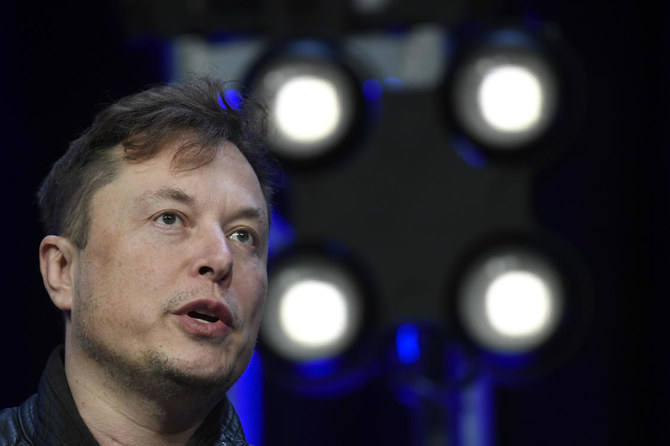

LONDON: Bitcoin popped back above $50,000 in Asian trade on Thursday, clawing back some of the 17 percent plunge that followed Elon Musk’s tweet that Tesla Inc. would stop accepting the digital tokens as payment for its cars.

The price of the world’s largest cryptocurrency dropped from around $54,819 to $45,700, its lowest since March 1, in just under two hours following the tweet shortly after 2200 GMT. It recovered about half of that drop early in the Asian session, and last traded about $51,099.

Ether, the world’s second-largest cryptocurrency, followed a similar pattern, dropping 14 percent to touch a low of $3,550, before bouncing back above $4,000.

“We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel,” Musk wrote.

Tesla’s announcement on Feb. 8 that it had bought $1.5 billion of bitcoin and that it would accept it as payment for cars has been one factor behind the digital token’s surging price this year.

As a result, Musk’s comments roiled markets even though he said Tesla would not sell any bitcoin and would resume accepting the cryptocurrency as soon as mining transitioned to more sustainable energy.

The digital currency is still 30 percent higher than before Tesla’s February announcement.

At current rates, bitcoin mining devours about the same amount of energy annually as the Netherlands did in 2019, data from the University of Cambridge and the International Energy Agency showed.

“The issue (of huge energy use by bitcoin miners) has been long known so it’s nothing new, but taken together with Musk’s recent comments about dogecoin, his latest comments seems to suggest his passion for cryptocurrencies may be waning,” said Makoto Sakuma, researcher at NLI Research Institute in Tokyo.

Cryptocurrency dogecoin lost more than a third of its price on Sunday after Musk, whose tweets had stoked demand for the token earlier this year, called it a “hustle” on the “Saturday Night Live” comedy show. On Tuesday, however, he was asking his followers on Twitter if they wanted Tesla to accept dogecoin.

A broader selling of risk assets in traditional markets was another factor in the plunge, said Jeffrey Wang, Vancouver-based head of Americas at Amber Group, a cryptocurrency service provider.

“I don’t think everything is selling off just because of this news. This was kind of the straw that broke the camel’s back in terms of adding to the risk sell-off,” he said.

On Wednesday, the S&P 500 dropped 2.1 percent, and the Nasdaq Composite lost 2.7 percent.

Smaller cryptocurrencies were less affected by the news.

“Interestingly enough, altcoins are performing well,” said Justin d’Anethan, sales manager at Hong Kong-based head of exchange sales at Diginex, a digital asset company.

“The reason given in the tweet is fossil fuel use for the mining of BTC, but most cryptocurrencies have already found more efficient ways to do that and therefore outperformed.”

Bitcoin has struggled since hitting a record $64,895.22 in mid-April, dropping to the cusp of $47,000 just 11 days later before hovering around $58,000 since the start of May.

By contrast, ether soared to a record $4,180.12 on Wednesday, and, even with the current pullback, is up 435 percent in 2021, eclipsing bitcoin’s 75 percent rise. Its popularity stems in part from the ethereum network’s growing number of uses, including non-fungible tokens, which are used to certify unique ownership of things like online artwork.

The bitcoin dominance index, a ratio of bitcoin’s share of the total market cap of all cryptocurrencies, dropped to 42 percent, its lowest since June 2018.

“The trade we’ve been pushing for a while now is short bitcoin, long ether, and that trade has been a thing of beauty,” said Chris Weston, head of research at broker Pepperstone in Melbourne.

“The question everyone is asking is at what stage will ether have a bigger market cap than bitcoin, and I think that day will come personally.”

Bitcoin recoups some losses after Musk-triggered tumble

https://arab.news/w8bh2

Bitcoin recoups some losses after Musk-triggered tumble

- Tesla will retain bitcoin holdings

- Musk reiterates faith in crypto

Airports in GCC are turning stopovers into tourism growth

- Governments and airport operators are turning aviation as a central pillar of tourism and economic strategy

CAIRO: Once defined by fleeting layovers and duty-free corridors, airports across the Gulf Cooperation Council are increasingly gateways to short-stay tourism, driving non-oil growth, hospitality revenues and job creation.

Across the region, governments, airlines and airport operators are treating aviation not merely as a transport sector but as a central pillar of tourism and economic strategy. Through streamlined visa regimes, airline-led stopover programs and sustained investment in airport infrastructure and technology, GCC countries are turning transit passengers into visitors.

“Across the GCC, destinations have shifted from functioning primarily as global transit hubs to positioning themselves as places travelers actively choose to visit, even for short stays during onward journeys,” Nicholas Nahas, partner at Arthur D. Little, told Arab News.

Airports in the Middle East are investing heavily in biometric processing systems, e-gates and digital border controls designed to shorten waiting times and improve passenger flow. These upgrades, backed by coordinated public-private initiatives, are narrowing the gap between arrival and exploration, making short stays viable even for passengers transiting for less than 48 hours.

Unified GCC visa

Two years after its initial proposal, the long-discussed unified GCC tourist visa is moving through final coordination stages, a development expected to further accelerate tourism spending linked to stopovers.

Looking ahead, the visa could allow the region to function as a single tourism corridor. Robert Coulson, executive adviser for real estate at Accenture, said the next phase is about regional continuity. “The next leap for the GCC is making the region feel like one seamless journey while differentiating each stop with a distinct identity,” he told Arab News.

First proposed in 2023 and approved in principle in 2024, the visa is designed to allow travel across Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE under a single permit. Analysts say Saudi Arabia is positioned to be among the biggest beneficiaries, given its scale, expanding destination portfolio and growing aviation capacity.

The unified visa is expected to complement existing stopover initiatives by allowing travelers to combine short visits to Saudi Arabia with trips to Dubai or Doha, effectively turning the Gulf into a single multi-country itinerary rather than a series of isolated transit points.

Saudi aviation surge

Saudi Arabia’s aviation-driven tourism growth has accelerated rapidly. The Kingdom welcomed an estimated 122 million visitors in 2025, moving closer to its Vision 2030 target of attracting 150 million tourists annually.

“GCC travel hubs have stopped selling connections and started selling experiences,” Coulson said. “They’ve cracked the stopover-to-stayover model, turning a layover into a mini-holiday rather than dead time.”

In January, Abdulaziz Al-Duailej, president of the General Authority of Civil Aviation, said international destinations served from Saudi Arabia increased to 176 in 2025, while the Kingdom remained home to some of the world’s busiest air routes.

He credited this performance to the “unlimited support” of the Kingdom’s leadership, identifying aviation as a key enabler of Vision 2030 and broader economic diversification.

Saudi Arabia’s newest airline, Riyadh Air, is expected to contribute more than $20 billion to non-oil gross domestic product and create over 200,000 direct and indirect jobs, underscoring aviation’s expanding economic footprint.

A key pillar of Saudi Arabia’s strategy has been the introduction of a digital stopover visa in 2023, allowing transit passengers to enter the Kingdom for up to 96 hours. The initiative enables short visits for Umrah, trips to Madinah or exploration of the country’s cultural and historical sites. The policy reflects a broader regional effort to turn time spent between flights into economic activity beyond the airport terminal, particularly in hospitality, transport and cultural tourism.

Short-stay shift

This evolution has been driven by global connectivity, simplified visa access and the ability to deliver high-quality experiences within a 24-to-72-hour window. The UAE, particularly Dubai, was the earliest and most established example of this transition, converting a growing share of its transit traffic into visitors through airline-led stopover packages, flexible visa categories and dense, short-stay-friendly attractions.

Dubai International Airport handles more than 85 million passengers annually. Curated stopover products combining hotel stays with cultural and entertainment experiences have helped transform transit traffic into leisure demand. Direct metro access and streamlined entry processes have further reduced friction. As a result, Dubai welcomed around 19 million international overnight visitors in 2025.

Other GCC destinations have since adopted similar models. Abu Dhabi expanded stopover offerings through its national carrier, promoting entertainment and cultural districts as compelling short-stay experiences. Qatar embedded stopover tourism into its national tourism strategy, converting transfer traffic at Hamad International Airport into city stays. Saudi Arabia expanded its tourism offering through its 96-hour digital visa linked to onward flights.

A smooth transit experience is often the deciding factor in whether passengers remain airside or choose to explore. Fast entry processes, intuitive airport design and reliable airport-to-city connectivity can turn even a six- to eight-hour layover into usable time rather than idle waiting.

Under Vision 2030, Saudi Arabia has invested heavily in airport expansion, digital border processes and urban mobility projects designed to shorten the distance between arrival and experience. Airline stopover platforms, transport apps and airport-based destination messaging increasingly reduce uncertainty and enable spontaneous exploration.

Beyond transit traffic, Nahas said tourism growth across the GCC has been driven by integrated destination ecosystems. Successful destinations are designed end-to-end — from trip planning and arrival through accommodation, mobility, experiences and departure — requiring coordination across tourism authorities, airlines, airports, transport providers and experience operators.

Designing destinations

For developers shaping the region’s next phase of tourism growth, the focus has shifted toward creating destinations that capture travelers from the moment they arrive.

Sultan Moraished, group head of technology and corporate excellence at Red Sea Global, said next-generation destinations are being designed to resonate with global travelers beyond a flight connection.

“As we design and build next-generation destinations, our focus is always on creating experiences that resonate with global travelers from the moment they arrive to when they choose to explore beyond a flight connection,” he told Arab News.

Moraished said offering experiences travelers cannot find elsewhere, from cultural immersion to nature-based activities, creates compelling reasons to extend visits beyond simple transit. He added that collaboration across aviation, hospitality and destination authorities ensures that every part of the journey is aligned with a shared vision for tourism growth.

Looking ahead, Moraished said the intersection of innovation and hospitality will continue to open new pathways, from smart digital experiences to regenerative tourism practices that appeal to increasingly conscious travelers and encourage repeat visitation.

Experience economy

Airports have shifted from being standalone infrastructure assets to functioning as world-class distribution engines for cities and destinations. Investments in gateway airports have made them part of the destination brand promise.

Tourism operates as a continuous conversion funnel, Coulson said. Every step removed between the flight gate and the city increases the likelihood that travelers will leave the terminal and spend money locally. Fast connections, predictable baggage handling and clear wayfinding reduce perceived risk, while simplified transit visas make spontaneity possible.

A unified GCC tourist visa could unlock longer stays and multi-country itineraries, supported by investment in walkable districts, waterfronts and climate-smart design.

Taken together, the transformation of transit hubs into tourism powerhouses reflects a broader shift in how the Gulf approaches aviation-led growth. Airports are no longer just points of passage but economic gateways where short stopovers translate into tourism spending, jobs and long-term diversification.