DUBAI: Saudi Aramco’s CEO Amin Nasser expects oil demand to rise this year as the company declared a full year dividend of $75 billion.

He said that the outlook was based on improving demand from China that was approaching pre-pandemic levels as well as the global roll-out of vaccines.

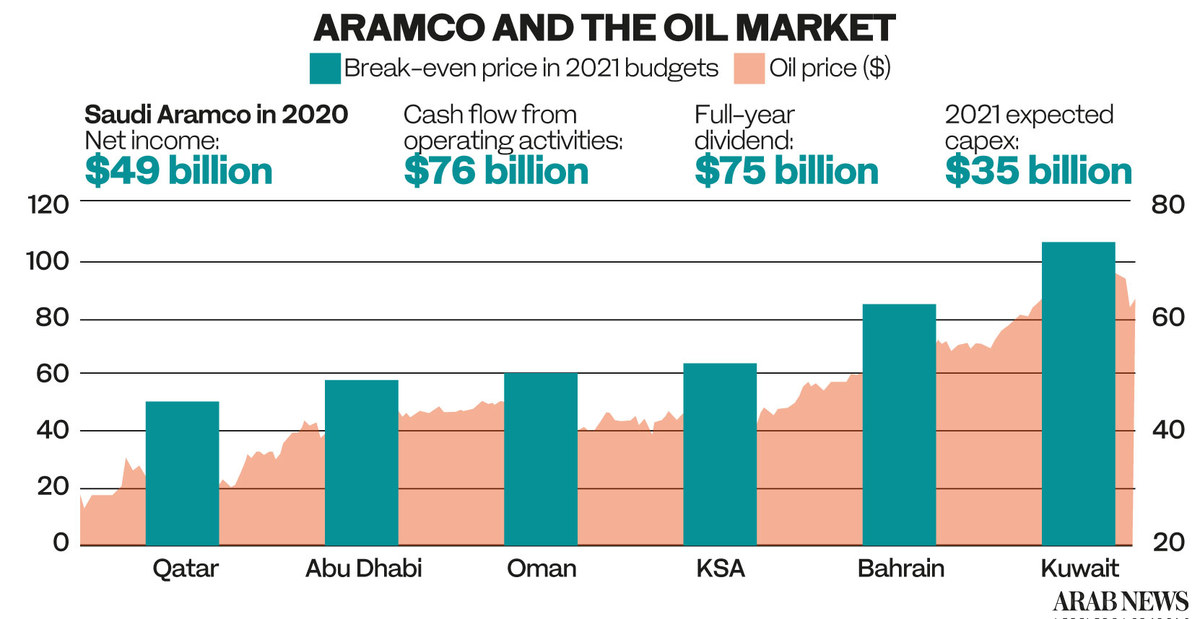

Earlier the world’s biggest oil company reported a 44.4 percent drop in net income to $49 billion in 2020, as the global energy industry emerged from the impact of lower crude oil prices and the COVID-19 pandemic.

The company, listed on the Saudi stock exchange, said revenues declined 30.5 percent to $204.83 billion.

“In one of the most challenging years in recent history, Aramco demonstrated its unique value proposition through its considerable financial and operational agility,” said Nasser. “Our exceptional performance during such testing times owed much to the unwavering spirit and resilience of our employees, who set operational records and continued to meet the world’s energy needs both safely and reliably,” he added.

Aramco shares gained about 0.4 percent in early trade.

In 2020, Aramco’s average hydrocarbon production was 12.4 million barrels per day of oil equivalent, including 9.2 million barrels per day (mmbpd) of crude oil, the company said.

A massive contraction in global oil demand that followed the first pandemic-related lockdowns a year ago has been a major blow to international oil companies as they rapidly re-shape their businesses in response to rapidly changing consumer demand.

Earnings among major global producers such as Royal Dutch Shell and BP fell sharply in 2020 while Exxon Mobil, the largest US energy company, reported its first annual loss.

“Looking ahead, our long-term strategy to optimize our oil and gas portfolio is on track and, as the macro environment improves, we are seeing a pick-up in demand in Asia and also positive signs elsewhere. We remain confident that we will emerge on the other side of this pandemic in a position of strength,” said Nasser.

Aramco said that its international bond issuance in the fourth quarter achieved record demand for a 50-year tranche and was 10 times oversubscribed compared to its initial offering size