ISLAMABAD: Pakistan expects to agree a deal to build an oil refinery and petrochemical complex at the Balochistani deep-sea Port of Gwadar, during the first state-level visit by Saudi Arabia’s Crown Prince Mohammed bin Salman.

The deal will see Pakistan join with Saudi Aramco to build the facility, expected to cost $10 billion.

“We are working on feasibility studies for the establishment of the oil refinery and petrochemical complex in Gwadar, and will be ready to start by early 2020,” Pakistan’s Minister for Petroleum Ghulam Sarwar Khan told Arab News on Thursday.

Once established, the project will help the South Asian nation cut its annual crude oil imports by up to $3 billion annually, in addition to creating thousands of job opportunities in the impoverished western province.

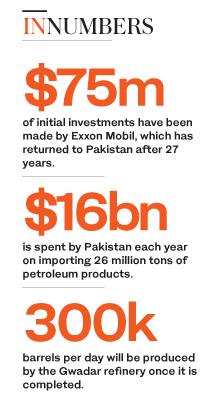

The country spends more than $16 billion each year on importing 26 million tons of petroleum products, including 800 million cubic feet of liquified natural gas (LNG) from Saudi Arabia, the UAE and other Gulf countries.

Khan claimed the refinery would produce up to 300,000 barrels per day once completed.

“The Saudi authorities have asked us to complete all the initial work on the project on a fast track, as they want to set it up as early as possible,” he said.

A Saudi technical team, including Energy Minister Khalid Al-Falih, has visited Gwadar twice in recent months to examine the site for the refinery, getting briefings from Pakistani officials on security in the area near the border with Iran.

“We will ensure complete security for Saudi investments and people working on the project. A detailed security plan has already been chalked up with help of the security agencies,” Khan added.

Pakistan currently has five oil refineries, but they can only satisfy half of its annual demand. Islamabad and Riyadh have long maintained strong ties, with the latter repeatedly offering the former financial assistance. Last year, the Kingdom guaranteed Pakistan $3 billion in foreign currency support for a year, and a further loan worth up to $3 billion in deferred payments for oil imports, to help stave off an economic crisis. The Islamic Republic also received $3 billion from the UAE to protect its foreign reserves.

Khan added that the Pakistani-Arab Refinery Co. (PARCO) was also setting up an oil refinery at Khalifa Point, near the city of Hub in Balochistan.

“The work on this project is at an advanced stage. Land for it has been acquired and other formalities are being fulfilled,” he said.

Khan hopes the world’s perception of Pakistan will change upon completion of these deals, after years of war in the surrounding region. Exxon Mobil returned to Pakistan last month after 27 years, and started offshore drilling with $75 million of initial investments.

“All results of the drilling are positive so far, and we expect huge oil and gas reserves to be discovered soon,” he said.

“More foreign companies are contacting us to invest in offshore drilling and exploration. Saudi Arabia is also setting up reservoirs for LNG in Pakistan. More Saudi investment will come to Pakistan with the passage of time.”