CUPERTINO, California: Apple aficionados in the Middle East will not have long to wait before they get their hands on what the company are calling the “most beautiful and advanced” iPhones.

As befits the hype, glitz and glamor of an Apple launch, the company revealed the details of its new smartphone models and a new smartwatch in Cupertino on Wednesday.

And technology-lovers will only have a few days to wait before they can pre-order the latest incarnations of the world’s most popular phone, with orders being taken from Sept. 14 and shipping for Saudi Arabia and the UAE starting on Sept. 21. iPhone addicts in Oman and Bahrain will have a week longer to wait, with the iPhones arriving in the two countries a week later on Sept. 28.

At the launch, Tim Cook confirmed the names of the new models — which had been leaked earlier in the day — as iPhone XS, XS Max and XR, as well as revealing release dates for global regions.

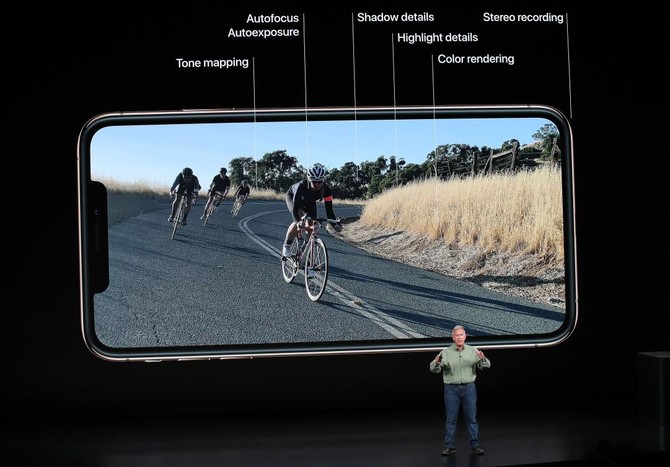

The major changes from previous models will be greater gearing toward internal upgrades rather than design changes, with all models improved with the fitting of the advanced A12 chip.

The new piece of kit is 50 percent more energy-efficient and faster than the previous processor, with apps loading 30 percent faster, too.

The A12 Bionic chip has an 8-core design — allowing it to run more advanced machine learning. At the launch, Apple called it a “breakthrough.”

The largest screen Apple has produced represents the firm’s attempt to feed consumer appetite for watching and recording videos, as well as taking photos.

The biggest news for most smartphone users was the announcement of the new phone’s dual-Sim capability, meaning users will have access to two phone numbers on the same iPhone at the same time.

But the price-tag of the top model will again have even the most ardent Apple fan wincing, with the XS Max going for an eye-watering $1,100 — $100 more than last year’s iPhone X. In the aftermath of the launch, questions were being asked about how high technology firms can push the prices of smartphones before consumers kick back.

Apple launched the iPhone X last year, and for the first time in more than a decade sales did not go as well as analysts had anticipated. But with Apple boosting the average iPhone selling price by nearly 20 percent, it still meant a bumper year for the tech firm.

By manufacturing more expensive iPhones, Apple has been able to boost profits despite falling demand due to people upgrading their phones less frequently. iPhones fetched an average price of $724 during the April-June period this year, a 20 percent increase from a year earlier. This time around, the iPhone XS will stay at the $999 mark while the iPhone XR will use cheaper materials and sell for about $750.

Apple also announced a new Apple Watch, which will move further into medical device territory. It has a larger screen and a built-in sensor that can detect irregular heart-rates and perform an electrocardiogram, as well as detect when a user has fallen.

Middle East Apple fans will not have long to wait for new iPhone models

Middle East Apple fans will not have long to wait for new iPhone models

- Apple aficionados in the Middle East will not have long to wait before they get their hands on the new iPhone

- As befits the hype, glitz and glamor of an Apple launch, the company revealed the details of its new smartphone models

The Family Office to host global investment summit in Saudi Arabia

RIYADH: The Family Office, one of the Gulf’s leading wealth management firms, will host its exclusive investment summit, “Investing Is a Sea,” from Jan. 29 to 31 on Shura Island along Saudi Arabia’s Red Sea coast.

The event comes as part of the Kingdom’s broader Vision 2030 initiative, reflecting efforts to position Saudi Arabia as a global hub for investment dialogue and strategic economic development.

The summit is designed to offer participants an immersive environment for exploring global investment trends and assessing emerging opportunities and challenges in a rapidly changing financial landscape.

Discussions will cover key themes including shifts in the global economy, the role of private markets in portfolio management, long-term investment strategies, and the transformative impact of artificial intelligence and advanced technologies on investment decision-making and risk management, according to a press release issued on Sunday.

Abdulmohsin Al-Omran, founder and CEO of The Family Office, will deliver the opening remarks, with keynote addresses from Saudi Energy Minister Prince Abdulaziz bin Salman and Prince Turki Al-Faisal, chairman of the King Faisal Center for Research and Islamic Studies.

The press release said the event reflects the firm’s commitment to institutional discipline, selective investment strategies, and long-term planning that anticipates economic cycles.

The summit will bring together prominent international and regional figures, including former UK Treasury Commercial Secretary Lord Jim O’Neill, Mohamed El-Erian, chairman of Gramercy Fund Management, Abdulrahman Al-Rashed, chairman of the editorial board at Al Arabiya, Lebanese Minister of Economy and Trade Dr. Amer Bisat, economist Nouriel Roubini of NYU Stern School of Business, Naim Yazbeck, president of Microsoft Middle East and Africa, John Pagano, CEO of Red Sea Global, Dr. Anne-Marie Imafidon, MBE, co-founder of Stemettes, SRMG CEO Jomana R. Alrashed and other leaders in finance, technology, and investment.

With offices in Bahrain, Dubai, Riyadh, and Kuwait, and through its Zurich-based sister company Petiole Asset Management AG with a presence in New York and Hong Kong, The Family Office has established a reputation for combining institutional rigor with innovative, long-term investment strategies.

The “Investing Is a Sea” summit underscores Saudi Arabia’s growing role as a global center for financial dialogue and strategic investment, reinforcing the Kingdom’s Vision 2030 objective of fostering economic diversification and sustainable development.