The Future Investment Initiative summit opened in Riyadh on Wednesday with a call for a “fundamental rethink” toward economic and social challenges in the pandemic era, and an invitation to take part in the big investment opportunities offered by Saudi Arabia’s transformation strategy.

Yasir Al-Rumayyan, governor of the Public Investment Fund, said the pandemic presented “an unprecedented opportunity for fresh thinking,” and urged the virtual global audience involved in the event “not to return to the status quo.”

He also invited financiers, bankers and business people to sample the “investment menu” in the Kingdom. “The variety of investments available in Saudi Arabia is really big — not just in the financial sector, but in the real economy,” he said.

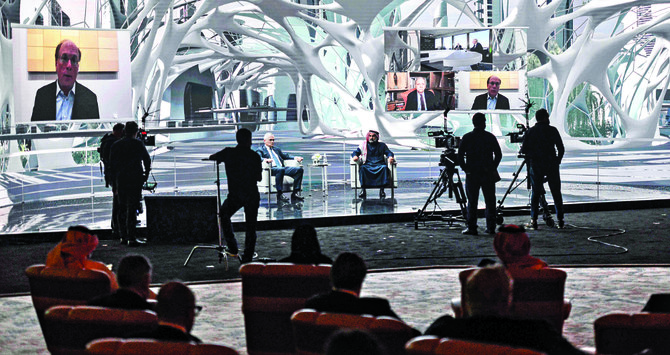

The event had been postponed from last autumn because of travel restrictions from the pandemic, but went ahead as a “hybrid” forum with a physical venue in the Saudi capital supported by online hubs in Beijing, Mumbai, Paris and New York. The organizers said about 9,500 people attended either in person or virtually.

Al Rumayyan said: “This is not a normal event, but it is the opportunity to open a new chapter for humanity — the neo-renaissance,” which is the theme of the two-day gathering.

The PIF boss and other investment experts talked enthusiastically about the range of potential investments in the Kingdom under the second phase of the Vision 2030 strategy, but also warned that the global economic situation remained uncertain.

Al-Rumayyan said the division between “those with funds waiting on the sidelines and the working class” was a potential risk for economic recovery in 2021.

That caution was echoed by one of the big investment heavyweights at the opening session, the founder of investment firm Bridgewater Associates, Ray Dalio, who said: “I don’t think equities will be as ebullient as last year.”

Khalid Al-Falih, the Saudi investment minister, was more optimistic, pointing out that foreign investment had risen in the Kingdom in 2020 despite the economic recession caused by the virus.

He called on governments to take on more of the risk of setting up business, as the Saudi government has done. “We have looked at 400 different investment regulations and half of them have been revamped,” he said.

A major theme of the opening day, reinforced by virtually every speaker, was the move toward more sustainable investment, especially in the crucial energy sector.

Prince Abdul Aziz bin Salman, the Saudi energy minister, predicted that the Kingdom would make more progress in tackling climate change in the next decades than many other countries.

“We will enjoy being looked at as a reasonable and responsible international citizen because we will be doing more than most European countries by 2030,” he said.

He praised the Kingdom’s efforts in fighting the virus and in rebalancing global oil markets last year. “When the going got tough, the tough got going,” he said.

Saudi Arabia’s FII hears call for ‘new chapter for humanity’ in response to pandemic

https://arab.news/5c7mj

Saudi Arabia’s FII hears call for ‘new chapter for humanity’ in response to pandemic

- Pandemic presents ‘an unprecedented opportunity for fresh thinking’

Saudi investment pipeline active as reforms advance, says Pakistan minister

ALULA: Pakistan’s Finance Minister Mohammed Aurangzeb described Saudi Arabia as a “longstanding partner” and emphasized the importance of sustainable, mutually beneficial cooperation, particularly in key economic sectors.

Speaking to Arab News on the sidelines of the AlUla Conference for Emerging Market Economies, Aurangzeb said the relationship between Pakistan and Saudi Arabia remains resilient despite global geopolitical tensions.

“The Kingdom has been a longstanding partner of Pakistan for the longest time, and we are very grateful for how we have been supported through thick and thin, through rough patches and, even now that we have achieved macroeconomic stability, I think we are now well positioned for growth.”

Aurangzeb said the partnership has facilitated investment across several sectors, including minerals and mining, information technology, agriculture, and tourism. He cited an active pipeline of Saudi investments, including Wafi’s entry into Pakistan’s downstream oil and gas sector.

“The Kingdom has been very public about their appetite for the country, and the sectors are minerals and mining, IT, agriculture, tourism; and there are already investments which have come in. For example, Wafi came in (in terms of downstream oil and gas stations). There’s a very active pipeline.”

He said private sector activity is driving growth in these areas, while government-to-government cooperation is focused mainly on infrastructure development.

Acknowledging longstanding investor concerns related to bureaucracy and delays, Aurangzeb said Pakistan has made progress over the past two years through structural reforms and fiscal discipline, alongside efforts to improve the business environment.

“The last two years we have worked very hard in terms of structural reforms, in terms of what I call getting the basic hygiene right, in terms of the fiscal situation, the current economic situation (…) in terms of all those areas of getting the basic hygiene in a good place.”

Aurangzeb highlighted mining and refining as key areas of engagement, including discussions around the Reko Diq project, while stressing that talks with Saudi investors extend beyond individual ventures.

“From my perspective, it’s not just about one mine, the discussions will continue with the Saudi investors on a number of these areas.”

He also pointed to growing cooperation in the IT sector, particularly in artificial intelligence, noting that several Pakistani tech firms are already in discussions with Saudi counterparts or have established offices in the Kingdom.

Referring to recent talks with Saudi Minister of Economy and Planning Faisal Alibrahim, Aurangzeb said Pakistan’s large freelance workforce presents opportunities for deeper collaboration, provided skills development keeps pace with demand.

“I was just with (Saudi) minister of economy and planning, and he was specifically referring to the Pakistani tech talent, and he is absolutely right. We have the third-largest freelancer population in the world, and what we need to do is to ensure that we upscale, rescale, upgrade them.”

Aurangzeb also cited opportunities to benefit from Saudi Arabia’s experience in the energy sector and noted continued cooperation in defense production.

Looking ahead, he said Pakistan aims to recalibrate its relationship with Saudi Arabia toward trade and investment rather than reliance on aid.

“Our prime minister has been very clear that we want to move this entire discussion as we go forward from aid and support to trade and investment.”