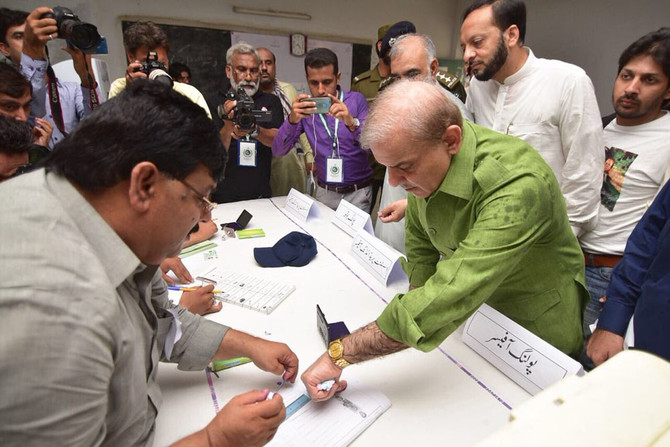

ISLAMABAD: Leaders of Pakistan’s major political parties cast their votes in their respective constituencies early on Wednesday, urging voters to do the same as a national duty. President Mamoon Hussain and former military chief Raheel Sharif also cast their votes.

Photos and captions

Main Pakistani figures vote, urge people to do the same

Main Pakistani figures vote, urge people to do the same

Peace can only prevail if Afghanistan renounces support for ‘terrorism’— Pakistan defense chief

- Pakistan’s chief of defense forces visits South Waziristan district bordering Afghanistan

- Pakistan says has killed 481 Afghan Taliban operatives since clashes began last Thursday

ISLAMABAD: Pakistan’s Chief of Defense Forces Field Marshal Syed Asim Munir said on Wednesday that peace with Afghanistan can only prevail if Kabul renounces support for “terrorism” and “terrorist” organizations, the military’s media wing said as the two countries remain locked in conflict.

Fighting between the two neighbors, the worst in decades, broke out last Thursday night after Afghan forces attacked Pakistan’s military installations along their shared border. Afghanistan said its attacks were in response to earlier airstrikes by Pakistan against alleged militant hideouts in its country.

Pakistan accuses Afghanistan of sheltering militant outfits such as the Tehreek-e-Taliban Pakistan (TTP) on its soil who have launched attacks against Pakistani civilians and security forces in recent years. Kabul denies the allegations.

Munir visited Wana town in Pakistan’s South Waziristan district to review the security situation and troops’ operational preparedness at the Afghan border, the Pakistani military’s media wing said in a statement.

“The Field Marshal reiterated that peace could only prevail between both sides if the Afghan Taliban renounced their support for terrorism and terrorist organizations,” the Inter-Services Public Relations (ISPR) said.

The military chief said the use of Afghan soil by militant outfits to launch attacks against Pakistan was unacceptable, vowing that “all necessary measures” would be taken to neutralize cross-border threats.

During the visit, Munir was briefed by military commanders about ongoing intelligence-based operations and measures being taken by the military to manage the border with Afghanistan.

He was also briefed about “Operation Ghazab Lil Haq” or “Wrath for the Truth,” the name Pakistan has given to its military operation against Afghan forces, the ISPR said.

The Pakistani military chief spoke to troops deployed in the area, praising their vigilance, professional conduct and high morale, the ISPR said.

Pakistan’s Information Minister Attaullah Tarar said on Wednesday that the military has killed 481 Taliban operatives, injured more than 690 and destroyed 226 Afghan checkposts since clashes began.

Arab News has been unable to verify claims by both sides about the damages they claim to have inflicted on each other.

Afghanistan has signaled it is open for dialogue but Pakistan rejected the offer, saying it would continue its military operations till its objectives were achieved.

Since the conflict began, diplomatic efforts have intensified with several countries, including global bodies such as the European Union and United Nations, urging restraint and calling for talks.

Turkish President Recep Tayyip Erdogan told Pakistani Prime Minister Shehbaz Sharif that Ankara would help reinstate a ceasefire, the Turkish Presidency said on Tuesday, as other countries that had offered to mediate have since been hit by the conflict in the Gulf.