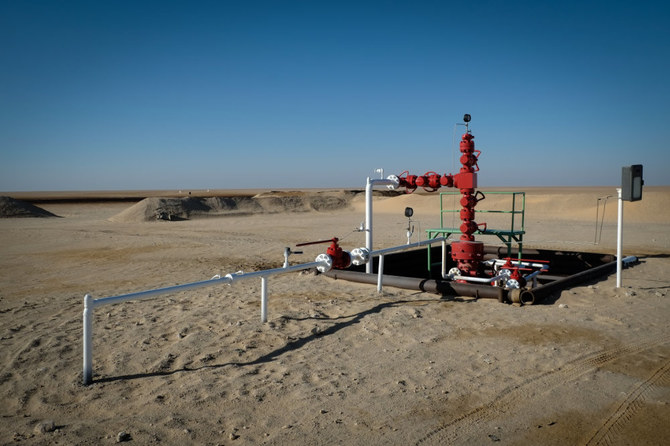

LONDON: Libyan oil production has reached 680,000 barrels per day (bpd), a Libyan oil source said on Thursday, more than a third higher than earlier this month, as the OPEC member seeks to revive its oil industry.

Libya’s National Oil Corp. (NOC) on Monday ended force majeure on the last facilities closed by an eight-month blockade of oil exports by eastern forces.

The blockade in January cut Libyan oil production to around 100,000 bpd from 1.2 million bpd.

The current output level marks a jump from around 500,000 bpd earlier this month.

The NOC said last week it expected oil production to rise to 1 million bpd in a few weeks’ time.

On Thursday, Repsol’s CEO said production at the Sharara oil field, Libya’s largest, is about 160,000 bpd, and expected to rise gradually to 300,000 bpd.

Libya’s growing output has weighed on prices as demand concerns are increased by government restrictions to contain a second wave of the new coronavirus.

Brent and US WTI crude futures were both down more than 5 percent on Thursday, extending another 5 percent loss the previous day.

Higher Libyan output and the weak demand outlook are expected to dominate talks at a meeting of the Organization of the Petroleum Exporting Countries (OPEC) and its allies — a group known as OPEC+ — on Nov. 30 and Dec. 1.

OPEC+ is limiting production by 7.7 million bpd, but is expected to shave around 2 million bpd from the supply curbs from January.