ISLAMABAD: Rating agency Moody’s said on Wednesday the Pakistani government’s credit profile was stable on the back of reforms and policy effectiveness, adding that the country’s banking system reflected banks’ solid funding and liquidity, although a challenging operating environment would weigh on asset quality and profitability.

Moody’s published its outlook on the Pakistan Banking System titled, “Banking System Outlook – Pakistan: Stable outlook balances loan book and profitability pressure against stable funding and a resilient sovereign.”

“Despite a difficult environment, the government’s credit profile is stable due to ongoing reforms and increasing policy effectiveness – a positive for the banks given their outsized holdings of Pakistani government debt link their credit profiles to that of the government,” said Constantinos Kypreos, a Moody’s Senior Vice President. “Deposit-based funding and good liquidity buffers also remain strengths, while the probability of government support in a crisis is high, even if its ability to do so is limited by fiscal challenges.”

The report said restrictions in place to contain the spread of the coronavirus would keep economic activity below pre-outbreak levels but the Pakistani economy was expected to return to modest growth of 1.5% in fiscal 2021.

“Government and central bank policy responses and structural reforms will soften the pandemic’s impact but not fully offset it,” the report said. “In this environment, we expect private-sector lending to grow modestly, by 5%-7%, over the calendar year.”

Nonperforming loans (NPLs) would rise from a sector-wide level of 9.9% of gross loans at September 2020 as the economic slowdown took a toll on borrowers’ repayment capabilities, the report said. Banks’ foreign operations, export-oriented industries and companies that depend on government payments and subsidies would be hit hardest. Loan repayment holidays and other support measures would contain the deterioration, but not eliminate the risks entirely. Banks’ heavy exposure to government bonds would also continue to link banks’ credit profiles with the fiscal strength of the government.

The report also said capital was modest but would remain broadly stable and profitability had materially increased during 2020, but would come under some pressure in 2021: Net interest margins will narrow after a huge 625-basis-point interest rate cut in 2020. Together with rising provisioning needs and subdued business generation, this will curb bottom-line profits.

“The government remains willing to support troubled banks but its ability to do so is limited by fiscal challenges reflected in its B3 rating,” the report concluded.

Moody’s maintains stable outlook for Pakistan banks

https://arab.news/gpn84

Moody’s maintains stable outlook for Pakistan banks

- Says despite difficult environment, government’s credit profile stable due to ongoing reforms and increasing policy effectiveness

- Pakistani economy expected to return to modest growth of 1.5 percent in fiscal year 2021 despite coronavirus restrictions

Pakistan raises petroleum prices citing ‘increasing trend’ in international market

- Pakistan has increased the prices of petrol by 4.53 rupees ($0.016) to 293.94 rupees

- Government also increases price of high speed diesel by 8.14 rupees to 290.38 rupees

KARACHI: Pakistan has increased the price of petrol by 4.53 rupees ($0.016) to 293.94 rupees with effect from today, Tuesday, the finance ministry said in a statement, citing rising petroleum prices internationally.

The government also increased the price of high speed diesel by 8.14 rupees to 290.38 rupees, the post said.

The price hikes come as Pakistan has initiated discussions with the IMF over a new multi-billion-dollar loan agreement as its current nine-month, $3 billion loan program expires with the disbursement of a final $1.1 billion tranche likely to be approved later this month.

Reforms linked to that bailout, including an easing of import restrictions and a demand that subsidies be removed, fueled record inflation, with the rupee hitting all-time lows. Authorities also raised petrol and diesel prices to record highs to meet conditionalities.

“The prices of Petroleum products have seen an increasing trend in the international market during the last fortnight,” the finance ministry said as it announced the new prices.

“The Oil & Gas Regulatory Authority (OGRA) has worked out the consumer prices, based on the price variations in the international market.”

Under the last IMF bailout, Pakistan was told to prevent further accumulation of circular debt in its power sector, arising from subsidies and unpaid bills. For a new program, the South Asian nation will need to implement reforms to reduce costs by improving electricity transmission and distribution, moving captive power into the grid, improving governance, and combating theft.

It will also have to maintain power and gas tariffs at levels that ensure cost recovery, with adjustments made to safeguard the financially vulnerable, through existing progressive tariff structures.

In a report released in January, the IMF noted Pakistan missed its target for power sector arrears, largely due to lower-than-expected recoveries and tariffs.

WHO warns of falsified cough syrup ingredients seized in Pakistan

- Five contaminated batches of propylene glycol falsely labelled as made by Dow Chemical units in Asia and Europe

- Contaminated cough syrups linked to deaths of more than 300 children globally since late 2022

The World Health Organization issued an alert on Monday warning drugmakers of five contaminated batches of propylene glycol, an ingredient used in medicinal syrups, that appear to have been falsely labelled as manufactured by Dow Chemical units in Asia and Europe.

The Drug Regulatory Authority of Pakistan (DRAP) issued three alerts between January and March over high levels of ethylene glycol (EG), an industrial solvent known to be toxic, found in drums purportedly made by subsidiaries of Dow Chemical in Thailand, Germany and Singapore.

DRAP sent suspect drums of propylene glycol, a sweet-tasting alcohol used in over-the-counter medicines such as cough syrups, for testing. The samples were found to have EG contamination of 0.76-100 percent, according to the WHO. International manufacturing standards say only trace amounts of EG, below 0.1 percent, can be considered safe.

Contaminated cough syrups made in India and Indonesia have been linked to deaths of more than 300 children globally since late 2022. The medicines were found to contain high levels of EG and diethylene glycol, leading to acute kidney injury and death. In the Indonesia case, authorities found that one supplier had placed false Dow Thailand labels onto drums containing EG that it sold to a distributor for pharmaceutical use.

Several of the batches seized by DRAP were labelled as having been manufactured in 2023, the WHO said, months after the agency issued a global alert calling on drugmakers to verify the quality of their suppliers.

The WHO said Dow confirmed that the materials identified in its Monday alert and found by DRAP were not manufactured or supplied by the company.

“The propylene glycol materials identified in this alert are considered to have been deliberately and fraudulently mislabelled,” the WHO said, noting batches may have been distributed to other countries and still be in storage.

Dow did not immediately respond to a request for comment.

The WHO alert comes the same week regulators in Tanzania and Rwanda joined Nigeria, Kenya and South Africa to recall batches of Johnson & Johnson children’s cough syrup after Nigeria said it found high levels of diethylene glycol, an industrial solvent known to be toxic.

The batch of Benylin Paediatric syrup recalled was made by J&J in South Africa in May 2021, although Kenvue now owns the brand after a spin-off from J&J last year.

Pakistan court strikes down clause setting gender-based age criteria for marriage

- The verdict was given on a petition seeking amendments to Child Marriage Act over gender-based distinction

- The court asks the Punjab government to issue a revised version of 1929 law in 15 days, based on its judgment

LAHORE: A high court in Pakistan on Monday struck down a section of the Child Marriage Act, 1929 that dealt with gender-based age distinction and ordered the government in the Punjab province to revise the legislation.

The verdict was given on a petition seeking amendments to the Child Marriage Act over apparent distinction on the basis of gender. The petitioner had stated in his petition that the Constitution of Pakistan granted equal rights to men and women.

The Lahore High Court (LHC) declared as “discriminatory” the 95-year-old act’s Section 2(a) and (b), which respectively fixed 18 and 16 years as legal ages for boys and girls for marriage.

“In sum, the words in section 2(a) viz . ‘if a male ….and if a female is under sixteen years of age’ being unconstitutional are held to be without lawful authority and of no legal effect. They are struck down,” Judge Shahid Karim wrote in his five-page verdict.

“The Govt. of Punjab (its relevant department) is directed to issue the revised version of 1929 Act (based on this judgment) within the next fifteen days and shall also upload that version on its website for information.”

Though the aforementioned law had been replaced by the Punjab Child Marriage Restraint (Amendment) Act, 2015 to criminalize child marriage in Punjab, Pakistan’s most populous province.

Women in Pakistan are often deprived of their basic rights and forced to marry against their will, in some cases even before reaching the legal age for marriage.

According to the Human Rights Commission of Pakistan (HRCP), about 500 women are killed each year by their family members over accusations that their “honor” has been violated, which are often triggered when women marry by choice.

The court observed there was a need to take effective steps against child marriages as the marriage laws in the country were meant to primarily keep in view the “social, economic and educational factors rather than religious.”

In his verdict, the judge referred to Article 25 of the constitution, which says: “All citizens are equal before law and are entitled to equal protection of law. There shall be no discrimination on the basis of sex.”

“The definition of ‘child’ in the 1929 Act while making a distinction on the basis of age, is not based on an intelligible criteria having nexus with the object of the law,” the court ruled.

“The definition is indeed a special provision for the protection of women but in the process it tends to afford greater protection to males by keeping their age of marriage higher than females.”

Pakistan PM urges increase in renewable energy resources to cut oil import bill

- Pakistan lacks adequate resources to run its oil- and gas-powered plants and imports most of its energy needs

- The country is currently faced with a balance of payments crisis, record inflation and steep currency devaluation

ISLAMABAD: Prime Minister Shehbaz Sharif on Monday directed the Pakistani energy ministry to maximize utilization of renewable energy resources in order to reduce the country’s oil import bill, Pakistani state media reported.

The remarks came at a meeting he presided over to review the country’s power sector, according to a report published by the Radio Pakistan broadcaster.

The prime minister said that oil imports worth billions of dollars could be controlled by using alternative resources like solar, wind and hydel power.

“The country currently imports oil worth 27 billion dollars to meet its power and transportation needs,” Sharif was quoted as saying in the report.

“In the future, only clean and low-cost hydropower and renewable plants will be installed in the country.”

Pakistan, which has been struggling with a balance of payments crisis, record inflation and steep currency devaluation, lacks adequate resources to run its oil- and gas-powered plants and imports most of its energy needs.

The South Asian country is currently looking to secure cheaper energy imports and alternate ways to lessen the cost of power generation.

The prime minister asked authorities to speed up efforts for foreign investment in solar energy projects as well as to accelerate the process of privatization of power generation companies and auction of inefficient power houses.

He lauded the performance of the Punjab government in the ongoing drive against power theft and expressed hope that other provinces would also follow suit to overcome the challenge.

“All possible measures are being taken to reduce the per unit price of electricity for the common man,” PM Sharif added.

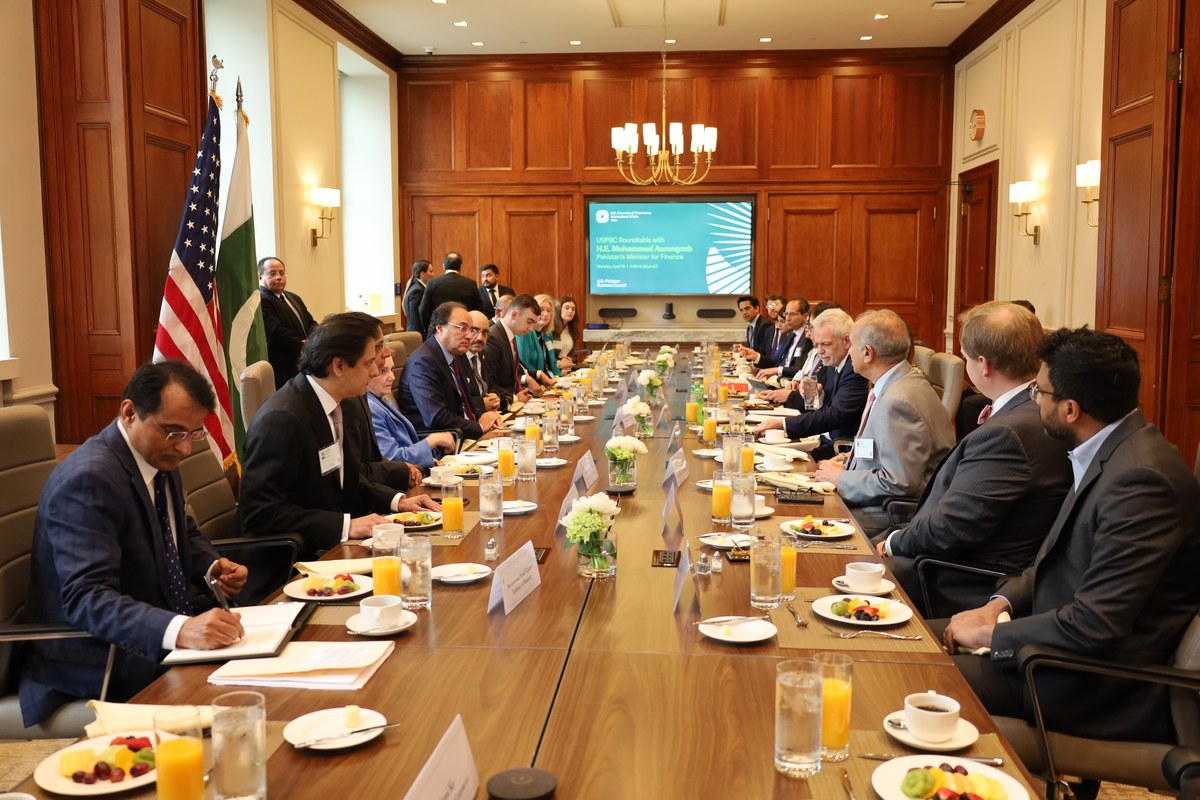

Finance minister discusses investment plans with US-Pakistani businessmen in Washington

- Muhammad Aurangzeb arrived in the US on Sunday to participate in spring meetings of the IMF, World Bank

- Pakistan is in need of external financing to shore up forex reserves to escape another macroeconomic crisis

ISLAMABAD: Pakistan’s Finance Minister Muhammad Aurangzeb on Monday met with a delegation from the US-Pakistan Business Council (USPBC) in Washington D.C. and discussed with them his government’s commitment to improving business climate in Pakistan.

Aurangzeb arrived in Washington D.C. on Sunday to participate in spring meetings of the International Monetary Fund (IMF) and the World Bank, amid Islamabad’s efforts to reach an agreement with the IMF for a new loan program by June this year.

The South Asian country of more than 240 million people remains in desperate need of external financing to shore up its foreign exchange reserves and escape yet another macroeconomic crisis after it barely averted a default last year, thanks to a $3 billion IMF program.

In order to overcome the present economic woes, Islamabad has been making efforts to attract foreign direct investment to keep the $350 billion economy afloat.

“During the meeting, the Finance Minister highlighted the government’s dedication to attracting both foreign and domestic investments in key sectors,” Aurangzeb’s ministry said in a statement. “These sectors include agriculture, IT, mines & minerals, and energy.”

The statement came days after Aurangzeb met with Prime Minister Shehbaz Sharif to discuss Pakistan’s economic strategy ahead of his meetings with IMF and World Bank officials.

“He discussed with the prime minister his scheduled meetings with the International Monetary Fund, World Bank and other organizations during the visit,” the Pakistani finance ministry said. “The overall economic situation of the country was also discussed in the meeting.”

Pakistan this month completed a final review of its current $3 billion IMF deal that cleared the way for the disbursement of a final tranche of nearly $1.1 billion. The South Asian country is now looking for another bailout program.

Last week, IMF chief Kristalina Georgieva confirmed Pakistan was in discussions with her organization on a potential follow-up loan program to its nine-month, $3 billion stand-by arrangement (SBA).

The IMF chief recognized Pakistan’s commitment to structural economic reforms during an event at the Atlantic Council think tank in Washington. She, however, noted that some important issues, including the tax base and overall economic transparency, were yet to be addressed by Pakistani authorities.