GENEVA: Two weeks after beating COVID-19, Thierry Salamin huffs as his ski boots crunch through Swiss snow near the Matterhorn peak, readying for a downhill run with his mood as bright as his blue and fluorescent yellow ski getup and the sun overhead.

The 31-year-old real estate agent from the southwestern Swiss region of Wallis can’t believe he is skiing during a pandemic, let alone one that he personally endured — and which has driven a wedge between his country and its Alpine neighbors over where people can ski, and where they can’t.

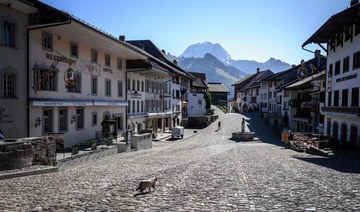

While the coronavirus resurgence has led Austria, France, and Italy to shut or severely restrict access to their ski stations this holiday season, Switzerland has kept its slopes open — a move that has fanned grumbling about an unlevel playing field when it comes to Alpine fun.

“It’s true, we’re privileged,” said Salamin, enthusing about the “paradise” of the Zermatt slopes and gesturing over the ridgeline toward Italy. “It’s too bad that people can’t go skiing on the Italian side, because those slopes are magnificent.”

The discord among countries during the worst pandemic in a century cuts across issues of health, business, economy, culture and wellbeing. But it also violates one of the key tenets that the World Health Organization promotes to help fight COVID-19: solidarity.

The Swiss say they’re taking reasonable action to fight the coronavirus. As across much of Europe, infection counts in Switzerland spiked in late October and peaked at more than 10,000 per day on two occasions about a month ago — a high tally for the country of 8.5 million.

The authorities require masks in ski lifts and queues, and recommend hand hygiene and physical distancing measures. These seem only minor concessions to the hundreds of faithful skiers who gleefully turned out for a weekday jaunt on the Swiss slopes near the Matterhorn on Thursday.

France’s government is all but taking aim at Switzerland, which is not a member of the EU, warning that any residents of France who come back from ski holidays could face virus tests and quarantine orders. The French move is aimed at limiting the spread of COVID-19, but it comes as some officials and business leaders in French Alpine towns have complained about unfair restrictions.

Andorra is one of the European countries that will be hardest hit by the lack of ski tourists this winter on account of COVID-19 precautions. (AFP)

On Friday, amid such pressure, Swiss Health Minister Alain Berset announced a “hardening” of Switzerland’s rules governing ski stations. Ski areas must now receive authorizations by the cantonal, or regional, authorities by Dec. 22 to continue operating.

His ministry said trains, gondolas and cable cars in ski areas will be limited to two thirds of maximum capacity starting Wednesday. But the stepped-up restrictions are still fewer than in other countries.

Neighboring regions are seething. Just across the border from Zermatt, in Italy, the Valle d’Aosta regional council voted to defy the national government and open its ski lifts anyway, but the issue may get tied up in court.

Nicolas Rubin, mayor of the French town of Chatel, near the Swiss border, has had his city hall draped in Swiss flags to protest the directives from Paris. He told Swiss public television Wednesday he felt “no jealousy” toward Switzerland, saying Swiss officials had fully thought through their rules.

The EU — which counts Austria, France and Italy as members — has stopped short of recommending a holiday season travel ban. However, national authorities are taking precautions, leery of superspreading events such as those earlier this year at ski resorts in those three countries that helped seed devastating outbreaks in Europe.

On Thursday, Italian Prime Minister Giuseppe Conte confirmed Italian ski lifts will remain closed through Jan. 7. France is still undecided, but looking at a mid-January restart at best. Austria will allow skiing to start on Dec. 24, but will limit the capacity of ski lifts until early January.

In Zermatt, this weekend — around the time of the start of the typical high winter season — could well be pivotal to see just how much the warnings from foreign politicians, and laments from wintertime business owners abroad, will register with would-be skiers.

“Tourism is our only income, it’s our life,” said Zermatt mayor Romy Biner-Hauser in an interview.

“Nobody wants to be a hotspot, nobody wants to be a super spreader,” she said. “Where is the difference (between) doing outdoor activity ... (in) the sun, the fresh air, mountains, versus a shopping mall in a big city? And nobody has given me that answer so far.”

Zermatt tourism officials are projecting a minimum 20 percent drop in overnight stays this year. Traditionally, about half of all visitors come from Switzerland, the other half from abroad — many from far away, not just neighboring countries.

“We hope so much that the government will not lock down again and we hope that people from other countries will be able to cross the borders,” said Dave Preis, an Italian ski instructor at Zermatt. “It makes no sense to lock down the world. It means: ‘Let’s stop living’.”