SINGAPORE: Southeast Asian ride-hailing and food delivery giant Grab has raised more than $300 million from investors led by South Korea’s Hanwha Asset Management Co. Ltd. for its rapidly-expanding financial services business.

Grab said this is the first external funding for the fintech business, which has chalked out ambitious plans in insurance, lending, wealth management and payments.

Grab competes with the likes of Indonesia’s Gojek and many local start-ups that are attracting millions of customers as they look to disrupt established financial services companies in a region home to some 650 million people.

“We are at an inflection point in Southeast Asia, as the pandemic has accelerated the need for digital financial services that help us grow and protect our incomes,” Reuben Lai, senior managing director at Grab Financial Group said in a statement.

Grab’s early backers such as GGV Capital and Singapore venture capital firm K3 Ventures also participated in the fintech arm’s funding. New investors included fintech investment firm Flourish Ventures, backed by EBay founder Pierre Omidyar.

“As more and more of our life, work and activities move online, tech platforms have played a big role in formalizing the economy,” Tilman Ehrbeck, managing partner at Flourish said.

“They have a real opportunity to bring financial services to the users who often are not reached by the traditional banking system, particularly true in Southeast Asia, which has a relatively higher mobile Internet penetration,” he said.

Reuters reported in September, citing sources, that Grab was negotiating with insurers including Prudential PLC, AIA Group Ltd. and others to raise $300 million to $500 million for the financial services unit.

In December, Internet platform company Sea Ltd. and Grab’s venture with Singtel each won Singapore’s first digital full bank licenses.

Backed by investors including Softbank Group Corp, Grab is seeking to evolve into an everyday app offering a variety of services.

Grab raises $300 million for fintech arm’s ambitious expansion

https://arab.news/jmfxx

Grab raises $300 million for fintech arm’s ambitious expansion

- Grab said this is the first external funding for the fintech business

- Grab competes with the likes of Indonesia’s Gojek

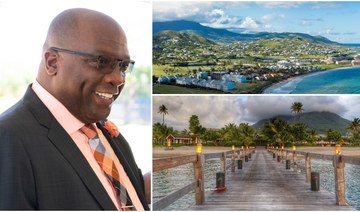

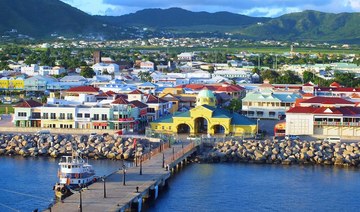

Saudi Fund for Development, St. Kitts and Nevis sign energy loan agreement

- $40 million will finance the expansion of St. Kitts and Nevis’ power generation capabilities through the establishment of a dual-fuel power generation station with a capacity of 18 megawatts

RIYADH: Saudi Arabia on Tuesday signed a loan agreement with St. Kitts and Nevis for $40 million to support the Caribbean nation’s energy sector, Saudi Press Agency reported.

The agreement was signed by the CEO of the Saudi Fund for Development, Sultan bin Abdulrahman Al-Murshid, and the deputy prime minister of St. Kitts and Nevis, Geoffrey Hanley, on the sidelines of spring meetings of the Bank Group and the International Monetary Fund in Washington DC.

The $40 million will finance the expansion of St. Kitts and Nevis’ power generation capabilities through the establishment of a dual-fuel power generation station with a capacity of 18 megawatts.

The project will contribute to providing a flexible hybrid power generation platform to improve efficiency and burn clean fuel and to support the transition to a sustainable energy future.

The agreement is part of the SDF’s mission to support countries and small island developing states around the world to overcome developmental challenges.

Saudi air cargo volumes witness 7% rise: GACA

RIYADH: The volume of air cargo handled by airports in Saudi Arabia saw an annual rise 7 percent in 2023 to reach 918,000 tonnes, official data showed.

In its latest report, the General Authority for Civil Aviation said that the Kingdom’s aviation sector strongly rebounded in 2023, with airports witnessing a 26 percent rise in passenger transportation compared to 2022.

GACA said that flight facilities in Saudi Arabia transported 112 million passengers last year, which also represented a rise of 8 percent compared to 2019.

The report revealed that the number of flights through the Kingdom’s airports in 2023 reached about 815,000, an increase of 16 percent compared to 2022.

In 2023, airports in Saudi Arabia handled 394,000 international and 421,000 domestic journeys, the authority added.

Fueled by significant growth in the Kingdom’s travel and tourism sector, 61 million international visitors and 51 million domestic passengers traveled through the region’s airports in 2023.

King Abdulaziz International Airport topped the list of the leading Saudi airports in terms of the number of flights, at a rate of 30 per hour.

KAIA was followed by King Khalid International Airport in Riyadh, which operated an average of 27 flights per hour, while King Fahd International Airport operated 11 carriers in an hour.

In February, Mohammed Al-Khuraisi, the executive vice president of strategy and business intelligence at GACA, said that Saudi Arabia’s aviation sector is expanding rapidly to meet the goal of reaching 250 destinations globally.

He also added that the Kingdom jumped 14 places in the International Air Transport Association Air Connectivity Index in 2023, along with achieving the highest level of air connectivity during the year 2023 by reaching 149 destinations.

Earlier this month, GACA, through its Air Transport and International Cooperation Sector, authorized China Southern Airlines to operate journeys between Riyadh and three cities in the Asian nation.

As a part of the authorization, the Chinese air carrier will operate flights from Beijing, Guangzhou, and Shenzhen to the Saudi capital.

This initiative is part of GACA’s continuous efforts to strengthen connectivity and broaden the Kingdom’s air transport network as part of the objectives of Saudi Vision 2030.

IMF raises growth forecast for Saudi economy to 6% in 2025

RIYADH: The International Monetary Fund has raised its expectations for Saudi Arabia’s economic growth in 2025 to 6 percent – up from 5.5 percent predicted earlier this year.

In its latest report, the IMF also noted that the Kingdom’s output will grow by 2.6 percent in 2024, down 0.1 percent compared to the previous projection.

The financial institution added that the overall economic growth in the Middle East and Central Asian region is projected at 2.8 percent and 4.2 percent in 2024 and 2025, respectively.

Earlier in April, the World Bank also raised the growth prospects of the Kingdom’s economy to 5.9 percent in 2025, up from an earlier projection of 4.2 percent.

Taming inflation should be a priority

According to the IMF, global economic growth, which is estimated at 3.2 percent in 2023, is projected to continue at the same pace in 2024 and 2025.

The report further pointed out that global headline inflation is expected to drop 5.9 percent this year after 2023’s 6.8 percent average.

However, the IMF warned that it is still too early to declare victory in the fight against inflation.

“Bringing inflation back to target should remain the priority. While inflation trends are encouraging, we are not there yet. Somewhat worryingly, progress toward inflation targets has somewhat stalled since the beginning of the year. This could be a temporary setback, but there are reasons to remain vigilant,” said IMF Economic Counsellor Pierre-Olivier Gourinchas.

He added: “Most of the good news on inflation came from the decline in energy prices and in goods inflation. The latter has been helped by easing supply-chain frictions, as well as by the decline in Chinese export prices. But oil prices have been rising recently in part due to geopolitical tensions and services inflation remains stubbornly high.”

Global economic recovery differs by region

According to the report, the global economy was resilient in 2023, but these gains were felt differently as low-income countries continued to experience the after-effects of the pandemic.

“We now estimate that there will be more scarring for low-income developing countries, many of which are still struggling to turn the page from the pandemic and cost-of-living crises,” said Gourinchas.

The IMF also called on countries to rebuild their fiscal buffers to help protect their sovereign debt levels, which will help them reverse the decline in medium-term growth prospects.

“Going forward, policymakers should prioritize measures that help preserve or even enhance the resilience of the global economy. The first such priority is to rebuild fiscal buffers. Even as inflation recedes, real interest rates remain high and sovereign debt dynamics have become less favorable,” he added.

Pakistan pushes to forge strategic, economic partnership as Saudi FM visits Islamabad

ISLAMABAD: Pakistani top leaders, including the prime minister, president and foreign minister, said on Tuesday the ongoing visit of Saudi Foreign Minister Prince Faisal bin Farhan to Islamabad would help transform a longstanding friendship between the two nations into a strategic and commercial partnership.

Prince Faisal arrived in Pakistan on Monday on a two-day visit aimed at enhancing bilateral economic cooperation and pushing forward previously agreed investment deals. His trip comes a little over a week after Crown Prince Mohammed bin Salman met Prime Minister Shehbaz Sharif in Makkah and reaffirmed the Kingdom’s commitment to expedite investments worth $5 billion.

Pakistan and Saudi Arabia enjoy strong trade, defense and cultural ties. The Kingdom is home to over 2.7 million Pakistani expatriates and the top source of remittances to the cash-strapped South Asian country.

“We aim to transform our traditionally fraternal ties into a strategic and economic partnership,” Foreign Minister Ishaq Dar said as he addressed a Pakistan-Saudi Arabia Investment Conference in Islamabad, held under the umbrella of Pakistan’s Special Investment Facilitation Council, set up last year to oversee all foreign investments.

“Your investments are not just financial commitments but are crucial in nurturing a deeply valued partnership,” Dar told the visiting dignitary.

“It is through the SIFC platform that we intend to streamline investment processes while ensuring rapid decision making and efficient handling of investments … The SIFC has a central role in augmenting our infrastructure and streamlining our regulatory frameworks to set the stage for a flourishing investment friendly economic environment.”

Dar said SIFC would ensure that investments were “swift and mutually beneficial, embodying our commitment to facilitating foreign direct investment in Pakistan.”

Pakistan was blessed with fertile agricultural lands, minerals and a large and dynamic population, complemented by a flourishing IT sector and abundant prospects for renewable energy creation, the foreign minister added.

He said Pakistan’s fertile lands and a vast network of water resources presented numerous investment opportunities in agri-tech and food processing, with the South Asian nation having the potential to become the region’s food basket.

“Our mining sector is marked by untapped potential especially in the expansive Tethyan belt known for its abundant deposits of copper, gold and other valuable minerals,” Dar said. “The strategic advancements in these areas are highlighted by projects such as Riko Diq copper [and gold] project which exemplifies our commitment to leveraging our natural resources for mutual benefit.”

On Sunday, Pakistani state media reported Saudi Arabia was likely to invest $1 billion in the mine project in Pakistan’s southwestern Balochistan province, one of the world’s largest underdeveloped copper-gold areas.

The foreign minister said Pakistan’s goal was to transform the country into a hub of economic activity, and innovation and create an attractive environment for global investors like Saudi Arabia.

“Investing in Pakistan is not merely a placement of capital. It would actually be instrumental toward forging a partnership that promises mutual prosperity and progress,” he concluded.

“Your engagement and investment in Pakistan will be handled with utmost respect and institutionalized commitment from our side, ensuring that together we achieve remarkable success.”

MEETINGS WITH PM AND PRESIDENT

Prince Faisal also met Pakistani PM Sharif on Tuesday who said the Saudi official’s visit would herald a new era of strategic and commercial partnerships between the two long-time allies.

“The visit is the beginning of a new era of strategic and commercial partnership between Pakistan and Saudi Arabia,” Sharif was quoted as saying in a statement from his office after he met Prince Faisal. “Pakistan wants to further promote cooperation in the fields of trade and investment between the two countries.”

The PM said Pakistan was taking steps to promote foreign investment and make partnerships “mutually beneficial” for allies, adding that Islamabad was grateful to the Saudi leadership for increasing investment.

Informing the Saudi delegation about the wide potential of investment in Pakistan, Sharif briefed them about the Special Investment Facilitation Council and measures the body was taking to promote investment.

Sharif also invited the Saudi crown prince to Islamabad.

“The people of Pakistan are looking forward to the visit of His Highness the Crown Prince Muhammad Bin Salman to Pakistan,” the PM’s office said.

President Asif Ali Zardari and Prince Faisal also met on Tuesday and reiterated the two nations’ resolve to build a strong partnership and promote mutually beneficial economic cooperation.

Zardari said Pakistan was working to transform its long-standing and decades-old relationship with Riyadh into a “long-term strategic and economic partnership.”

The two sides also discussed regional dynamics and recent developments in the Middle East and called for an immediate and unconditional ceasefire in Gaza and an end to Israeli air and ground offensives there.

INVESTMENT PUSH

In a statement shared with media on Monday, the Pakistan information ministry said the Saudi delegation would consult with Pakistani officials “on the next stages of investment and implementation issues.”

Saudi Arabia’s planned investment in the Reko Diq gold and copper mining project would be discussed during the visit, the ministry said, adding that Riyadh was also interested in investing in agriculture, trade, energy, minerals, IT, transport and other sectors in Pakistan:

“As a result of this visit, Pakistan’s export capacity will increase, joint ventures will be launched and new opportunities will be paved.”

Cash-strapped Pakistan desperately needs to shore up its foreign reserves and signal to the International Monetary Fund (IMF) that it can continue to meet requirements for foreign financing that has been a key demand in previous bailout packages. Pakistan’s finance minister, Muhammad Aurangzeb, is currently in Washington to participate in spring meetings of the International Monetary Fund and World Bank and discuss a new bailout program. The last loan deal expires this month.

Saudi Arabia has often come to cash-strapped Pakistan’s aid in the past, regularly providing it oil on deferred payments and offering direct financial support to help stabilize its economy and shore up its forex reserves.

Last year, however, Saudi Arabia’s finance minister said the Kingdom was changing the way it provides assistance to allies, shifting from previously giving direct grants and deposits unconditionally and moving toward mutually beneficial investment deals backed by internal economic reforms.

The PM said Pakistan was taking steps to promote foreign investment and make partnerships “mutually beneficial” for allies, adding that Islamabad was grateful to the Saudi leadership for increasing investment.

Informing the Saudi delegation about the wide potential of investment in Pakistan, Sharif briefed them about the Special Investment Facilitation Council and measures the body was taking to promote investment. The body was set up last year to oversee all foreign funding.

Sharif also invited the Saudi crown prince to Islamabad.

“The people of Pakistan are looking forward to the visit of His Highness the Crown Prince Muhammad Bin Salman to Pakistan,” the PM’s office said.

Diriyah Co. CEO appointed UN Tourism ambassador

RIYADH: Saudi historical destination developer Diriyah Co.’s CEO, Jerry Inzerillo, has been appointed as a UN Tourism ambassador, joining an elite group including Lionel Messi, Georgio Armani, and Placido Domingo.

The appointment was made during the global body’s first-ever sustainability week, being held in New York from April 15 to 19, according to a press statement.

Inzerillo has been honored for his “lifelong commitment” to employing “innovative design and development strategies” that bolster local communities and cultivate new and undiscovered tourism destinations, it added.

“The UN Tourism is enormously proud to welcome Inzerillo as our newest tourism ambassador. In this new role, he will help to amplify the UN Tourism’s key messages of the ability of tourism to drive change and achieve sustainable growth,” said Secretary-General Zurab Pololikashvili.

Diriyah is located on the outskirts of the Kingdom’s capital city, Riyadh. At its core is the UNESCO World Heritage Site of At-Turaif, the historic capital of the First Saudi State.

Upon completion, the Diriyah project will host 100,000 residents, workers, students, and visitors, offering a diverse range of cultural, entertainment, retail, hospitality, educational, and residential spaces.

Developing tourist destinations like Diriyah is crucial for Saudi Arabia, as the Kingdom pursues economic diversification, in line with the goals outlined in Vision 2030.

“In the area of tourism, we have the privilege to work in one of the world’s fastest growing sectors that employ 320 million people today and will add a further 100 million within the next decade. But with that privilege comes enormous responsibility to ensure that our developments are innovative, actionable and have real and enduring impact,” said Inzerillo.

Spearheaded by Inzerillo, Diriyah Co.’s development strategies adhere to the highest international sustainability, preservation, and conservation standards. They aim to support the mobility, health, and well-being of the local community.

“A key part of our master planning strategy is that our commitment to sustainable practices must also extend beyond the day-to-day operations of Diriyah Co.,” he added.

In January, Inzerillo told Arab News that Riyadh will be undergoing consistent transformative change “every year” that will allow visitors and residents to feel a palpable difference.

He added that visitors to the Kingdom’s capital do not need to look forward to 2030 to begin to witness the changes that the tourism sector is undergoing.

Formerly known as the World Tourism Organization, UN Tourism is a global agency responsible for promoting responsible, sustainable, and universally accessible tourism.

As a leading international organization, it advocates for tourism as a catalyst for economic growth, inclusive development, and environmental sustainability.