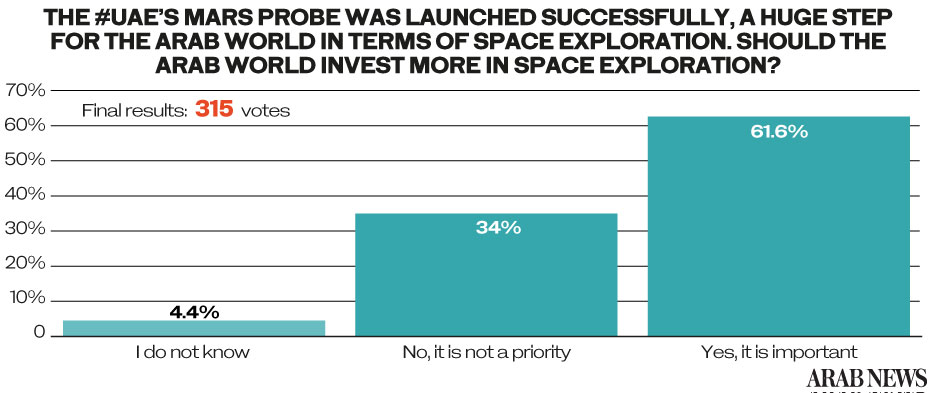

DUBAI: A straw poll of Arab News readers has found that two-thirds believed the Arab world should invest more in space exploration.

The UAE’s Mars probe “Hope” launched from Japan last week on a seven-month voyage to Mars, the Arab world’s first venture into space.

Responding to the Arab News poll one reader said the “Arab world must prepare a large legend of scientists, engineers, doctors, global planners, desert cultivation agricultural agronomists.”

The #UAE’s Mars probe was launched successfully, a huge step for the Arab world in terms of space exploration. Should the Arab world invest more in space exploration?

— Arab News (@arabnews) July 24, 2020

The 500 million-kilometer journey to the Red Planet, which will take more than 200 days, will start collecting information once it enters the Martian atmosphere.

The probe will study daily and seasonal weather changes and, during the course of a year, send information back to research laboratories for analysis.

Amal’s arrival in Mars’ orbit is expected to be in February 2021, which coincides with the 50th anniversary of the UAE’s formation.

The UAE is aiming to establish a Martian colony by 2117, and has already started designing its Mars Science City – a research center in the desert built to simulate the Martian environment.

Now take our new poll

#POLL: Even if #coronavirus cases continue to rise across the world, governments must not force another lockdown.

— Arab News (@arabnews) July 26, 2020