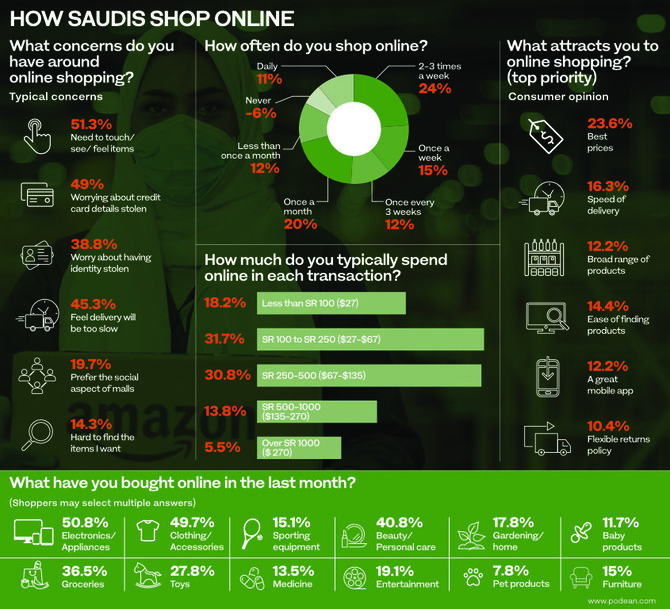

LONDON: Saudi spending habits have been revealed in research showing half of the Kingdom’s consumers shop online at least every week.

Some 24 percent of those surveyed shop online two to three times a week while 11 percent shop daily, according to research from Podean.

Online shopping has boomed this year as pandemic-related lockdowns have closed shops. Now some online retailers fear delays in the run up to the busy year-end festive period as delivery companies become overloaded.

“The pandemic rapidly accelerated the already fast growing adoption of online shopping in Saudi Arabia, with consumers that were slow to adopt e-commerce as a way to buy goods forced to embrace this channel whilst under lockdown,” said Mark Power, CEO of Podean. “We are now seeing brands that were prepared for this rapid shift in consumer behavior reaping the rewards.”

Electronics tops the list of online purchases in the Kingdom, slightly ahead of clothing and beauty.

Ownership of smart speakers is among the highest in the world at a reported 73 percent who already own or are looking to buy.

Amazon.sa is the most popular online retailer in the Kingdom according to the research with 64 percent of shoppers regularly shopping there. In second place is noon with 59.7 percent and Jarir at 45 percent.

Recently published studies from around the world anticipate a bumper online shopping period between now and Christmas with a study from Periscope by McKinsey finding that 55 percent of consumers expected to participate in Black Friday with 43 percent planning to shop on Amazon Prime Day and 39 percent on Cyber Monday.