alongside regulatory complexity and market volatility influenced by oil prices and regional dynamics.

“Building strong local partnerships and understanding the regulatory landscape will be essential to mitigate risks and succeed in this evolving market,” he concluded.