RIYADH: Saudi Arabia is making sincere efforts towards economic, social and cultural diversification with the works in progress on giga-projects, which are designed to be places of inspiration, discovery and fruitful engagements for the millennial generation.

The biggest development projects till date: Qiddiya Entertainment City, NEOM, the Red Sea Project and Amaala resort will shape the future of tourism as an important hub to meet and satisfy the recreational, social and cultural needs of the Kingdom’s current and future generations.

Crown Prince Mohammad bin Salman in 2016 mandated the development of long-term model of prosperity for the Kingdom and the result was Vision 2030, an ambitious yet attainable blueprint to ensure that Saudi Arabia is a vibrant society, a thriving economy and a progressive nation.

These developments are part of the Crown Prince’s ambitious plan Saudi Vision 2030 that aims to diversify the economy, away from a dependency on oil and society with varied and rich experience of a quality lifestyle including world class tourism.

In response to multiple societal challenges including limited entertainment options, demographic and social change, careers in a world beyond oil, and public health, the Public Investment Fund (PIF), a sovereign wealth fund owned by Saudi Arabia has been tasked with developing the series of “giga-projects.”

Qiddiya city has been named after the Aba Al-Qid road (Camel Trail) that used to connect Al-Yamama to Hijaz. (Supplied)

QIDDIYA

The Qiddiya project aims to meet these challenges by providing a destination where Saudis find excitement, inspiration, creative communities and career and investment opportunities.

Qiddiya city has been named after the Aba Al-Qid road (Camel Trail) that used to connect Al-Yamama to Hijaz. When completed Qiddiya will become a place to live, work and play, a prominent landmark and an important hub to meet and satisfy the recreational, social and cultural needs of the kingdom’s current and future generations.

Qiddiya, an important hub planned in the Saudi capital to fulfill the recreational and entertainment needs of the people, will see the launch of the construction phase this year. Qiddiya CEO Mike Reininger told Arab News in January: “2019 will see Qiddiya move from the planning and design phase to the construction phase.”

The Qiddiya site is 40 kilometers from the center of Riyadh city. When completed, this prominent landmark is expected to be the world’s largest entertainment city, surpassing Walt Disney World in Florida.

The ambitious project hopes to attract local, regional and international tourists. It includes theme parks, entertainment centers, sports amenities capable of hosting international competitions, training academies, desert and asphalt tracks for motorsport enthusiasts, water- and snow-based recreation, adventure activities alongside nature and safari experiences, and an array of historical, cultural and educational activities and events.

Visitors will have access to more than 300 recreational and educational facilities designed around five cornerstones of development that drive the strategy: Parks and attractions, sports and wellness, motion and mobility, nature and environment, and arts and culture.

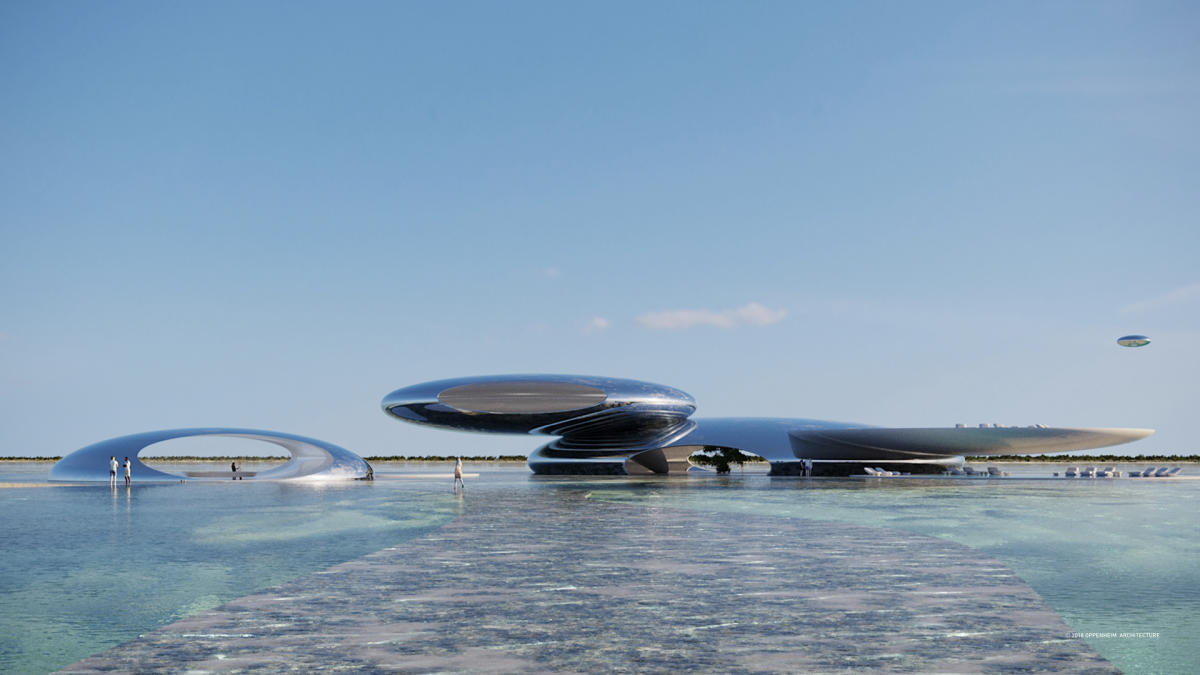

The area earmarked for the NEOM project offers excellent prospects for leisure tourism, combining the Red Sea, beautiful beaches and islands and unspoiled natural beauty. (Supplied)

NEOM

NEOM, is a giant zone being being developed in the northwest of Saudi Arabia with a $500 billion investment support from the Public Investment fund (PIF).

The project, which has been described as “the destination for the future of living,” will stretch across the Egyptian and Jordanian borders and aims to transform the Kingdom into an international pioneering example, through introduction of value chains of industry and technology.

The area earmarked for the NEOM project offers excellent prospects for leisure tourism, combining the Red Sea, beautiful beaches and islands and unspoiled natural beauty.

The origin of the name is a combination of the Latin word “neo” meaning “new,” and the first letter “m” of the Arabic word “mustaqbal” which means “future”.

NEOM, which was announced in 2017 and is in a pristine position on the Red Sea, is expected to focus on luxurious living, and will include high-end hotels and villas. Moreover, homes in the development will be marketed to both regional and international buyers.

Saudi Arabia announced in January this year that it will start developing the first urban area of the zone after the founding board, chaired by Crown Prince Mohammed bin Salman, approved the master-plan for NEOM Bay, which will include homes, lifestyle and tourist facilities, and “innovation centers.” Construction work was expected to start in the first quarter of 2019 and will be completed in 2020.

“We are now preparing for the development of NEOM Bay area, which will provide a new concept of urban living that will enable it to become a platform for attracting the world’s top minds for creating advanced economic sectors,” said Nadhmi Al-Nasr, NEOM chief executive, in January.

In late January, Saudi Arabia established a company to develop NEOM. The closed joint-stock NEOM Company will be fully owned by the PIF and will develop the vast project, which will include multiple cities, airports, a seaport, tourist areas, industrial complexes and “innovation centers.”

According to Al-Nasr, the new entity will be responsible for developing a new global destination from scratch on a huge area and a futuristic civilization that is based on sustainability and livability.

“All this aims to turn NEOM into a global center for attracting investment, knowledge, innovation and technology in order to compete with all economic capital cities,” he said.

NEOM’s economic prospects will focus on 16 sectors: Energy, water, mobility, bio-tech, food, manufacturing, media, entertainment, culture, and fashion, technology including digital, tourism, sport, design and construction, services, health and well-being, education and liveability.

The Red Sea Project will set new standards in sustainable development and redefine the world of luxury tourism with objectives to position the Kingdom on the global tourism map. (Supplied)

THE RED SEA PROJECT

The Red Sea Project, one of the giga-projects announced by the crown prince in 2017, is billed as one of the the world’s most ambitious tourism and hospitality projects: An ultra-luxury destination that is being created around one of the world’s hidden natural treasures.

The Red Sea Project will set new standards in sustainable development and redefine the world of luxury tourism with objectives to position the Kingdom on the global tourism map.

Once completed, visitors will be able to explore the wonders and rich cultural heritage of Saudi Arabia’s untouched Red Sea Coast.

This is a touristic project that includes more than 90 unspoiled islands located between the cities of Umluj and Al-Wajh. It covers a number of the Red Sea’s untouched islands and a nature reserve containing regional flora and fauna.

Situated between the cities of Umluj and Al Wajh on the west coast of Saudi Arabia, the site is strategically located at the crossroads of Europe, Asia, the Middle East and Africa and within eight hours’ flying time of 80 percent of the world’s population.

The vision of the project includes creating an exquisite ultra-luxury destination within a pristine 28,000 sq km area that includes an archipelago of more than 90 unspoiled islands, volcanoes, desert, mountains, nature and culture.

The project is planned to set new standards for sustainable development and environmental protection, exceed expectations with the highest standards of service excellence and use technology to enable a seamless personalized experience that will position Saudi Arabia on the global tourism map.

The project offers a secure and stable environment for investors within the world’s fastest growing tourism region. In December 2018 King Salman received a team from the Red Sea Development Company (TRSDC), led by CEO John Pagano at Al-Yamama Palace in Riyadh that gave a progress report on the ambitious tourism and leisure project with a presentation detailing the master plan and its economic and developmental objectives, which aim to establish it as a leading global destination in the luxury tourism sector.

The first phase of the project, scheduled for completion in 2022, includes 14 luxury and hyper-luxury hotels providing 3,000 rooms across five islands and two inland resorts on the Kingdom’s west coast, an airport to serve the destination, and marinas, along with residential properties and recreational facilities.

By the time the project is completed, there will be 22 developed islands out of a total of 90 islands.

It is expected to create 70,000 jobs and play a significant role in driving economic diversification in the Kingdom by attracting nearly a million visitors a year and contributing SR22 billion to the country’s GDP.

Notably, plans to develop the project have been given the green light. The TRSDC has received final approval from its board of directors for the program’s master plan in January this year.

Commenting on it Pagano said: “With the master plan approved, we are now identifying investors and partners who are interested in working with us on realizing the objectives of the project and who share our commitment to enhance, not exploit, the natural ecosystems that make the destination so unique.”

Significantly, the Red Sea project ensures protection of ecology. As part of the planning process, major environmental studies were carried out to ensure that the area’s sensitive ecology was protected both during and after completion of the development.

Furthermore, the master plan is underpinned by an extensive smart destination management system that will support a wide range of personalized products and services designed to appeal to the modern luxury traveler.

The TRSDC employed the world’s first destination-scale computer simulation techniques, created in Saudi Arabia, to assess the impact of the development and future tourism on the environment. The resulting plan now targets a 30 percent net increase in biodiversity over the next two decades, a conservation equivalent to designating the site as a marine protection area.

Technology also underpins the destination’s sustainability initiatives, with a suite of sensors and monitoring devices in place to track and measure variations in environmental factors such as water salinity, temperature, visibility and tidal flows.

“The leadership of the Kingdom has shown great foresight in its insistence on balanced development of this pristine destination,” said Pagano. “Our plan not only envisions a stunning luxury destination, it also takes tangible, measurable steps to enhance that destination for future generations to enjoy and cherish.”

The Amaala resort, already being dubbed the Riviera of the Middle East, will be focused upon wellness and healthy living. (Supplied)

AMAALA

The Amaala project is another global destination aims to focus on ultra-luxury “wellness tourism” and the arts alongside other Red Sea mega-projects NEOM, a 26,500 square mile business zone and Saudi Arabia’s answer to Silicon Valley currently under development in the northwest of the kingdom and the Red Sea project.

This ultra-luxurious destination on the Kingdom’s northwestern coast of the Red Sea has been announced by the PIF, which is spearheading the project and will provide initial funding. Partnership and investment packages will be available to the private sector as it progresses.

The “Amaala” resort, already being dubbed the “Riviera of the Middle East,” will be focused upon wellness and healthy living. The resort will be located in the Prince Mohammed bin Salman Nature Reserve. PIF said Amaala will sit alongside NEOM and the Red Sea Project as part of a giga-projects investment portfolio, which will establish a unique “tourism ecosystem,” supporting economic diversification and creating high-value job opportunities.

Nicholas Naples, a veteran luxury hospitality and development executive, will be the CEO of the project, PIF said in September 2018.

“Amaala will awaken the world’s imagination by rephrasing the current concept of the luxury tourism experience, especially in terms integrative wellness, specialty treatments and related recreational offerings,” Naples said at the time.

“Amaala represents a unique and transformational luxury experience where full-fledged wellness tourism is integrated alongside a curated mix of arts, culture and sports offerings that are individually tailored for the ultra-luxury lifestyle, including the availability of a fashion scene, healthy-living services, and year-round sea expeditions,” Naples added.

According to the developers, Amaala will feature “extraordinary architecture and unprecedented luxury in both hotels and private villas as well as a quaint retail village.”

It will also include an arts academy that will foster the growth and development of young artists from Saudi Arabia and the region.

PIF announced there will be cultural events, artistic performances and related conferences in a bid to bring international visitors to the region, where they can enjoy a wide array of unique and personalized holiday experiences set against stunning scenery, mountainous landscapes and diving among pristine coral reefs.

The project will include marinas and a yacht club and aims to be a destination for boutique luxury cruises.

The retail areas will include a mix of galleries, ateliers, artisan workshops and bespoke outlets along with a wide range of international and local restaurants.

As envisioned in Vision 2030, Amaala – along with the other giga-projects — will support the diversification of Saudi Arabia’s leisure and tourism industry, while promoting cultural conservation, ecological preservation and sustainability.