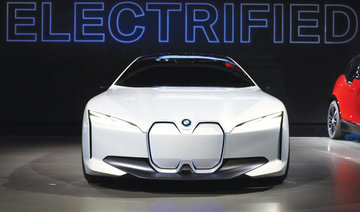

BERLIN: German high-end car giant BMW and British group Jaguar Land Rover announced Wednesday they are teaming up to develop a new generation of electric motors.

A joint team will be based in Munich and tasked with developing the “next generation electric drive units” which BMW will launch together with JLR.

“Cooperation between car manufacturers to share know-how and resources is important” as the automotive industry tackles “the significant technological challenges” posed by the electric cars of the future, said BMW in a statement.

The partnership is for research and development and the engines will be produced “by each partner in their own manufacturing facilities,” BMW said in a statement.

Both groups hope the partnership will reduce development costs at a time when the transition to electric vehicles weighs heavily on manufacturers’ balance sheets.

Like many other traditional carmakers, both BMW and JLR are racing to catch up with US tech giant Tesla which has a head-start in making the cleaner, smarter vehicles of the future.

Pressure is also coming from the EU for the European automotive industry to shift gears to electric engines, as new tougher CO2 emissions limits come into force from 2020.

To meet the high costs shifting away from internal combustion engines, other carmakers have also struck up partnerships.

Mercedes-Benz maker Daimler and Chinese auto giant Geely in March announced plans to develop the next generation of electric Smart cars to be made in China in a joint venture.

JLR last year unveiled an electric Jaguar SUV and is currently carrying out major restructuring in a bid to save £2.5 billion ($3.2 billion, 2.8 billion euros) so as to be able to invest more in electric cars.

BMW partners Jaguar Land Rover to develop electric engine

BMW partners Jaguar Land Rover to develop electric engine

- A joint team will be based in Munich and tasked with developing the next generation electric drive units which BMW will launch together with JLR

- Like many other traditional carmakers, both BMW and JLR are racing to catch up with US tech giant Tesla which has a head-start in making the cleaner, smarter vehicles of the future

Oil Updates – crude steady as market weighs US demand concerns, Middle East conflict risks

SINGAPORE: Oil prices steadied on Thursday after settling lower in the previous day, as signs of retreating fuel demand in the US, the world’s biggest oil user, contended with widening conflict risks in the key Middle East producing region, according to Reuters.

Brent crude futures inched up 18 cents, or 0.2 percent, to $88.20 a barrel at 9:30 a.m. Saudi time, while US West Texas Intermediate crude futures gained 13 cents, or 0.2 percent, to $82.94 a barrel.

Data from the US Energy Information Administration on Wednesday showed that gasoline stockpiles fell less than forecast while distillate stockpiles rose against expectations of a decline, reflecting signs of slowing demand.

The falling fuel demand is occurring amid signs of cooling US business activity in April and as stronger-than-expected inflation and employment data means the US Federal Reserve is more likely to delay expected interest rate cuts, weighing on economic sentiment.

“The current weakness in benchmark prices, after testing above $90 (a barrel) levels, is due to market sentiment refocusing on global economic headwinds over geopolitical tensions,” said Emril Jamil, senior oil analyst at LSEG Oil Research.

Geopolitics aside, prices this quarter will be driven by factors including major producer supply cuts, economic data out of China and Eurozone, on top of incremental demand expectations as the Northern Hemisphere heads into summer amid expected tighter supply, said Jamil.

A better indication of the Fed’s rate intentions will be seen after US gross domestic product and March personal consumption expenditure data is released on Thursday and Friday.

Meanwhile, fighting in the Gaza Strip between Israel and Hamas is expected to expand as Israel may start an assault on Rafah, in the enclave’s south, which may increase the risk of a wider war that could potentially disrupt oil supplies.

However, there have been no other signs of direct conflict between Israel and Hamas-backer Iran, a major oil producer, since last week.

“Tensions between Iran and Israel have eased, but Israeli attacks on Gaza are expected to worsen, and the risk of conflicts spreading to neighboring countries is underpinning oil prices,” said Toshitaka Tazawa, an analyst at Fujitomi Securities Co. Ltd.

Other EIA data on Wednesday showed that crude stocks slumped by 6.4 million barrels to 453.6 million barrels, compared with expectations in a Reuters poll for an 825,000-barrel rise.

Saudia unveils beta version of new Travel Companion platform

RIYADH: The Kingdom’s flagship airline Saudia has launched a beta version of its digital platform, the Travel Companion, powered by advanced artificial intelligence, aiming to transform the industry.

The new initiative, unveiled during a special event, is part of a two-year plan developed in partnership with global professional services firm Accenture.

“This platform, resulting from our ongoing collaboration with Accenture, signifies our forward-looking approach to providing guests with unparalleled convenience and flexibility,” the Director General of Saudia Group, Ibrahim Al-Omar, said.

The main objective of this launch is to transform how travelers engage with the airline and establish new benchmarks for digital travel.

TC, initially named, offers personalized and tailored solutions to meet individual preferences and needs, providing search results from trusted and authenticated sources and incorporating visual aids in its responses.

The interface is designed as a comprehensive, one-stop solution that enables users to book concierge services, including hotels, transportation, and restaurants, as well as activities and attractions, without the need to switch between multiple platforms.

“This is a beta version. This is not the product. We will keep enhancing and developing it,” Al-Omar stressed.

Moreover, it establishes seamless connections with transportation platforms and various train companies, ensuring a smooth and uninterrupted journey.

Commenting on the new announcement, Chief Data and Technology Officer at Saudia, Abdulgader Attiah, told Arab News: “It’s like having the VVVIP concierge service at your hand. For public, it’s not any anymore VIP service. It’s not a paid service. You have it for free, and it will give you all what all kind of services that VVIP service would provide to you, so it’s your private concierge.”

He added: “We will be the anchor for the travel industry. We are not anymore, an operator for an airline, but with this app, you will be an anchor for all tourism ecosystem in a single app, so everyone can collaborate in this app, and having the links, so you don’t need to communicate with any other party, so through this app, you can communicate to all travel ecosystem.”

In future phases, Saudia plans to add more features, including voice command and digital payment solutions.

“Once we add the complete solution we will add the more services, which is we call it the concierge services; booking for hotels and transportation and the restaurants, all of these ones is done during the, next two years, and this is the complete life cycle of the, vision we have today,” Attiah told Arab News.

He added: “If you want to develop this app, five years back, it would take three, four years. Today, we have developed only in seven, eight months. To that from the inspirational part to having an actual booking, we started back in June and now we are live.”

Attiah also underlined that Saudia is the first airline in the world to implement a GenAI-based chatbot that can perform end-to-end actions, meaning it can not only engage in conversation but also execute tasks or actions based on user requests.

With an always-on Travel Companion available through a telecom e-SIM card provided by Saudia, users can stay connected globally without relying on additional internet providers.

Furthermore, users can purchase data packages for extended use, guaranteeing continuous access to the platform’s services.

Saudi economy witnessing a fundamental shift, says minister

RIYADH: Since the launch of Vision 2030, Saudi Arabia has witnessed a fundamental shift in its economy and the business environment is transforming with the creation of new sectors, said the Kingdom’s economy minister.

Faisal Al-Ibrahim was speaking at a conference in Riyadh on Wednesday during which he highlighted the fast-evolving business landscape of the Kingdom focused on diversifying its income sources away from oil.

Speaking at the event titled “Industrial policies to promote economic diversification,” the top official said there have been fundamental changes in the legislative and economic regulations to promote sustainable development since the launching of the Vision 2030 plan.

He said the Kingdom’s efforts to diversify its economy have led to the creation of new sectors due to the initiation of several megaprojects such as NEOM, the Red Sea, and others.

“We stand at a crossroads to change the global economy,” Al-Ibrahim said.

He stressed the need for strategies to ensure a flexible and sustainable economy.

“The presence of foreign investments will develop competitiveness in the long term,” the minister affirmed.

The minister also highlighted how the Kingdom was working in the medium term to focus on transforming sectors that represent a technological shift.

Saudi Arabia is keen on achieving development in the medium term by balancing short-term profits and promoting long-term success, Al-Ibrahim highlighted.

Since the launch of the vision, the Ministry of Economy and Planning has conducted several economic studies aimed at diversifying the economy by developing objectives for all sectors, raising complexity levels, and studying emerging economies to enhance the Kingdom’s capabilities.

Saudi Arabia closes April sukuk issuance at $1.97bn

RIYADH: Saudi Arabia has completed its riyal-denominated sukuk issuance for April at SR7.39 billion ($1.97 billion), representing a rise of 66.44 percent compared to the previous month.

The National Debt Management Center revealed that the Shariah-compliant debt product was divided into three tranches.

The first tranche, valued at SR2.35 billion, is set to mature in 2029, while the second one amounting to SR1.64 billion is due in 2031.

The third tranche totaled SR3.51 billion and will mature in 2036.

“The Kingdom also plans to expand funding activities during the year 2024, reaching up to a total of SR138 billion from what has been stated previously in the Annual Borrowing Plan, with a portion of this amount already covered up to date,” said NDMC in a press statement.

It added: “This step comes with the aim of capitalizing on market opportunities to achieve proactive financing for the coming year and utilizing it to bolster the state’s general reserves or seize additional opportunities to enhance transformative spending during this year, thereby accelerating strategic projects and programs of Saudi Vision 2030.”

In March, NDMC concluded its second government sukuk savings round for March, with a total volume of requests reaching SR959 million, allocated to 37,000 applicants.

The center added that the financial product, also known as Sah, offers a return of 5.64 percent, with a maturity date in March 2025.

Earlier this month, Fitch Ratings, in a report, said that global sukuk issuance is expected to continue growing in the coming months of this year, driven by funding and refinancing demands.

The credit rating agency noted that various other factors like economic diversification efforts by countries in the Gulf Cooperation Council region and development of the debt capital market will also propel the growth of the market in the future.

In January, another report released by S&P Global revealed that sukuk issuance worldwide is expected to total between $160 billion and $170 billion in 2024, driven by higher financing needs in Islamic nations.

The report noted that higher financing needs in some core Islamic finance countries and easing liquidity conditions across the world are two crucial factors which will drive the growth of the market this year.

Closing Bell: TASI edges down to close at 12,355 points

RIYADH: Saudi Arabia’s Tadawul All Share Index dipped on Wednesday, losing 128.72 points, or 1.03 percent, to close at 12,355.69.

The total trading turnover of the benchmark index was SR8.45 billion ($2.25 billion) as 41 of the listed stocks advanced, while 187 retreated.

Similarly, the MSCI Tadawul Index decreased by 14.78 points, or 0.95 percent, to close at 1,548.62.

Also, the Kingdom’s parallel market Nomu dipped, losing 365.84 points, or 1.37 percent, to close at 26,326.12. This comes as 17 of the listed stocks advanced, while 45 retreated.

The best-performing stock of the day was Al-Rajhi Co. for Cooperative Insurance as its share price surged by 9.87 percent to SR138.

Other top performers include Al Sagr Cooperative Insurance Co. and First Milling Co., whose share prices soared by 6.38 percent and 5.63 percent, to stand at SR35.85 and SR78.80, respectively.

In addition to this, other top performers included Batic Investments and Logistics Co. and Saudi Research and Media Group.

The worst performer was Al-Baha Investment and Development Co., whose share price dropped by 7.14 percent to SR0.13.

Other weak performers were National Co. for Learning and Education as well as Arriyadh Development Co., whose share prices dropped by 5.95 percent and 5.91 percent to stand at SR148.60 and SR22.60, respectively.

Moreover, other subdued performers also include Red Sea International Co. and AYYAN Investment Co.

On the Kingdom’s parallel market Nomu, the best-performing stock of the day was Osool and Bakheet Investment Co., as its share price surged by 12.05 percent to SR40.90.

Other top performers on Nomu include Arabian Plastic Industrial Co. and Lana Medical Co., with their share prices soaring by 7.42 percent and 3.59 percent, respectively, reaching SR37.65 and SR41.85.

The worst performer was Jahez International Co. for Information System Technology, whose share price dropped by 5.88 percent to SR32.

Other weak performers were Alhasoob Co. as well as Aqaseem Factory for Chemicals and Plastics Co., whose share prices dropped by 3.61 percent and 3.38 percent to stand at SR64.10 and SR62.80, respectively.

On the announcements front, HSBC Saudi Arabia, serving as sole financial advisor, joint bookrunner, underwriter, and lead manager, has announced the intention of Dr. Soliman Abdel Kader Fakeeh Hospital Co., known as Fakeeh Care Group, to proceed with its initial public offering on the main market of Saudi Exchange.

According to a statement, the offering will include 49.8 million ordinary shares, with 19.8 million existing shares and 30 million new shares upon completion.

This offering is set to represent 21.47 percent of the company's share capital post-capital increase.

Saudi Exchange and the Capital Market Authority approved the listing and IPO, respectively, with the pricing of shares to be determined after the book-building period.