WASHINGTON: The Trump administration announced Thursday it will impose tariffs on steel and aluminum imports from Europe, Mexico and Canada after failing to win concessions from the American allies. Europe and Mexico pledged to retaliate quickly, exacerbating trans-Atlantic and North American trade tensions.

Commerce Secretary Wilbur Ross said the tariffs would be 25 percent on steel and 10 percent on aluminum, and go into effect on Friday, as the administration followed through on the penalties after earlier granting exemptions to buy time for negotiations. President Donald Trump had announced the tariffs in March, citing national security concerns.

The European Commission’s president, Jean-Claude Juncker, said Trump’s decision amounted to trade protectionism and that Europe would respond with countermeasures. “This is protectionism, pure and simple,” Juncker said. Mexico said it would penalize US imports including pork bellies, apples, grapes, cheeses and flat steel.

The tariffs directed at some of the US’s most ardent allies represented the latest move in Trump’s “America First” agenda that has roiled financial markets and raised the specter of a trade war involving the US, China and some of the globe’s most dominant economies.

The trade actions have opened the US to criticism that it’s burning bridges at a time when Trump is seeking to rid North Korea of nuclear weapons and help stabilize the Middle East.

“We are alienating all of our friends and partners at a time when we could really use their support,” said Wendy Cutler, a former US trade negotiator who is now vice president at the Asia Society Policy Institute.

Ross told reporters that talks with Canada and Mexico over revising the North American Free Trade Agreement were “taking longer than we had hoped.” Talks with Europe had “made some progress” but not enough for additional exemptions, he said in a conference call from Paris.

“We continue to be quite willing and indeed eager to have further discussions,” Ross said. He said he planned to travel to China on Friday for trade talks between the world’s two biggest economies.

European officials had braced for the tariffs and the EU has threatened to retaliate against US orange juice, peanut butter and other goods in return. In terms of the NAFTA talks, the tariffs could hinder the negotiations among the North American neighbors.

On NAFTA, Ross said there was “no longer a very precise date when they may be concluded and therefore (Canada and Mexico) were added into the list of those who will bear tariffs.”

Brazil, Argentina and Australia have agreed to limit steel shipments to the US in exchange for being spared the tariffs, the Commerce Department said. Tariffs will remain on imports from Japan.

Fears of a global trade war are already weighing on investor confidence and could hinder the global economic upturn. European officials argue that tit-for-tat tariffs will hurt growth on both sides of the Atlantic and Canada said before the announcement that it would respond in kind.

“Canada considers it frankly absurd that we would in any way be considered to be a national security threat to the United States,” Canadian Foreign Minister Chrystia Freeland said before the tariffs were announced. “The government is absolutely prepared to and will defend Canadian industries and Canadian jobs. We will respond appropriately.”

German Chancellor Angela Merkel stressed her opposition even before the US announcement, saying the looming tariffs were incompatible with World Trade Organization (WTO) rules. She said if there were no exemptions, “We will respond in an intelligent, decisive and joint way.”

German Foreign Minister Heiko Maas slammed US import duties, pledging a united European front against protectionist measures.

“Our answer to ‘America First’ can only be ‘Europe united’,” he said in a statement.

“Trade wars don’t have any winners.”

France’s finance minister, Bruno Le Maire, called the US tariffs “unjustified, unjustifiable and dangerous.”

“This will only lead to the victory of those who want less growth, those who don’t think we can develop our economies across the world. We think on the contrary that global trade must have rules in a context of multilateralism. We are ready to rebuild this multilateralism with our American friends,” he said.

The EU trade commissioner, Cecilia Malmstrom, said the EU “did everything to avoid this outcome.” Noting her discussions with US officials, she said.

She said the EU will launch a case at the WTO against the US move.

“The US has sought to use the threat of trade restrictions as leverage to obtain concessions from the EU. This is not the way we do business, and certainly not between longstanding partners, friends and allies,” she said.

“Now that we have clarity, the EU’s response will be proportionate and in accordance with WTO rules. We will now trigger a dispute settlement case at the WTO, since these US measures clearly go against agreed international rules.

“We will also impose rebalancing measures and take any necessary steps to protect the EU market from trade diversion caused by these US restrictions.”

“I have argued for the EU and the US to engage in a positive trans-Atlantic trade agenda, and for the EU to be fully, permanently and unconditionally exempted from these tariffs.”

Tariffs on steel and aluminum imports to the US can help local producers of the metals by making foreign products more expensive. But they can increase costs more broadly for US manufacturers that cannot source all their needs locally and have to import the materials. That hurts the companies and can lead to more expensive consumer prices, economists say.

“Unilateral responses and threats over trade war will solve nothing of the serious imbalances in world trade. Nothing,” French President Emmanuel Macron said Wednesday.

In a clear reference to Trump, Macron added: “These solutions might bring symbolic satisfaction in the short term. ... One can think about making voters happy by saying, ‘I have a victory, I’ll change the rules, you’ll see.’“

But Macron said those “who waged bilateral trade wars ... saw an increase in prices and an increase in unemployment.”

Britain said also it was deeply disappointed by the US decision.

“We are deeply disappointed that the US has decided to apply tariffs to steel and aluminum imports from the EU on national security grounds,” a government spokesman said.

“The UK and other European Union countries are close allies of the US and should be permanently and fully exempted from the American measures on steel and aluminum.”

Besides the US steel and aluminum tariffs, the US is also investigating possible limits on foreign cars in the name of national security.

Ross criticized the EU for its tough negotiating position. But German Economy Minister Peter Altmaier insisted the Europeans were ready to negotiate special trade arrangements, notably for liquefied natural gas and industrial goods, including cars.

World stocks jittered Thursday as fears returned of a global trade war sparked by US tariffs, just after global equities had started to recover from concerns over a fresh eurozone crisis.

The US market opened in the red just before Ross announced steep tariffs steel and aluminum imports from the European Union, Canada and Mexico.

For weeks the markets had been on a roller coaster ride after Trump announced the tariffs in March.

Since then, world leaders have made repeated appeals to safeguard the international trade system.

European stocks were also down in afternoon trading, even though they had appeared to be on the path to recovery in earlier action, with investor fears fading after the worst of the political storm in Italy.

The euro climbed as inflation in the eurozone leaped to the ECB’s target in May, fueled by a huge increase in oil prices as the US decided to pull out of a nuclear deal with Iran.

Asian equities earlier Thursday bounced back from the previous day’s mauling as fears of turmoil in Italy were soothed by conciliatory noises from the country’s two biggest populist parties.

“Fears over an Italian snap election have receded,” noted Joshua Mahony, market analyst at IG traders.

The news had provided relief to global markets beginning Wednesday after they were sent spinning by the crisis in Italy — the eurozone’s third biggest economy — which many feared could lead to fresh elections that could essentially become a referendum on euro membership.

Oil prices were down but holding up after they also rallied Wednesday in response to a report that said OPEC would likely lift output gradually, soothing concerns about a new supply glut.

Crude markets have been hammered since OPEC kingpin Saudi Arabia and Russia last week indicated they could lift a cap on production, which has supported prices for two years, as an oversupply crisis eases.

Investors are looking forward to the release Friday of key US jobs figures, which could provide some idea about the Federal Reserve’s plans for raising interest rates.

Payrolls firm ADP estimated US private sector job growth at 178,000 in May, down from 204,000 in April and slightly below analysts’ expectations.

However, while sentiment is positive, analysts warned that ongoing geopolitical issues and the unresolved China-US trade row continue to dog trading floors.

“We are going to be filled with tremendous uncertainty over the course of the summer,” David Ader, chief macro strategist at Informa Financial Intelligence, told Bloomberg Television.

“If you look at things like the various economic surprise indices out there they have been slowing down, but on the other hand you still have a Fed hike coming in June. I see a lot of uncertainty, which results in a lot of volatility.”

US impose new trade tariffs; EU, Mexico pledge to retaliate

US impose new trade tariffs; EU, Mexico pledge to retaliate

- The US says it will impose stiff tariffs on steel and aluminum imports from the EU, Canada, Mexico,

- World stocks jitter as fears returned of a global trade war sparked by US tariffs

World food prices up in April for second month: UN agency

PARIS: The UN food agency’s world price index rose for a second consecutive month in April as higher meat prices and small increases in vegetable oils and cereals outweighed declines in sugar and dairy products.

The Food and Agriculture Organization’s price index, which tracks the most globally traded food commodities, averaged 119.1 points in April, up from a revised 118.8 points for March, the agency said on Friday.

The FAO’s April reading was nonetheless 7.4 percent below the level a year earlier.

The indicator hit a three-year low in February as food prices continued to move back from a record peak in March 2022 at the start of Russia’s invasion of Ukraine.

In April, meat showed the strongest gain in prices, rising 1.6 percent from the prior month.

The FAO’s cereal index inched up to end a three-month decline, supported by stronger export prices for maize. Vegetable oil prices also ticked higher, extending previous gains to reach a 13-month high due to strength in sunflower and rapeseed oil.

The sugar index dropped sharply, shedding 4.4 percent from March to stand 14.7 percent below its year-earlier level amid improving global supply prospects.

Dairy prices edged down, ending a run of six consecutive monthly gains.

In separate cereal supply and demand data, the FAO nudged up its estimate of world cereal production in 2023/24 to 2.846 billion metric tonnes from 2.841 billion projected last month, up 1.2 percent from the previous year, notably due to updated figures for Myanmar and Pakistan.

For upcoming crops, the agency lowered its forecast for 2024 global wheat output to 791 million tonnes from 796 million last month, reflecting a larger drop in wheat planting in the EU than previously expected.

The revised 2024 wheat output outlook was nonetheless about 0.5 percent above the previous year’s level.

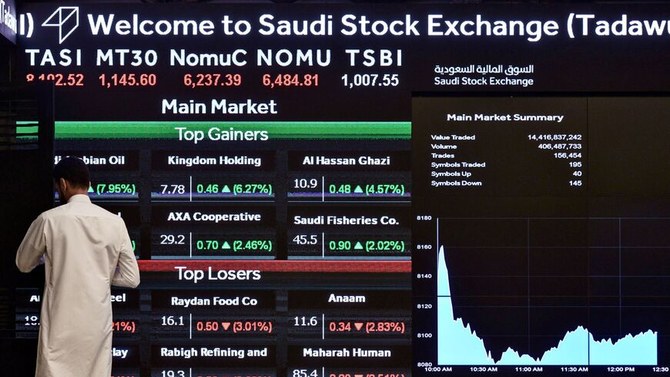

Material sector dominates TASI trading in first quarter of 2024

RIYADH: The materials sector led trading on Saudi Arabia’s Tadawul All Share Index, accounting for approximately SR87 billion ($23.2 billion) or 15.11 percent of the market, according to TASI’s 2024 first-quarter report.

SABIC, the largest component of this sector, boasted a market capitalization of SR234.9 billion, with trading value reaching nearly SR7 billion.

The banking sector trailed with transactions valued at SR71.22 billion, comprising 12.37 percent of the market. Al-Rajhi Bank took the lead in market capitalization within the sector and secured the second spot in trade value totaling SR23.62 billion.

In a February report by Bloomberg, Al-Rajhi Bank, seen as an indicator of Saudi Arabia’s growth strategies, exceeded the performance of JPMorgan Chase & Co., exhibiting nearly a 270 percent surge in shares since the initiation of Vision 2030. It has outpaced both local and global competitors, including state-supported banks, emerging as the largest bank in the Middle East and Africa, boasting a market cap of around $95 billion.

According to Morgan Stanley analysts led by Nida Iqbal, as reported by Bloomberg, “We see it as a long-term winner in the Saudi bank sector… While Al-Rajhi is best placed for a rate-cutting cycle, we believe current valuation levels reflect this.”

Gulf central banks, including Saudi Arabia’s, frequently align their policies with those of the Federal Reserve to maintain their currency pegs to the dollar. According to Bloomberg Intelligence senior analyst Edmond Christou, a reduction in Fed rates could potentially bolster Al-Rajhi Bank’s profitability and expansion, as it will encourage gathering cheap deposits while enabling it to issue debt at more attractive levels.

In this period, the energy sector secured the third position in terms of value traded, reaching SR55.4 billion. Saudi Aramco topped the list with a market capitalization of SR7.47 trillion and registered the highest value among companies traded on the index, totaling SR28.82 billion.

In March of this year, Aramco announced a net income of $121.3 billion for its full-year 2023 financial results, marking the second-highest in its history. Aramco credited these results to its operational flexibility, reliability, and cost-effective production base, underscoring its dedication to delivering value to shareholders.

Tadawul’s quarterly report also indicated that the transportation sector recorded the fourth-highest value traded at SR39.25 billion, equivalent to 6.82 percent of the market. Among the top performers in this sector was cargo firm SAL Saudi Logistics Services, ranking third in value traded on the TASI during this period, following Aramco and Al-Rajhi Bank, with a total value of SR22.74 billion.

SAL debuted on the main market of the Saudi Exchange in November last year. With aspirations to manage 4.5 million tonnes of air cargo by 2030, Saudi Arabia is empowering its logistics sector from a supportive role to a pivotal driver of economic growth.

SAL, in which the Saudi government holds a 49 percent stake through the Saudi Arabian Airlines Corp., experienced a 30 percent surge in its share price during its initial public offering, raising $678 million and becoming Saudi Arabia’s second-largest IPO of the year.

In a January report by Forbes, SAL’s CEO and Managing Director Faisal Al-Beddah emphasized the company’s potential to shape the future of logistics in Saudi Arabia and beyond. He stated: “Logistics is the backbone of any economy. Now we are ready. We have the rotation, we have the infrastructure, we have the regulations, and most importantly, we have the mindset and the technology for Saudi Arabia to be the leading connecting logistics hub in the region.”

The top gainer during this period in terms of price appreciation was MBC Group, with a quarter-to-date percentage change of 127.6 percent, according to Tadawul.

Saudi Arabia’s MBC Group, a media conglomerate, debuted as the first new listing on TASI in 2024. Its trading began on Jan. 8. The company raised SR831 million through its initial public offering.

Saudi Steel Pipes Co. in the materials sector was the second highest gainer, with price appreciating by 88.15 percent.

Etihad Atheeb Telecommunication Co. had a QTD price percentage change of 81.91 percent making it the third-highest gainer on the exchange during this period.

TASI concluded the first quarter of 2024 with a 3.6 percent increase, climbing by 435 points to reach 12,402 points.

Saudi startups raised $3.3bn in last 10 years, says report

- MAGNiTT report shows fintech emerged as the most funded sector in Kingdom

RIYADH: Startups in Saudi Arabia saw massive growth during the last decade raking in $3.3 billion in venture capital funding, according to a report issued by MAGNiTT.

The data platform, in its “10 Years Saudi Arabia Founders Report” sponsored by Saudi Venture Capital Co., provides an in-depth analysis of the backgrounds, experiences, and expertise of founders.

“MAGNiTT initially published a report on founders in the MENA VC ecosystem in 2018, focusing on uncovering the DNA of successful entrepreneurs in the region. Today, in partnership with the Saudi Venture Capital Co., we present a comprehensive report on the founders of the top 200 funded startups in the Kingdom over the last ten years,” said Philip Bahoshy, CEO and founder of the platform.

“By shedding light on founders’ experiences in the Saudi ecosystem, we aim to dispel myths around founders, empower aspiring entrepreneurs looking to establish their ventures in the Kingdom, guide government decision-makers in shaping policies conducive to innovation, and provide invaluable intelligence to investors seeking opportunities in the region,” he added.

SVC CEO Nabeel Koshak emphasized the remarkable growth and dynamism in the Saudi startup landscape.

FASTFACTS

Forty-four percent of these startups were launched by teams with two founding members, who together secured 53 percent of the total funds.

Startups founded by a single individual accounted for 30 percent of the funded startups but only captured 15 percent of the funding in the last decade.

Thirty-six percent of the 400 founders analyzed had at least 10 years of work experience before launching their respective startups.

Fifty-nine percent of founders had technical education backgrounds, highlighting science, technology, engineering, and mathematics.

Thirty-nine percent of founders held degrees in business, contrasting with the global average of 19 percent, according to an Endeavor Insight study.

“The Kingdom’s strategic initiatives, driven by the Saudi Vision 2030, have laid a solid foundation for innovation, entrepreneurship, and investment. As a result, we have seen a surge in startup activity, with a growing number of ambitious founders seizing opportunities and driving innovation across various sectors,” he said.

“The goal of the report is to provide policymakers, government officials, and investors with insights and data to inform strategic decisions and policies to further nurture the startup ecosystem for the next 10 years,” Koshak added.

A decade of funding

Compiling data from the 200 Saudi-based startups, which collectively raised a total of $3.3 billion from 2014 to 2023, the report highlighted that 44 percent of these startups were launched by teams with two founding members, who together secured 53 percent of the total funds.

He further stated that with the significant support for innovation, the Kingdom is set to witness the emergence of more unicorns.

In contrast, startups founded by a single individual accounted for 30 percent of the funded startups but only captured 15 percent of the funding in the last decade.

Notably, 36 percent of the 400 founders analyzed had at least 10 years of work experience before launching their respective startups.

The report also indicated a trend toward entrepreneurship among less experienced founders, with 66 percent being first-time startup founders and only 30 percent with previous regional startup experience.

It revealed a significant gender disparity in the VC landscape within Saudi Arabia, with male founders comprising 94 percent of the total 400 individuals, while female founders accounted for only 6 percent.

This gender gap is considerably wider than the global norms, where, according to research by Startup Genome conducted between 2016 and 2022, the average proportion of female founders in an ecosystem was 15 percent.

Additionally, only 7 percent of solo founders were female, and there were no recorded startups with two or more female founders only.

However, as the number of founders per startup increased, so did gender diversity, albeit slightly. In startups with three founders, 18 percent were of mixed gender, while in startups with four or more founders, the figure was 12 percent.

Furthermore, 91 percent of male-only founded startups claimed 98 percent of total funding. Conversely, 3 percent of female-only founded startups accounted for 0.4 percent of the total funding.

Founders' education

The report further delved into the education qualification of founders revealing that 55 percent in the Kingdom had attained at least a bachelor’s degree.

In terms of technical development, 59 percent of founders had technical education backgrounds, highlighting science, technology, engineering, and mathematics.

Thirty-nine percent of founders held degrees in business, contrasting with the global average of 19 percent, according to an Endeavor Insight study.

Over half of the 400 founders obtained their degrees internationally, while 22 percent held both international and local degrees.

King Saud University, King Fahd University of Petroleum and Minerals, and King AbdulAziz University were among the most common institutions for startup founders.

Seven of the top 10 universities of Saudi founders that raised funding were public institutions.

The top international schools of Saudi founders had Stanford and Harvard among the top choices, mirroring global trends.

Professional experience

Despite fintech being the most funded sector, only 7 percent of founders had experience in finance, and 18 percent in banking, which is lower compared to the 48 percent with backgrounds in information technology.

Additionally, even fewer founders, only 12 percent, had experience in e-commerce, despite this industry accounting for the highest share of deals, 20 percent, closed by the top 200 Saudi startups.

The report also revealed that 36 percent of the founders in Saudi Arabia are skilled professionals with over 10 years of experience before starting their businesses.

Notably, Saudi Aramco was the most common previous employer among the funded founders, with 7 percent having worked there before launching their startups.

Furthermore, McKinsey and Microsoft were among the top 10 companies where the 400 founders covered in this report had previously been employed.

The majority of these founders held significant leadership roles, with 31 percent having served as a founder, co-founder, or board member. Only 4 percent originated from entry-level positions.

The report also pointed out: “While Saudi Arabia has witnessed several serial entrepreneurs, 66 percent of founders in the last decade were first-time founders,” indicating a vibrant and growing entrepreneurial ecosystem.

Oil prices set for steepest weekly drop in 3 months

NEW YORK: Oil prices edged up on Friday on the prospect of OPEC+ continuing output cuts, but the crude benchmarks were headed for the steepest weekly losses in three months on demand uncertainty and easing tensions in the Middle East reducing supply risks.

Brent crude futures for July rose 14 cents to $83.82 a barrel by 0646 GMT. US West Texas Intermediate crude for June was up 16 cents, or 0.2 percent, to $79.11 per barrel.

Still, both benchmarks were on track for weekly losses as investors worried about the prospect of higher-for-longer interest rates curbing growth in the US, the top global oil consumer, and in other parts of the world.

“With the US driving season almost upon us, high inflation may see consumers opt for shorter drives over the holiday period,” analysts at ANZ Research said in a note on Friday.

The market is now looking towards US economic data and indicators of future crude supply from the world’s top producer.

The US Federal Reserve held interest rates steady this week, and flagged recent disappointingly high inflation readings that could make rate cuts take awhile in coming.

Geopolitical risk premiums due to the Israel-Hamas war, which had kept prices high due to global supply risks, are also fading, with Israel and Hamas considering a temporary ceasefire and holding talks with international mediators.

Brent headed for a 6.3 percent weekly decline, while WTI moved toward a loss of 5.6 percent on the week.

The drop comes just weeks ahead of the next meeting of the Organization of the Petroleum Exporting Countries and allies led by Russia, together called OPEC+.

Three sources from OPEC+ producers said the group could extend its voluntary oil output cuts of 2.2 million barrels per day beyond June if oil demand fails to pick up, but the group has yet to begin formal talks ahead of the June 1 meeting.

Saudi authorities plan to boost assets under management to 29.4% of GDP in 2024

- Capital Market Authority plans to accelerate the pace of listings by welcoming 24 new companies

RIYADH: Saudi Arabia aims to enhance its stock exchange appeal to foreign investors, targeting 17 percent ownership of free float shares by 2024, a new report has revealed.

According to the 2023 Financial Sector Development Program document, the Saudi Capital Market Authority plans to boost assets under management to 29.4 percent of gross domestic product in 2024 by increasing the investment environment and attracting more investors.

The report, published annually, highlights the achievements in the financial sector, particularly the Kingdom’s ongoing progress in competitiveness indicators related to the capital market, as stated by Mohammed Al-Jadaan, minister of finance and chairman of the FSDP.

Commenting on the development of the financial sector, Al-Jadaan emphasized the importance of innovation and investment in talent and technology.

“We have placed innovation and investment in both talent and technology at the top of our priorities, because we recognize the importance of building a dynamic financial environment that allows companies — especially startups — to flourish and succeed,” the minister stated.

In line with its commitment to facilitating financing in the capital market, the CMA also plans to accelerate the pace of listings by welcoming 24 new companies in 2024.

Moreover, there will be a focus on supporting the development of new and promising sectors, with a target of having micro and small enterprises account for 45 percent of total listings.

Another area of emphasis is the deepening of the sukuk and debt instruments market, with the goal of increasing the debt-to-GDP ratio to 22.1 percent by the end of 2024. These measures aim to provide diverse financing options for companies and further stimulate economic growth.

“The capital market ecosystem continued its efforts to contribute to developing the financial sector and achieving the Saudi Vision 2030,” stated Mohammed El-Kuwaiz, chairman of the CMA.

“By approving rules for foreign investment in securities and streamlining regulatory procedures, we have witnessed a significant increase in foreign investments in the capital market, reaching SR401 billion ($106.9 billion),” El-Kuwaiz added.

The Saudi Central Bank also reaffirmed its commitment to adhering to international standards and best practices to enhance the strength and stability of the financial sector.

Initiatives such as developing digital solutions for supervising the financial sector and enabling local and international FinTechs demonstrate the Kingdom’s dedication to embracing technological advancements.

Furthermore, the Financial Academy unveiled its new strategy for 2024-2026, focusing on enhancing human capabilities in the financial sector through training programs and professional certifications.

The academy aims to increase the number of trainees and improve the quality of its services to meet the evolving needs of the industry.

The 2023 FSDP report highlighted significant progress across sectors like fintech and digital banking.

The Kingdom saw a surge in fintech companies, surpassing 2023 targets with 216 in operation and launching two digital banks.

Saudi Arabia claimed the top spot in the Corporate Boards Index among G20 nations and secured second place in various indices. Foreign companies relocated headquarters to the Kingdom, deepening the capital market.

Moody’s, Fitch, and S&P Global Ratings revised Saudi Arabia’s outlook to “Positive” and affirmed its “A1” and “A+” credit ratings, citing fiscal policy development, economic reforms, and structural improvements.

Saudi Arabia led venture investments in the Middle East & North Africa, securing 52 percent of total investments in 2023, and allocated SR10 billion to support small and medium enterprises across economic activities and regions in the first half of the year.