DUBAI: Foreign investors are flocking to Saudi Arabia as the reform program under the Vision 2030 strategy accelerates, new official figures show.

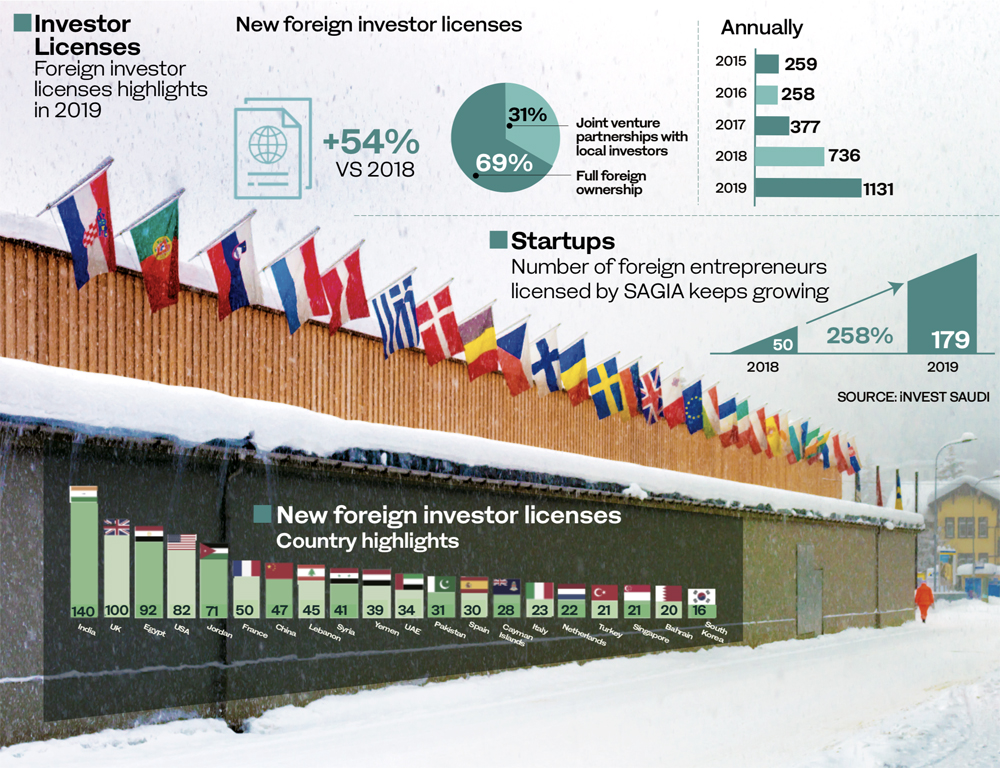

In 2019, according to statistics released by the Saudi Arabian General Investment Authority (SAGIA), there was a 54 percent increase in the number of international companies setting up operations in the Kingdom, with 1,131 new foreign businesses launched — a record year.

“Leading growth sectors include construction, manufacturing and information and computer technology, as demand in these industries increases alongside infrastructural development and progress of the Kingdom’s giga projects driving forward in line with Vision 2030,” said SAGIA’s Invest Saudi report.

“During 2019, 193 new construction, 190 manufacturing and 178 ICT (information and communications technology) companies were established, compared to 111, 113 and 111 established in the three sectors in 2018 respectively.” The pace of new foreign startups accelerated in the final quarter, the report said.

SAGIA Gov. Ibrahim Al-Omar said: “Guided by Saudi Vision 2030, our country is undergoing a remarkable economic transformation. The continued prosperity of the Kingdom depends on sparking innovation, attracting foreign investors and empowering the private sector.”

He added: “The positive growth numbers that we have seen in the final quarter of 2019 — and indeed throughout the entire year — represent a significant milestone on the road to 2030.”

The Kingdom’s growing foreign investment landscape is underpinned by sweeping economic and social reforms made throughout 2019, aimed at improving Saudi Arabia’s business climate and attracting new investments.

The impact of these reforms is being recognized on a global scale: Saudi Arabia was ranked the world’s top improver and reformer by the World Bank, climbing 30 places in its Doing Business 2020 report, SAGIA said.

“The goal of our reform program is to help realize the potential that Saudi Arabia holds for the benefit of Saudi nationals and improve our competitiveness,” said Al-Omar, who will be among the Saudi delegation at the forthcoming World Economic Forum (WEF) annual meeting in Davos.

Snow falling in Davos, Switzerland, where around 3,000 political and business leaders will gather for the World Economic Forum this week. (Shutterstock)

“The investment opportunities that the Kingdom offers international companies also creates opportunities for the transfer of skills, expertise and best practice to local communities across the Kingdom, while providing new private sector job prospects for young Saudi men and women,” he added.

“We consider foreign companies who look to Saudi Arabia as growth partners for their business expansions — whether they seek a joint venture with Saudi companies or choose to set up on their own,” he said.

“Out of the new international companies setting up in Saudi Arabia in 2019, 69 percent were full foreign ownership, while 31 percent were joint venture partnerships with local investors. Our 2019 figures therefore demonstrate how integral new international businesses are to the success of our journey toward 2030.”

The Invest Saudi report found that the growth in the number of foreign startups came from “long-standing and strategically-important Saudi partners” such as the US and UK, with 100 UK companies and 82 US ones setting up in 2019, compared to 24 for both countries in 2018.

India, Egypt, Jordan and China were also among the top countries represented, with India’s share of the market increasing dramatically from 30 companies established in 2018 to 140 in 2019, driven by high-profile royal visits to the country in February 2019.

Other top countries from 2018, Jordan and France, were well-represented in 2019, the report said.

FASTFACT

The number of international companies setting up in Saudi Arabia rose by 54 percent last year.

SAGIA is continuing to introduce new measures to make setting up in the Kingdom easier and more efficient.

“We want to make it easier for foreign companies to set up and do business in Saudi Arabia,” said Al-Omar.

“We have taken global best practice models and combined them with local knowledge and insights in order to eliminate unnecessary barriers to doing business, while making it easier for our new partners from abroad to understand our unique Saudi culture and customs and how they can better integrate and contribute.”

SAGIA has increased its global profile, and will have a prominent presence at the forthcoming WEF annual meeting in Davos.

“We have played an important role in attracting foreign companies to establish operations in the Kingdom throughout 2019, facilitating a series of high-level investor forums in countries such as China, India, Germany and South Korea, as well as hosting delegations to the Kingdom from the US, UK, Japan and Russia,” Al-Omar said.