TOKYO: Japan’s SoftBank Group Corp. on Monday reported a 50.1 percent rise in first-quarter operating profit, after the company included the Saudi-backed Vision Fund, the world’s largest private equity fund, as a new reportable segment and booked a valuation gain.

The Internet and telecoms giant said profit for the quarter through June increased to 479.2 billion yen ($4.33 billion).

SoftBank has not released a forecast for the current business year ending in March, saying there are too many uncertain factors.

Thomson Reuters Starmine SmartEstimate puts full-year profit at 1.16 trillion yen, based on the estimates of 20 analysts.

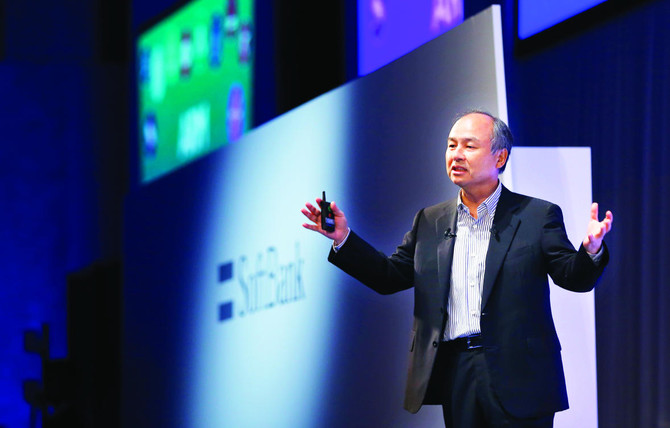

SoftBank is a prolific investor in technology startups, with founder and chief executive officer Masayoshi Son instrumental in creating the Vision Fund.

Recent investments include US online lender Kabbage, which on Thursday said it had received a $250 million investment from SoftBank.

SoftBank also has a foothold in the US market through its wireless unit Sprint Corp., which last week reported a quarterly profit for the first time in three years as a result of cost-cutting efforts.

The fourth-biggest US wireless carrier by subscribers is exploring options to boost finances and better compete, through means such as merging with T-Mobile US Inc. as well as a tie-up with cable provider Charter Communications Inc.

SoftBank also said it would be interested in parking funds in ride-hailing firms Uber Technologies or Lyft Inc. in the future.

This is the first time Softbank has publicly indicated an interest in Uber, after having so far put funds into its rival Grab in Southeast Asia and China’s Didi Chuxing.

Last month, a media report said Uber shareholders and its board were mulling a stock sale to SoftBank and other investors.

“We are interested in discussing with Uber, we are also interested in discussing with Lyft, we have not decided which way,” said Son.

“Whether we decide to partner and invest into Uber or Lyft, I don’t know what will be the end result,” he told reporters at SoftBank’s first-quarter earnings briefing on Monday.

Vision Fund, backed by investors including Saudi Arabia’s sovereign wealth fund, Apple and Foxconn, has raised more than $93 billion.

Its backers expect technology investments that will match or beat the 44 percent internal rate of return that SoftBank says Son has delivered by investing in Internet firms in the last 18 years.

Longer term “if all goes well Vision Fund should contribute several hundred billion yen in annual revenue,” Son said.

Thomson Reuters Starmine SmartEstimate puts SoftBank’s full-year profit at 1.16 trillion yen, based on estimates from 20 analysts.

SoftBank, however, has not released a forecast for the current business year ending March, citing uncertainty.

SoftBank profit jumps 50% after inclusion of Saudi-backed Vision Fund

SoftBank profit jumps 50% after inclusion of Saudi-backed Vision Fund

Saudi-US roundtable meeting held to strengthen economic relations

RIYADH: The Saudi-US Roundtable was held in Riyadh on Jan. 20, coinciding with the ninth session of the Saudi-US Trade and Investment Association, organized by the General Authority for Foreign Trade.

The meeting was attended by the Deputy Governor of International Relations at GAFT Abdulaziz Al-Sakran and the Secretary General of the Federation of Saudi Chambers Waleed Alorainan. It was also attended by the President and CEO of the Saudi-US Business Council Charles Hallab and representatives from government agencies, as well as 83 private sector companies.

The meeting reviewed ways to strengthen economic relations between Saudi Arabia and the US. It also explored opportunities for trade and investment cooperation in various sectors that play a fundamental role in developing trade ties and increasing bilateral trade volume, which reached approximately $33 billion in 2024.

Al-Sakran indicated that the roundtable meeting comes within the framework of the authority’s keenness to enhance the role of the private sector in developing trade relations by enabling it to access foreign markets and removing all external obstacles it faces, in coordination with relevant entities.

He noted that trade relations between the Kingdom and the US have witnessed significant economic activity, resulting in a trade volume exceeding $500 billion over the past decade.

It is worth noting that GAFT works to develop bilateral trade relations by overseeing business councils and coordination councils. In addition, it enables Saudi Arabia’s non-oil exports to access foreign markets and helps overcome the various challenges they face.