LONDON: The value of contracts awarded in Saudi Arabia almost doubled in the second quarter compared to a year earlier, led by the energy, property and military sectors, according to a report published on Tuesday.

The contract tally reached SR64.3 billion ($17.2 billion) during the period — up 32 percent on the previous quarter and an increase of 92 percent on a year earlier, the US-Saudi Arabian Business Council (USABC) said in its report.

It represents the highest value of contracts awarded by quarter in four years with more awards made in the first half of this year than the whole of 2018.

“This highlights the resurgence in 2019, which is on pace to match the construction boom witnessed prior to the brief economic downturn,” USABC said.

The collapse of oil prices in 2014 led to billions of dollars worth of projects being placed on hold throughout the Gulf, but business activity in Saudi Arabia, the region’s largest economy has started to accelerate.

While a majority of the contracts were awarded by the government, the private sector was an active participant in the real estate sector in particular, USABC noted.

The oil and gas sector overwhelmingly dominated the contracts awarded in the period, accounting for almost three-quarters of the total.

Saudi Aramco continued awarding projects to international contractors at its Marjan oil field as well as the Tanajib oil complex in the Eastern Province, the council said.

For the second consecutive quarter, the Eastern Province contributed the largest share of awarded contracts by region.

The order pipeline for the rest of the year also looks set to continue the strong momentum, led by Aramco’s Marjan and Berri field projects as well as the first phase of the Red Sea Tourism Project.

Saudi contract awards surge to highest in four years

Saudi contract awards surge to highest in four years

- The contract tally reached SR64.3 billion during the second quarter — up 32 percent on the previous quarter and an increase of 92 percent on a year earlier

- The oil and gas sector overwhelmingly dominated the contracts awarded in the second quarter, accounting for almost three-quarters of the total

Saudi bank loans up by 11% in March to hit $712bn

- Real estate financing for corporate dealings specifically surged by 27 percent

RIYADH: Saudi banks’ loans totaled SR2.67 trillion ($711.5 billion) in March, marking an 11 percent increase as compared to the same month in 2023, according to the latest official data.

Figures released by the Saudi Central Bank, also known as SAMA, showed personal borrowings accounted for 35 percent of this growth, while the remaining 65 percent went to the corporate sector, particularly for real estate activities, as well as electricity, gas, and water supplies.

Real estate financing for corporate dealings specifically surged by 27 percent in the third month of the 2024, marking the highest annual growth rate in 10 months, reaching SR275.2 billion.

A study by Mortor Intelligence, which used 2023 as a base year, estimated the Kingdom’s real estate market at $69.51 billion in 2024, and expects it to reach $101.62 billion by 2029, growing at a compounded annual growth rate of 8 percent between 2024 and 2029.

The surge in real estate and construction endeavors may have heightened the need for debt-based financing primarily sourced from the local banking sector. Saudi banks play a central role in the provision of loans for real estate projects.

According to SAMA data, new retail residential mortgage loans experienced a notable increase, reaching a 14-month high at SR7.63 billion in March. This marked a 5 percent rise compared to the amount granted in the same month last year and a 10 percent increase from the previous month.

HIGHLIGHTS

• New retail residential mortgage loans experienced a notable increase, reaching a 14-month high at SR7.63 billion in March.

• SAMA data also revealed that financing for professional, scientific, and technical activities soared by 54 percent, hitting SR6.4 billion.

In March, lending for home purchases accounted for the largest portion, comprising 64 percent of new mortgages to individuals, totaling SR4.91 billion. The most notable growth, however, was observed in apartment loans, surging by 28 percent to reach SR2.24 billion. Meanwhile, land loans experienced a more modest growth of 4 percent, reaching SR474 million in new mortgages.

One factor contributing to this growth could be the need for residential properties from expatriates arriving in the Kingdom, along with government initiatives aimed at modernizing the financial system.

In a March study by Knight Frank, a notable trend emerged among expatriates, with 68 percent expressing a strong preference for owning an apartment rather than a villa. This inclination was especially prominent among individuals aged 35-45 and 45-55.

Growth in lending for electricity, gas and water supplies came as the second contributor in corporate loans after real estate, registering an annual rise of 27 percent to reach SR147.42 billion in March.

According to an April report by Global Data, the key sectors in the Saudi Arabia power market are the residential sector, commercial sector, industrial sector, and others. In 2023, the residential sector had the dominant share in the power consumption market.

SAMA data also revealed that financing for professional, scientific, and technical activities soared by 54 percent, hitting SR6.4 billion, marking the highest annual growth rate among sectors.

Education loans also showed robust growth, with an annual increase of 28 percent to reach SR6.27 billion. Additionally, financing for administrative and support service activities rose by 20 percent, totaling around SR34.22 billion.

Budget deficit is ‘intentional’ to ensure sustainable development

- ‘As long as deficit is directed toward productive expenses, it is acceptable,’ says Al-Jadaan

RIYADH: Saudi Finance Minister Mohammed Al-Jadaan on Tuesday said the Kingdom is intentionally running a budget deficit to achieve its development goals.

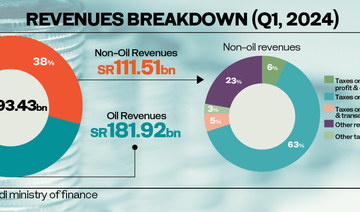

The Finance Ministry announced the quarterly budget performance report on Sunday. As per the report, the Kingdom posted a deficit of SR12.4 billion ($3.3 billion) in Q1, marking the sixth consecutive quarterly deficit with revenues amounting to SR293.4 billion and expenditures hitting a record SR305.8 billion.

“We’re intentionally running a sustainable deficit for economic development, contrasting with mandatory borrowing in some nations for essential but unproductive expenses,” the minister told Al-Eqtisadiyah in an interview.

He said the deficit is not merely a consequence but an attempt to achieve development goals. The minister said the government prioritizes spending to accelerate the implementation of its development strategies and projects.

Al-Jadaan also shed light on the overall situation of the global economy and how Saudi Arabia’s prudent fiscal policies have supported growth and enhanced the Kingdom’s resilience in dealing with changes.

HIGHLIGHTS

Efforts are underway to attract domestic and foreign investments that stimulate economic growth and contribute to reducing the budget deficit.

Strategic spending has a multiplier effect on the economy, like creating jobs and enhancing trade through infrastructure investments.

Saudi Arabia is committed to optimizing government expenditures by directing them toward promising strategies.

Regarding the budget deficit and its potential impact on the economy, he reassured citizens that managing the budget deficit is a top priority.

The minister clarified that as long as the deficit is directed toward productive expenses, the government views it as acceptable, as it generates economic returns that exceed the cost of debt.

Highlighting sustainable financial policies, Al-Jadaan cited the government’s efforts to reduce its reliance on oil revenues by diversifying sources of income.

He said non-oil revenues made up 38 percent of the total income in 2023, compared to 9 percent in 2015. The minister said the ratio of non-oil revenues to covering expenditure ceilings was about 17 percent in 2015 and surged to reach 35 percent in 2023.

Al-Jadaan said: “Financial policies can enhance financial inclusion and access to funding, both vital for supporting entrepreneurship, small and medium-sized enterprises, and innovation. This contributes to achieving the goals of Saudi Vision 2030, which has succeeded in unprecedented achievements across various sectors.”

He also addressed the efficiency of government spending and its pivotal role in fostering economic development and bolstering economic resilience.

“We are committed to optimizing government expenditures by directing them toward promising strategies aimed at diversifying the economic base,” the official added.

He said by the end of 2023, total government spending had reached approximately SR1.29 trillion, reflecting continued progress in implementing initiatives and structural reforms.

These initiatives include regional and sectoral strategies supportive of structural transformation for comprehensive sectoral development and economic diversification, Al-Jadaan added.

Moreover, the finance minister revealed that active efforts are underway to attract both domestic and foreign investments that stimulate economic growth and contribute to reducing the budget deficit.

Commenting on the impact of strategic spending on the national economy, he said it “involves directing and allocating financial resources toward specific goals and priorities that align with long-term economic objectives.”

This is achieved by strategically guiding funds, enabling governments and institutions to stimulate economic growth and development, foster innovation, and enhance productivity, he explained.

The minister went on to say that for instance, investments in additional industrial zones, expanding ports’ capacities, and investing in roads have led to significant growth in industrial investments and logistics services, creating business opportunities and employment for many citizens.

“This supports economic activity and raises the non-oil gross domestic product, thereby increasing non-oil revenues and covering additional debt costs,” he added.

Al-Jadaan said that strategic spending has a multiplier effect on the economy, like creating jobs and enhancing trade through infrastructure investments.

The minister also highlighted Saudi Arabia’s remarkable international presence over the past seven years.

He emphasized that Saudi Vision 2030 has positioned the Kingdom as a preferred and leading destination worldwide.

Al-Jadaan explained: “The foreign direct investment as a percentage of GDP reached 2.4 percent, which stimulated economic growth and bolstered the Kingdom’s competitiveness in the global market, leading it to advance seven positions to become one of the top 20 countries in the Global Competitiveness Report for the year 2023.”

Additionally, Saudi Arabia participated in regional economic integration initiatives, strengthened close economic relations with neighboring countries, and capitalized on regional markets to achieve mutual benefits.

“The Ministry of Finance has undertaken the task of enhancing international cooperation in financial policies through fostering international economic and trade partnerships, exchanging expertise, and promoting development at both regional and global levels,” the minister said.

Al-Jadaan emphasized Saudi Arabia’s commitment to promoting international dialogue. “We take pride in the Kingdom’s strong relations with international organizations, believing in the importance of international cooperation to achieve development, enhance peace and international security, promote human rights, combat climate change, and foster economic collaboration.”

Saudi Arabia chaired the G20 meetings, the most important global economic forum, in 2020 and effectively managed global consensus on addressing the COVID-19 pandemic.

He emphasized that the Kingdom has presented initiatives that are still being implemented globally, including the Debt Service Suspension Initiative for the benefit of poor countries, further enhancing its international standing.

Moreover, Saudi Arabia won the bid to host the 2030 International Expo, further solidifying its international position. The Kingdom’s nominees also secured victories in several international organizations.

In terms of financial and monetary policy, Saudi Arabia’s recent successes and its active participation in local, regional, and international events led the IMF to choose the Kingdom to chair the International Monetary and Financial Committee.

“This reflects the close and long-standing relationship between the two sides, affirming the Kingdom’s commitment to actively participate in shaping and implementing international financial and economic policies,” Al-Jadaan added.

The minister highlighted the IMF’s Riyadh-based regional office and said: “The opening of the IMF’s regional office in Riyadh is a strategic move that reflects the Kingdom’s commitment to enhancing international cooperation and promoting economic stability at the regional level.”

Saudi Arabia’s green energy shift could slash electricity costs by $30bn annually by 2030: S&P Global executive

RIYADH: Saudi Arabia’s transition from oil power to renewable energy could reduce annual electricity costs by $30 billion by 2030, according to a senior S&P Global executive.

Speaking during a panel session at the 2024 Saudi Arabia Capital Markets Conference hosted by the firm in Riyadh, Director of Infrastructure and Project Finance Ratings Sofia Bensaid highlighted the Kingdom’s ambitious targets of 50 percent renewable electricity by 2030 and net zero emissions by 2060.

While Bensaid believes the target is achievable, she raised concerns regarding implementation, as the plan requires adding more than 20 gigawatts of renewables annually until 2030, totaling 130 GW in six years.

“Now in terms of CapEx (capital expenditure), we expect the whole rebuilding agenda to cost approximately $86 billion and will aim at replacing the entire oil-fired power fleet. But it’s very important to keep in mind that this $86 billion bill is raised by developers on a project finance scheme and hence does not sit on the government balance sheet,” Bensaid said.

She added: “Once this 130 GW is reached, the Kingdom’s annual electricity bill will reduce by approximately $30 billion.”

During the same panel, Director of Corporate Ratings at S&P Global Rawan Oueidat explained that national oil companies in the region are expected to maintain high capital expenditures but with modest growth compared to 2022-23 levels.

“We estimate that in aggregate, the region and national oil companies will be spending somewhere around $110-$115 billion annually, on average, at least until 2026,” Oueidat said.

However, recent capacity expansion pauses, like those in Saudi Arabia, raise concerns about cash flow visibility, especially for oilfield service companies.

This could translate into higher credit metrics for the oilfield service companies in Saudi Arabia.

Furthermore, the conference shed light on the Kingdom’s dual focus on non-oil divisions and renewable energy initiatives.

Government investments are driving expansions in non-oil sectors, which are expected to continue below the 5 percent growth rate.

Fields like tourism, consumer products, healthcare, and telecom are thriving, supported by demographic trends and favorable oil prices.

“They will continue to be fueled by public investments, but they’re also supported by mega trends as well in Saudi Arabia, such as population growth,” said Tatjana Lescova, associate director of corporate ratings at S&P Global, adding that S&P Global’s expectations are “relatively favorable, and the oil price is also helping, of course.”

She went on to say that sectors that are consumer driven “will continue to thrive,” adding: “Consumer spending is growing, it’s expanding, but relatively limited inflation levels compared to some other parts of the world are also helping the rest of our competitive pressures.”

Lescova further explained the positive outlook for various sectors in Saudi Arabia, such as consumer-driven industries like healthcare, which are thriving due to growing spending trends and relatively low inflation rates.

“But overall attraction is very positive. (The) healthcare sector will benefit from the positive population demographic dynamic, and there’s also widespread requirements of mandatory insurance across the region and Saudi Arabia as well,” she stated.

Lescova also flagged up the telecom sector as “performing really well over the past few years,” adding: “The telecom companies continue to invest in 5G infrastructure that boasts mobile data consumption, and in addition to this, they are also developing a lot of digital nontoken businesses.”

Additionally, during another panel session, Director of Sovereign Ratings at S&P Global Zahabia Gupta underlined Saudi Arabia’s ambitious Vision 2030 plan for substantial social and economic transformation.

She noted that the significant costs associated with various large-scale projects under this vision are estimated to be around a trillion dollars or more.

“As we get closer to 2030, we expect that PIF and the government will ramp up debt issuance for the implementation of these projects. We did an exercise to forecast public finances for Saudi Arabia until 2030,” Gupta said.

She added: “What we see right now is that total PIF and government debt issuances will come to about $250 billion from 2024 to 2030, that comes to about $35 billion of annual issuance. That’s quite a large absolute number, especially when you consider that most of this funding will be done through external (sources).”

Despite the substantial debt issuance, Gupta noted that Saudi Arabia will remain in a “comfortable” net asset position of around 47 percent of gross domestic product by 2027, adding: “Even by 2030, it would be about 30 percent of GDP.”

With support from PIF, this projection reflects that the government will only implement a portion of Vision 2030, while other entities, such as the private sector and foreign investors, will also contribute.

According to S&P Global’s latest report on May 6, the Saudi government’s assets are forecasted to remain strong amid steady economic diversification efforts aimed at reducing the Kingdom’s dependence on oil.

The increasing debt issuance to fund Vision 2030 projects may exert pressure on Saudi Arabia’s net asset position until the end of the decade.

However, the Kingdom will mitigate this impact through its prudent fiscal policies.

“S&P Global Ratings expects that growing debt issuance to finance Vision 2030 projects could pressure the sovereign’s fiscal metrics. In our base case, however, we expect the government’s net asset position will deteriorate but remain strong,” stated the credit-rating agency.

It added: “The ramp-up in fiscal deficits and debt could weaken the government’s balance sheet far sooner than returns on investment will accrue. Much will depend on the roles that foreign investment, the private sector, and capital markets will play in financing Vision 2030.”

The US-based firm highlighted that the Saudi government will continue to support PIF in various ways, including funding essential infrastructure for mega and giga-project sites.

Closing Bell: TASI edges down to close at 12,357 points

RIYADH: Saudi Arabia’s Tadawul All Share Index dipped on Tuesday, losing 14.51 points, or 0.12 percent, to close at 12,357.99.

The total trading turnover of the benchmark index was SR7.03 billion ($1.87 billion) as 70 of the listed stocks advanced, while 150 retreated.

Similarly, the MSCI Tadawul Index decreased by 1.42 points, or 0.09 percent, to close at 1,547.71.

The Kingdom’s parallel market Nomu slipped by 49.36 points, or 0.18 percent, to close at 26,741.64. This comes as 24 of the listed stocks advanced while as many as 28 retreated.

The best-performing stock of the day was Batic Investments and Logistics Co., whose share price surged by 6.36 percent to SR3.51.

Other top performers include Development Works Food Co. Ltd and Electrical Industries Co., whose share prices soared 5.42 percent and 4.97 percent to SR128.40 and SR5.70, respectively.

Other top performers include Saudi Co. for Hardware and Zahrat Al Waha for Trading Co.

The worst performer was Saudi Real Estate Co., whose share price dropped by 7.61 percent to SR22.34.

Other worst performers were Al-Baha Investment and Development Co. as well as Americana Restaurants International PLC, whose share prices dropped by 7.14 percent and 5.07 percent to stand at SR0.13 and SR3.18, respectively.

Additional poor performers include United Cooperative Assurance Co. and AlSaif Stores for Development and Investment Co.

On the announcements front, Americana Restaurants International PLC announced its interim financial results for the period ending on March 31, with revenues amounting to SR1.85 million, down from SR2.21 million in the corresponding period in 2023.

The company attributed the 16.3 percent decline to lower like-for-like sales due to ongoing geopolitical tensions in the region, as well as reduced sales volumes in March due to shifts in consumer behavior during Ramadan.

Net profits also decreased by 51.8 percent to reach SR105,090 in the first three months of 2024 compared to SR217,984 in the same period last year.

According to a statement by the company on Tadawul, this decrease was attributed to lower sales due to the geopolitical situation and the onset of Ramadan, as well as higher depreciation charges and rent expenses on account of new store openings during the period.

Saudi Real Estate Co. also announced its financial results for the same period, with revenues surging by 8.8 percent to reach SR427.6 million, compared to SR393 million in 2023.

The increase was primarily driven by a 28 percent surge in revenues from infrastructure projects, totaling SR56 million, and a 23 percent increase in rental revenue, totaling SR15 million.

However, the company’s net profits decreased in the first quarter of this year to SR2.9 million, marking a 67.4 percent decline compared to the same quarter in 2023.

This decline, as stated in an official Tadawul announcement, was attributed to an increase in cost of revenues resulting in a 13 percent increase, totaling SR34 million, a 14 percent rise in general and administrative expenses amounting to SR5 million, and an increase in finance costs by 14 percent with the amount of SR8 million

Riyadh Air, STA ink deal to launch new routes and destinations

RIYADH: Saudi Arabia’s second flag carrier Riyadh Air will soon announce more routes and destinations thanks to a new agreement with the Kingdom’s official tourism body.

The airline, backed by the country’s Public Investment Fund, inked the memorandum of understanding with the Saudi Tourism Authority, at Dubai’s Arabian Travel Market.

According to a statement, Riyadh Air and STA will seek joint sponsorships and will collaborate at global trade shows and events.

The two parties will also work together to offer joint loyalty program schemes with exclusive offers and rewards to benefit guests.

“Increasing Saudi’s connectivity with the world is a key pillar of our tourism strategy and will ensure we sustain our rapid growth and meet our new ambitious target of 150 million visits by 2030,” STA CEO Fahd Hamidaddin said.

“This exciting new partnership with Riyadh Air will support our goals and ensure more visitors can travel to experience the cool mountains, pristine waters and dynamic cities that make Saudi a great year-round destination,” Hamidaddin added.

He added that the firm is currently connected to over 180 destinations and is aiming to triple annual passenger traffic to 330 million by 2030. The CEO also shed light on how as well this new agreement will help propel these efforts.

The new deal will also make airline booking processes simpler due to collaboration on payment solutions.

Riyadh Air CEO Tony Douglas added: “This is another momentous day in the history of Riyadh Air.”

He added: “Working alongside the STA to elevate the travel experience for our guests and those coming to visit the Kingdom of Saudi Arabia signifies what we’re all about.”

He also highlighted that the carrier is working on elevating aviation standards to previously unseen levels.

“We have a shared commitment to travel and tourism in the Kingdom along with our forward-thinking approach to innovation, sustainability, and the satisfaction of our guests,” the CEO concluded.

Earlier this week, Douglas said that the airline has plans to bolster its aircraft lineup through additional orders, as it requires “a very large fleet” to establish itself alongside regional giants.

This move came as the Kingdom’s second flag carrier ordered 39 Boeing 787-9 jets last year, with options for 33 more.

It also aligns well with Saudi Arabia’s goal to expand its aviation industry and attract more tourists, broadening its airline capacity beyond pilgrimage travel, which currently forms the backbone of the country’s inbound tourism.