JEDDAH: Establishing work environments with genuine equality between male and female employees will encourage innovation and productivity, and could boost Saudi Arabia’s GDP (gross domestic product) by up to $400 billion over the next decade, according to new research.

Saudi companies that have more equality for men and women perform better overall, according to a joint report published in November by global professional services company Accenture and the Riyadh-based Al-Nahda Society, a non-profit organization dedicated to the socioeconomic empowerment of women.

The “Women in the KSA Workforce” report found that the improvements that create a culture of equality between the sexes benefit not only women but also companies overall. This should encourage Saudi companies to invest more in training women and creating an environment that is welcoming and supportive, it added.

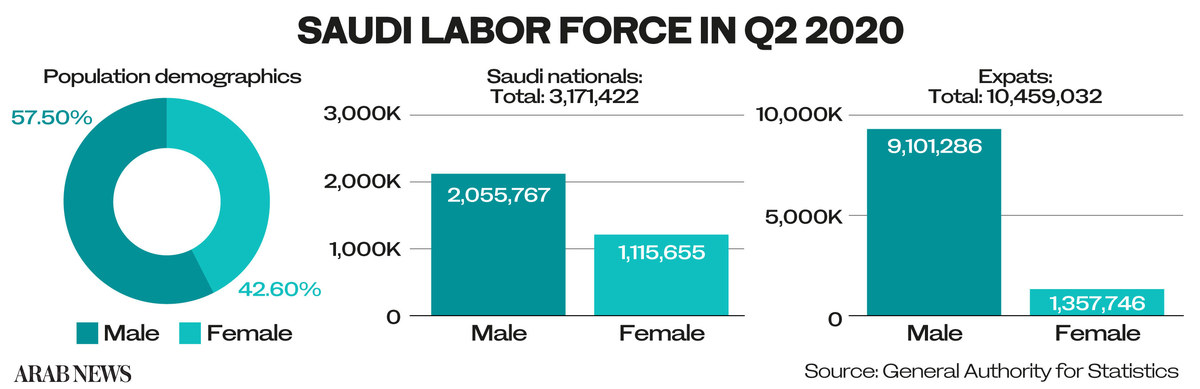

As part of the report, Al-Nahda observed that much has changed in the past decade for Saudi working women. In 2009, 14 percent of Saudi women over 15 worked mostly in the public sector, while occupying only 8.5 percent of private sector jobs. Today, they make up 32 percent of the private sector.

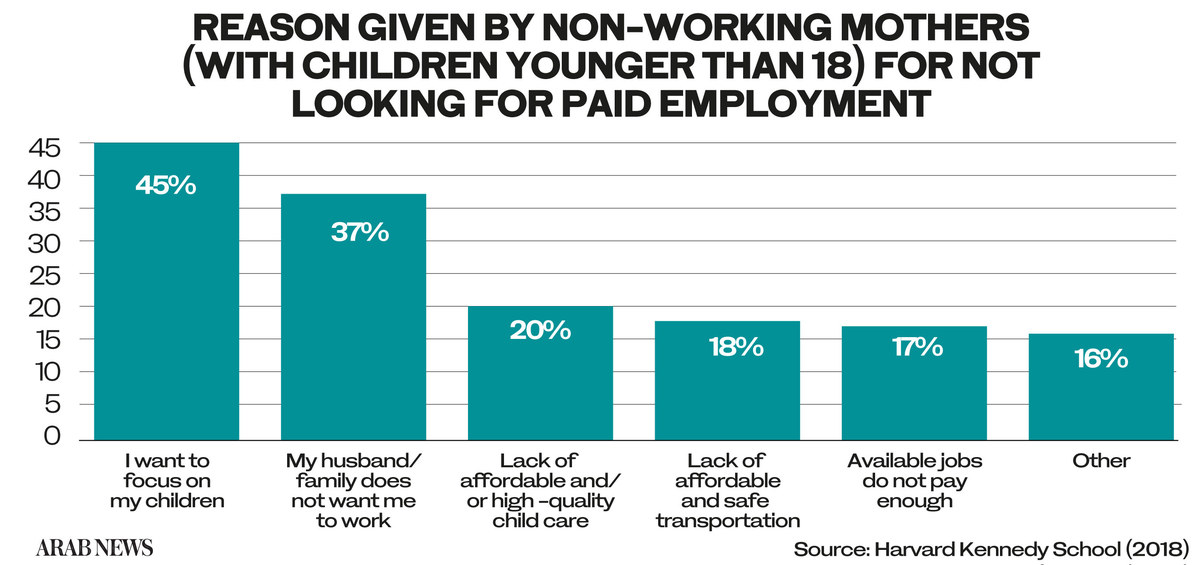

The research showed that in the past many obstacles stopped women from entering the workforce, including familial and spousal obligations and restrictions, unequal pay, and a lack of affordable child care services and transportation.

However, the Kingdom has been pushing women’s empowerment since announcing its goals for Vision 2030, lifting a ban on driving, introducing child care programs allowing women to travel without their guardian’s consent.

Khaled Al-Dhaher, country managing director for Accenture in Saudi Arabia, said that leadership needs to come from senior managers.

“In Saudi Arabia, a critical starting point for the career advancement of women is at the top. Our research concludes that a positive tone from the top of the organization goes a long way in setting out both the moral and commercial case for gender equality,” he said.

“Ultimately, a positive workplace culture facilitates a shift in the collective corporate mindset — and, in turn, enables a resilient economy that is less dependent on oil and more reliant on a young and emerging generation ready to seize the limitless opportunities of the future.”

Organizations that follow that module, where the top 10 percent are mostly equal, have female employees with ambition and confidence levels that are 23 percent higher than average and have a 62 percent likelihood of reaching managerial positions.

Such environments also encourage innovation among employees of both genders, Al-Dhaher said. Their ability to be creative is 50 percent higher than organizations that are seen as less equal for women.

In the past three years, Accenture has been working on redefining the cultural reset needed to boost the country’s economy. In a survey of 70,000 employees, the company found five major “cultural actions” that can help the Kingdom create greater equality.

“Our analysis highlights three areas of focus: Building more gender-diverse senior leadership teams; setting targets on gender diversity, measuring and sharing progress; and creating environments in which women ‘have a voice.’ In environments that pull these together, women are 33 percent more likely to advance to manager level and beyond — and their levels of ambition and confidence rise by 7 percent. Employee innovation mindset also rises by 4 percent,” Al-Dhaher said.

Protecting women against discrimination, harassment and unethical behavior, and creating an environment where they feel comfortable reporting such misconduct has boosted ambition and confidence by 21 percent in organizations where this is carried. Women employees’ likelihood of advancement soared by 15 percent.

Additional factors include providing employees with a flexible work environment, supporting parental leave for both genders, and investing in training programs for both genders. According to Accenture’s survey, 88 percent of Saudi women agreed that getting the proper training that helps advance their skillset was important to them, but only 25 percent of employers agreed.

The mistakes companies make in this area are similar around the world, according to author and workplace culture adviser Dawn Metcalfe, who has worked as a consultant with Saudi companies for more than a decade. Companies tend to consider a few successful cases as enough to set women up in the work environment, when there is much more to be done, she said.

“We (companies) don’t think about the systemic issues. We don’t do enough to remove obstacles, to make sure that all the people who could have an influence understand why this is in their best interest,” she told Arab News.

“We are not empowering women here. Women are fine. We’re empowering a country by making sure that 50 percent (51 percent globally) of its asset are being fully utilized,” she added.

Metcalfe said the challenges that companies face are also universal. In her words, history seems to be the biggest one.

“We have a long history of the same people always being in charge, and those have always been men. The whole system is set up for men,” she said.

Change can only happen once more women are seen at senior levels, Metcalfe added. Once women start taking leadership positions, they will hire more women, while men will begin to shift their misconceptions about women in a working environment the more they are exposed to working with female colleagues.

“Saudi companies need to do the same thing as every other company (in order to establish a workforce that is equal and creative for women). If something is important in business, then we put resources behind it, targets against it and hold people accountable.”

Empowering women will not be achieved by chanting the words. Metcalfe said companies need to invest in women and to increase the representation of women in the workforce by creating budgets that empower them. Only then will the $400 billion boost to Saudi GDP be achieved by 2030.