TOKYO: Japan’s SoftBank Group said Monday it logged an eight-fold jump in net profit in the six months to September thanks to strong returns from its investment funds.

Net profit rose to ¥840 billion ($7.4 billion) from ¥103 billion during the same period last year, the Japanese mobile giant and IT investor said.

The rise was largely driven by gains of ¥649 billion from the SoftBank Vision Fund, which compared to ¥194 billion in the previous period.

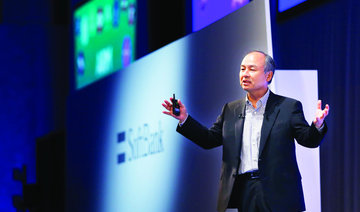

Under tycoon CEO Masayoshi Son, SoftBank, which started as a software firm, has increasingly been seen as an investment firm, plowing funds into a broad range of companies and projects outside its core business.

In recent years, it has completed deals with the likes of French robotics firm Aldebaran and Chinese e-commerce giant Alibaba.

Nearly half of the money in the SoftBank Vision Fund comes from Saudi Arabia and there has been a pledge of another $45 billion this year.

That gives the Saudis at least an indirect role in some of the hottest companies in the tech sector, including Uber, Slack, WeWork and Nvidia.

SoftBank has also made high-profile investments in the autonomous vehicles sector, announcing last month a tie-up with car giant Toyota for “new mobility services” such as meal deliveries.

Earlier this year, General Motors said the Japanese firm was investing $2.25 billion in GM’s autonomous car program in exchange for a stake in the venture.

SoftBank first-half net profit jumps on strong investment returns

SoftBank first-half net profit jumps on strong investment returns

- Net profit rose to ¥840 billion from ¥103 billion during the same period last year

- The rise was largely driven by gains of ¥649 billion from the SoftBank Vision Fund

Closing Bell: Saudi main index closes in red at 11,183

RIYADH: Saudi Arabia’s Tadawul All Share Index dipped on Monday, losing 44.79 points, or 0.4 percent, to close at 11,183.85.

The total trading turnover of the benchmark index was SR4.05 billion ($1.08 billion), as 69 of the listed stocks advanced, while 191 retreated.

The MSCI Tadawul Index decreased, down 6.63 points or 0.44 percent, to close at 1,504.73.

The Kingdom’s parallel market Nomu lost 328.20 points, or 1.36 percent, to close at 23,764.92. This comes as 22 of the listed stocks advanced, while 49 retreated.

The best-performing stock was Maharah Human Resources Co., with its share price surging by 7.26 percent to SR6.50.

Other top performers included Arabian Cement Co., which saw its share price rise by 6.27 percent to SR22.71, and Saudi Research and Media Group, which saw a 4.3 percent increase to SR104.30.

On the downside, the worst performer of the day was Arabian Internet and Communications Services Co., whose share price fell by 8.01 percent to SR207.80.

Jahez International Co. for Information System Technology and Al-Rajhi Co. for Cooperative Insurance also saw declines, with their shares dropping by 5.61 percent and 4.46 percent to SR12.79 and SR75, respectively.

On the announcement front, Etihad Etisalat Co. announced its financial results for 2025 with a 7.9 percent year-on-year growth in its revenues, to reach SR19.6 billion.

In a Tadawul statement, Mobily said that this growth is attributed to “the expansion of all revenue streams, with a healthy growth in the overall subscriber base.”

Mobily delivered an 11.6 percent increase in net profit, reaching SR3.4 billion in 2025 compared to SR3.1 billion in 2024.

The company’s share price reached SR67.85, marking a 0.37 percent increase on the main market.