DUBAI: Some people see a stock exchange merely as a financial marketplace where business is done on a daily and, hopefully, profitable basis.

Others regard them as centers of economic and financial power that can become a standard-bearer for a country’s urban development ambitions.

There is no doubt that the great stock markets of the world — in New York, London and Tokyo, for example — are regarded as national assets and key economic pillars.

For Saudi Arabia, Tadawul — the Riyadh exchange — is both. The development and expansion of Tadawul is one of the key pillars of the Vision 2030 plans to grow the financial sector of the economy.

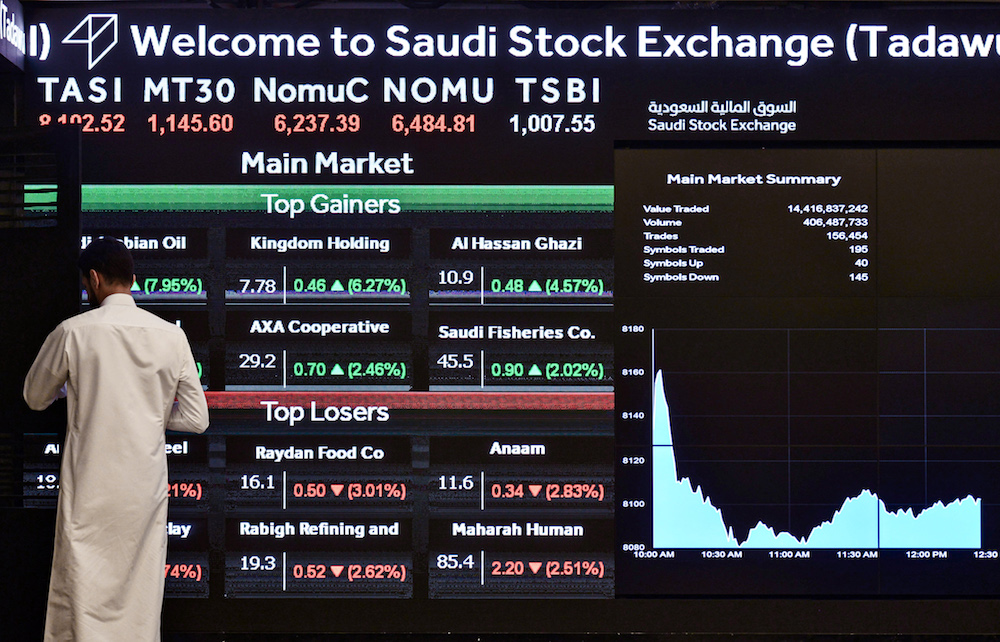

A Saudi man monitors stock prices at Tadawul Saudi bourse in Riyadh on November 3, 2019. (AFP/File Photo)

Khalid Abdullah Al-Hussan, Tadawul’s CEO since 2015, has also made clear that he sees the exchange as a place for investors to make money, and to help facilitate the flow of capital that Saudi companies need to grow and thrive.

“In stock exchanges, in developed markets or in emerging markets, our business is to compete,” he told Arab News.

The big question for Tadawul now is: With whom is it competing, the other regional exchanges of the Middle East, or the great financial marketplaces of the world?

Over the past five years, Tadawul has moved decisively ahead in the competition with the other regional exchanges.

It always had big advantages in terms of sheer size and as the financial market of the Gulf’s biggest economy.

This picture taken December 12, 2019 shows a view of the exchange board at the Tadawul bourse in Riyadh displaying Aramco shares on the second day of their trading. (AFP/File Photo)

But what was a major handicap was that for a long time it was effectively closed to foreign investors.

Rules preventing foreign ownership have been gradually relaxed — first for big institutional investors and, more recently, for non-financial investors — to take “strategic” share stakes in Tadawul-listed companies.

Another big boost to global ambitions came from the inclusion last year in the MSCI emerging market index, which led to an instant inflow from overseas investors seeking access for their indexed funds.

Some 2,156 foreign investors are active on Tadawul, with a rise of 78 percent this year compared to last year, though they still comprise a relatively small proportion of daily activity.

It was the record-breaking initial public offering (IPO) of Saudi Aramco last December that propelled Tadawul into the premier league of global stock exchanges.

It jumped into the top 10 rankings of the biggest exchanges in the world, boosted by the huge market capitalization of the Kingdom’s oil giant.

This picture taken December 12, 2019 shows a view of the exchange board at the Tadawul bourse in Riyadh displaying Aramco shares on the second day of their trading. (AFP/File Photo)

Saudi Arabia has the third-biggest emerging-markets exchange in the world, behind only those of China and India.

In regional terms, it is virtually no contest. According to figures from the World Federation of Exchanges, it is by far the largest in the Gulf.

The value of the companies traded on Tadawul comprises more than 80 percent of the total for the Gulf Cooperation Council region.

Rivals in the UAE, Qatar and elsewhere — which do a perfectly good job serving their local economies — are barely in the same league as Tadawul in global terms.

THENUMBERS

Saudi Tadawul

* SR8.23 trillion Market capitalization of Tadawul (July 1, 2020).

* SR381 billion Volume traded on Tadawul (July 1, 2020).

* 2,156 Foreign investors active on Tadawul.

* 78% Increase in foreign investors over last year.

* 80% Tadawul companies’ share of total GCC valuation.

Al-Hussan said: “We’re competing with regional exchanges and international exchanges, and attracting more investors to invest in Tadawul.”

Regional financial experts are well aware of Tadawul’s edge. Tarek Fadlallah, CEO of Dubai-based Nomura Asset Management, told Arab News: “Tadawul is by far the dominant stock exchange in the region, whether judged by market capitalization or liquidity. Moreover, it’s arguably the most advanced in terms of its trading and settlement platforms.”

Al-Hussan has dramatically upgraded those systems to reach international best standards. Just in the past two years, a state-of-the-art independent clearing house, Muqassa, has been set up to handle settlement of share trades, as well as other improvements in the settlements and clearing system, such as custody and depository functions.

It has added other refinements that are taken for granted in the big global exchanges — such as share borrowing and short-selling — but which are rare in the Middle East.

Most recently, it announced plans to commence derivatives trading on Tadawul, another normal practice in Western markets but one that caused some comments in the region.

A file photo taken on December 12, 2019 shows a view of the exchange board at the Tadawul bourse in Riyadh. (AFP/File Photo)

Was Tadawul going headlong into the “trader” mentality of London and New York, with all the risks involved?

Wael Al-Hazzani, CEO of the Muqassa clearing-house operation, insists that risk is being managed carefully and prudently, especially in the planned derivatives business.

“The biggest risk any investor could face in any markets, even in cash markets, is the credit risk, and how the counterparty will fulfil their sides of any trades in the markets,” he told Arab News.

“We intend to complement our operations with sophisticated risk-management systems, making sure we’re controlling risk to the maximum extent we can.”

Al-Hussan reinforced this point, highlighting measures to ensure constant monitoring and supervision of margin requirements — the amount of cash an investor has to put up to trade the derivative — especially for small retail investors. Further fine-tuning of these mechanisms will be introduced later this year, he said.

The other big event on his calendar is the IPO of Tadawul itself. Floating your own shares on your own exchange is quite a common thing in global markets, and Tadawul has made no secret of the fact that it would like to follow suit.

A Saudi investor monitors the stock exchange at the Saudi Stock Exchange, or Tadawul, on December 14, 2016 in the capital Riyadh. (AFP/File Photo)

“We don’t have any internal debate on whether we should float the company. We confirm our position to take Tadawul public, but deciding to go public is about timing. Now, from a financial standpoint, Tadawul is solid and stable. The discussion today is about the right time to go for an IPO,” he said, indicating that a share flotation is on the cards sometime in the next two years.

Simultaneous with these moves to modernize and streamline Tadawul, Al-Hussan is thinking carefully about his next steps in the Gulf.

“If you look at it from a strategic point of view, I think our priority is to strengthen the region, if we can,” he said.

“We still believe this region has a strategic position between Europe and Asia, but it’s still behind on activating itself as a region,” he added.

“We believe, being the largest and most liquid exchange, we have a duty to activate as much as we can the region, alongside growing ourselves. This is where we stand.”

Activating can involve reaching alliances with other exchanges, like Tadawul has already done with the Abu Dhabi Securities Exchange to mutually enhance trading capabilities, for example in depository systems.

It can also mean dual listings, where a company has its primary market listing on, say, the Dubai Financial Market but also allows its shares to be traded on the more liquid markets of Tadawul in Riyadh.

“Based on the demand we’ve received from Gulf corporates, we’ve worked to define the model for cross-border listings and the infrastructure needed to accept companies from overseas,” said Al-Hussan.

“We’ve spoken to several that are interested to join Tadawul. The pandemic had some impact on these moves, but we still expect them to be coming to the market soon.”

A Saudi investor monitors the stock exchange at the Tadawul on December 14, 2016 in the capital Riyadh. (AFP/File Photo)

Might Tadawul’s regional play mean more than that, including the possibility that it could take over another exchange completely? Some financial experts in the region think that could be the logical outcome.

Fadlallah said: “It makes better sense to embrace a regional approach in which Tadawul can absorb its smaller peers.”

He added: “Acquiring the Bahraini stock exchange, for example, would appear logical and, subject to demonstrating successful integration and mutual benefits, perhaps adding other local exchanges over time could offer a single, deep and liquid destination for all international investors.”

It is by no means certain that the exchanges of the UAE, Kuwait and especially Qatar would want to give up their independence, of course.

But if there is ever to be a single Gulf stock market, serving as the key exchange in the crucial time zone between Asia and Europe, Tadawul would appear to be the only existing player capable of performing that role.

------------------------

Twitter: @frankanedubai