DUBAI: COVID-19 has changed consumer behavior patterns around the world, and the GCC bloc is no exception, according to new research by consultancy firm McKinsey & Company.

Besides the obvious human challenges, the study, entitled “Digital: A Spotlight on the New Consumer,” has shed light on the pandemic’s potential implications for the global economy, businesses and employment.

It found the crisis has affected consumers in six notable ways. Many are now spending less, a greater number are shifting to online shopping, and brand loyalty has suffered a setback.

Researchers also observed a greater focus on health and hygiene, more deliberate consumption and the rise of the “homebody economy” — where spending is geared towards the domestic bubble.

The shift appears to have placed digital adoption at the center of all industries. “The current crisis has provided us a bit of a glimpse of what could potentially be our future,” said Joydeep Sengupta, senior partner and leader of McKinsey’s digital and analytics practice in Eastern Europe, the Middle East and North Africa.

“Human digital interactions have overtaken human-to-human interactions.”

Although the population was already becoming more sedentary and prone to staying indoors, Sengupta says the coronavirus and resulting lockdown measures have further bolstered these habits — and in turn forced institutions to adapt. “The adoption by consumers of digital tech is further driving and accelerating the trend,” he said.

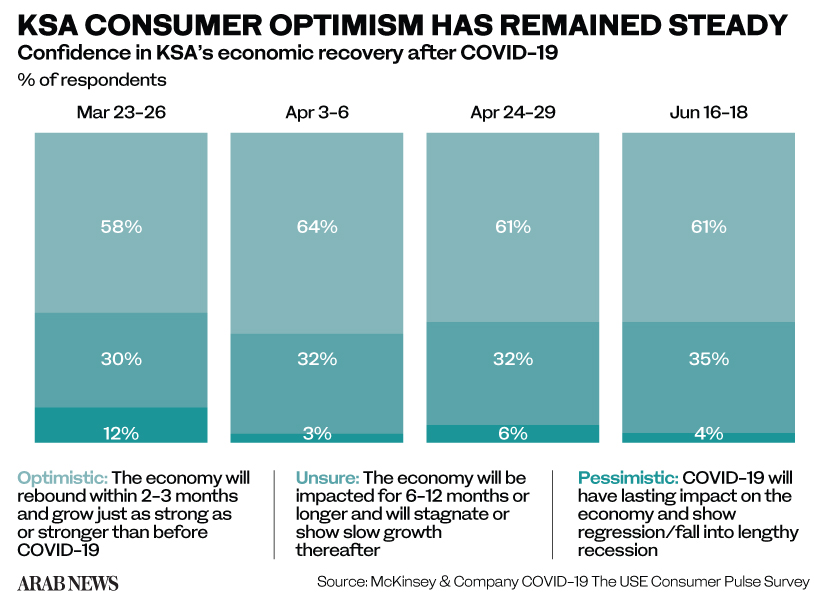

The study, conduced around the middle of this year, found that although incomes and savings have suffered for more than half of respondents in Saudi Arabia over the pandemic period, consumer confidence has remained steady throughout the crisis. Some 61 percent of Saudi respondents said they believe the economy will soon recover — making them one of the more optimistic countries polled, compared to Europeans.

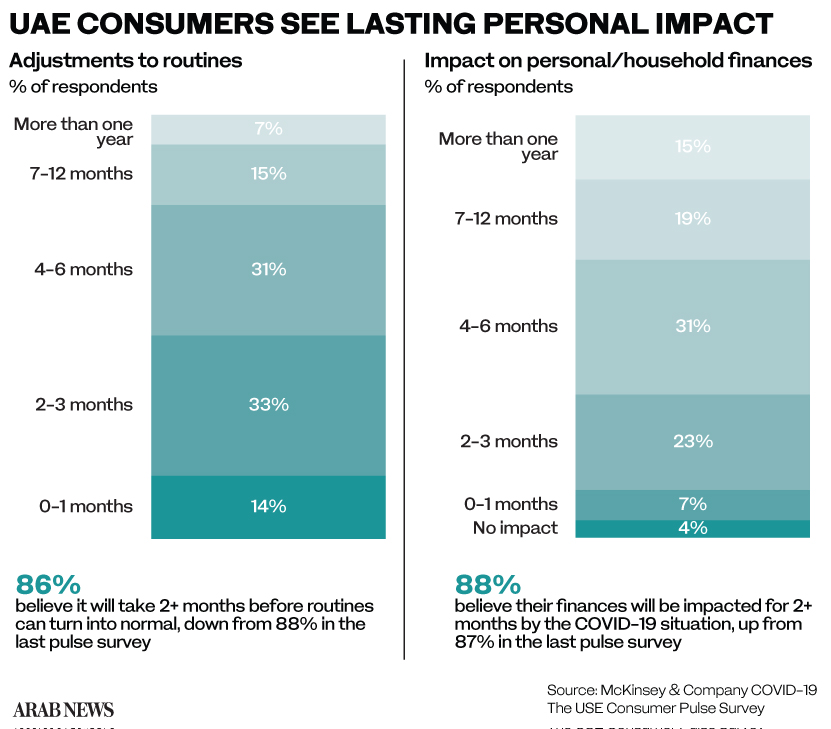

And although a large proportion of Saudi consumers expect their incomes and savings to soon stabilize, a growing number believe the changes to their routines wrought by COVID-19 will last well beyond the next two months.

New study sheds light on the pandemic’s potential implications for the global economy, businesses and employment. (AFP)

“Consumers are not just hapless bystanders,” said Sengupta. “They’re also playing a key role in perpetuating the push by tech companies. The digital flood that’s going on is created (to a large extent) by the confusion that the consumer is creating in terms of their ever-shifting preferences and their unpredictable demands.”

The McKinsey study, which sought to unpack some of these questions, found some interesting developments in product preferences. Many Saudis polled said they are focusing more on healthy and hygienic packaging and are judging the companies they buy from based on how they treat their employees.

“In terms of health and well-being, we see consumers overall becoming much more mindful,” said Abdellah Iftahy, partner and leader of McKinsey’s consumer and retail practice in the Middle East.

“The region, which was lagging in this dimension versus other economies in the world, is now catching up and leapfrogging in terms of awareness of the consumer in general when it comes to health and well-being.

Tom Isherwood, Joydeep Sengupta and Abdellah Iftahy.

“If these retailers are anchored in clear values and what they stand for from a purpose perspective, the local content is becoming more and more important here in the region.”

The study also found up to two-thirds of consumers in Saudi Arabia and the UAE expect their personal and household finances will be impacted in some way by the crisis for another four months to come. As such, 52 percent of Saudi consumers said they are becoming more mindful about how they spend their money, while many are adopting habits like making lists and doing their research before making purchases.

“We are seeing today, and we will see going forward, consumers that are more and more conscious and mindful about their spending and thinking about value for money as a key criterion for decision-making,” Iftahy said.

“Obviously, the whole shift to online and digital is absolutely a big trend that is here to stay. Many companies have seen some of their 10-year targets achieved within weeks, and some of these trends have been massively accelerated thanks to digital (modes) and technology.”

The McKinsey study found that a high rate of Saudi consumers are not regularly engaging in out-of-home activities and do not plan to return to many of these, other than grocery shopping, once the crisis passes. (AFP)

Saudi Arabia and the UAE, followed by the US and Europe, saw the biggest growth in consumers who intend to continue using online channels, even after the crisis ends. Such behavior is likely to fit nicely with the Kingdom’s Vision 2030 — especially with such a young population and many more women entering the workforce.

“Consumer behavior and consumer fundamentals in Saudi Arabia are actually great assets for the Kingdom overall to build up the digital economy in many aspects,” Iftahy said. “Saudi Arabia is one of the countries where consumers are the most connected when it comes to digital assets globally, which means getting access to them and interacting with them digitally through social media is something which is easily accessible.”

And there are clues as to why Saudis are so immersed in the online world. The McKinsey study found that a high rate of Saudi consumers are not regularly engaging in out-of-home activities and do not plan to return to many of these, other than grocery shopping, once the crisis passes.

Saudis were found to be the most wary when it came to activities such as going to big events or to the gym, while around 70 percent of GCC consumers said they are reluctant about returning to the out-of-home activities they had attended before the pandemic. This trend has further intensified digital adoption.

“One of the themes within Vision 2030 has been around digitization and we’re seeing that trend accelerate globally,” said Tom Isherwood, partner and core leader of McKinsey’s public sector and digital practice in the Middle East.

“For Saudi Arabia to navigate the coming decade in a really successful way, it will really be doubling down on that theme and not just at the government level, but also across industries as companies look at their own business models and try to figure out how to modernize and digitize more.”

Twitter: @CalineMalek