DHAHRAN: Amneh Shaikh-Farooqui’s book “Fearless: Stories of Amazing Women from Pakistan” chronicles the social, economic, political, and cultural achievements of 50 Pakistani women. The 112-page book – accompanied with vibrant portrait illustrations – highlights the achievements of Pakistani politicians, army generals, artists, humanitarians and philanthropists.

The book introduces Pakistani women to the world and, importantly, provides representation of South Asian women in mainstream literature. In her forward, Shaikh-Farooqui states that her own children were thrilled to read lesser-known stories of women in history. However, she found that accomplishments of women of color were missing from these narratives. With the premise “If you can’t see it, you can’t be it,” the concise book includes a page each, celebrating notable women and how they each inspired change.

The stories are not arranged thematically, however, it makes for an easy read that young adults within the diaspora will appreciate. Released in late February, Shaikh-Farooqui’s book does well at walking a middle line and does not fall into the trap of embellishing each woman’s achievements, however, the author does not fully explain how she whittled down her choice to 50 women — it’s a small detail that would have been appreciated.

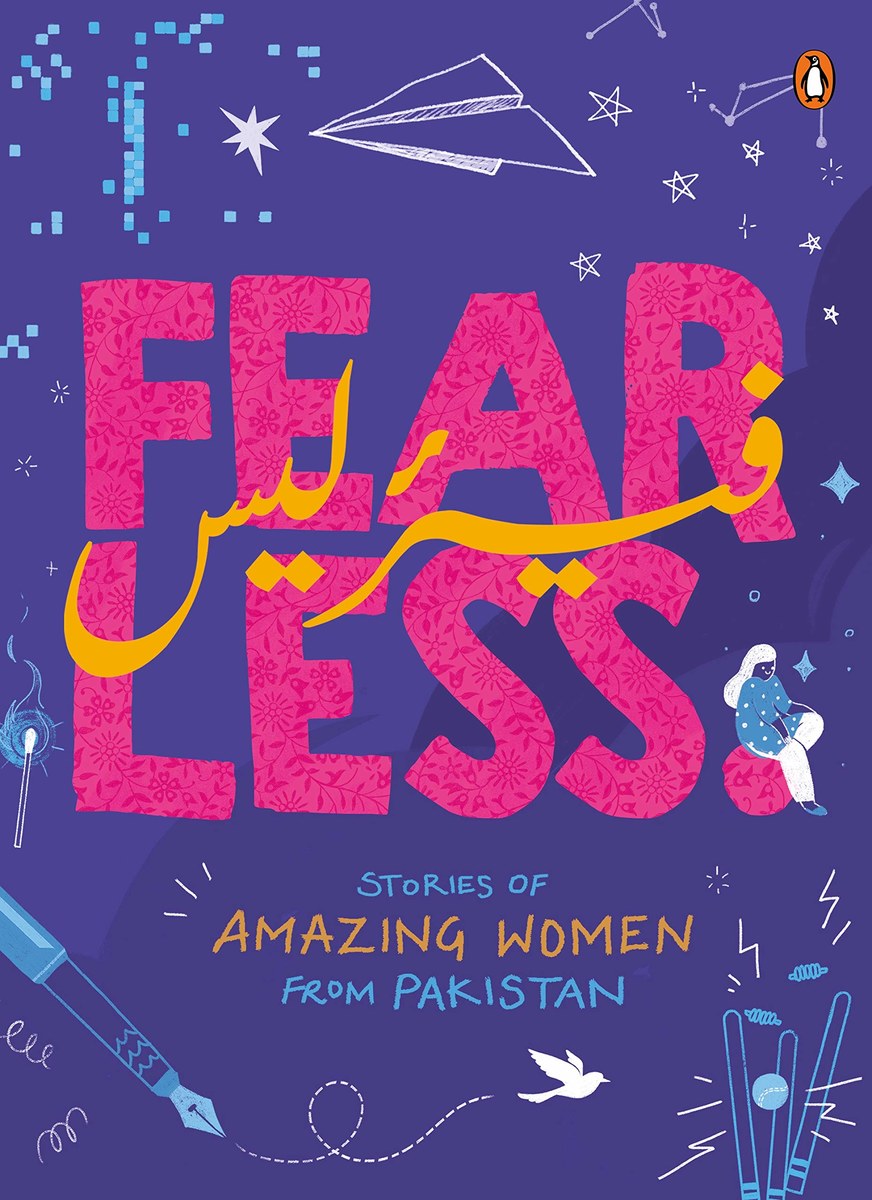

“Fearless: Stories of Amazing Women from Pakistan” is a 112-page book. (Supplied)

Alongside Malala Yousafzai and Fatima Jinnah, the book features women and stories that may be lesser-known to mainstream media, like Majida Rizvi, the first woman judge of a High Court in Pakistan. Rizvi dedicated her life to educating Pakistani women about their legal rights and as a chairperson of the National Commission for the Status of Women, fought for human and gender rights against religious conservative parties. Or actress and director, Putli Bai, known by her screen name, Shamim Ara for her strong, female protagonist roles in a series of movies like Miss Hong Kong, Miss Singapore, Miss Colombo, Lady Smuggler, and Lady Commando. “Her contribution in creating a more balanced industry, with space for nuanced characters and a broader set of roles for women, both on and off screen will not be forgotten,” opines author, Shaikh-Farooqui.

Or even the controversial Qandeel Baloch, whose videos empowered women and led to her eventual murder by her brother. Apart from individuals, the book also features activist groups like the Women’s Association Forum (WAF), a women’s rights organization and Girls at Dhabas (DAG), an initiative that highlights challenges women face in male-dominated public areas and advocates for freedom of movement.