JEDDAH: The important role of foreign investments in supporting the Arab region’s post-pandemic recovery was highlighted by keynote speakers during the second day of the Arab Federation of Exchanges.

The 11th annual conference was a two-day virtual event that was hosted by Saudi Arabia and concluded on Tuesday.

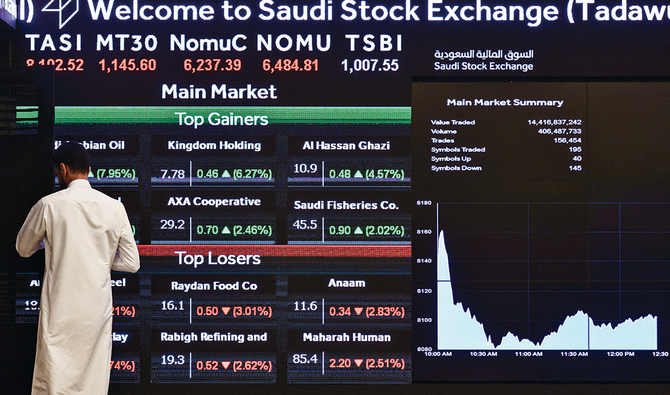

During a session discussing the Arab markets’ response to coronavirus (COVID-19), Saudi Stock Exchange Company (Tadawul) CEO Khalid Al-Hussan said stimulating and encouraging foreign investment would lighten the impact of the pandemic.

“Looking at COVID-19, if we are an isolated exchange, we would be impacted more by the pandemic compared to if we were an integrated platform and economy,” Al-Hussan said.

As part of its Vision 2030, Saudi Arabia is working on mobilizing investments in the country, especially with the recent privatization law and the launch of several high-profile megaprojects, such as the revolutionary zero-carbon city “The Line” and the “Coral Bloom” luxury Red Sea project.

Saudis are keen to open up the country and integrate it with the rest of the world. From a capital perspective, stock exchanges do not necessarily need to compete with each other, Al-Hussan said.

“Tadawul benefitted from opening this channel,” he said. “The inclusion we made has positively impacted the cash inflow by billions in the Saudi market.”

According to an Al Eqtisadiah report, Tadawul collected SR5.5 billion ($1.46 billion) in share sale proceeds last year. Despite the pandemic, that represents a year-on-year increase of 34 percent, excluding the bumper 2019 Aramco Initial Public Offering (IPO).

According to Ahmed Shams El-Din, the managing director and global head of research at EFG Hermes, Saudi Arabia is currently the most diversified market in the region.

He said the Kingdom has “a very active IPO compared to other markets,” and pointed out that the UAE market lacks retail and domestic support, while Egypt lacks foreign support.

By the end of 2020, Tadawul saw an increase of 22 percent in the number of qualified foreign investors (QFI).

“We have been witnessing a big activity since the beginning of this year with QFIs owning around 15 percent of the free float shares in a market worth $2.5 trillion,” Tadawul Chief of Markets Mohammed Sulaiman Al-Rumaih told delegates.

“There is a growing interest from investors that we need to do some enhancement. But every enhancement they ask for is either something we planned for or we need to tweak existing services and products for it.”

The Arab Federation of Exchanges was the largest gathering of regional financial institutions in the region this year. During the first day of the conference, keynote speakers focused on the role of environmental, social and corporate governance practices in achieving economic growth and financial prosperity.