CAIRO: Egypt is looking to offer shares in eight to 10 state companies on the stock exchange over the next 18 months, Finance Minister Amr El-Garhy told Reuters on Sunday, as part of a drive to attract foreign investors.

The flotations will be the first batch in a program to float stakes in dozens of state-owned companies over the next three to five years in areas including oil, services, chemicals, shipping and real estate.

“The companies will include companies listed on the exchange and those not listed,” Garhy told Reuters by phone, referring to the first batch.

He did not specify the sectors or sizes of the companies under consideration.

The government said previously that it expected the first share offering would be in oil company ENPPI, in the first quarter of 2018.

Egypt’s stock market has taken off since the country floated its pound currency in November 2016, with the Egyptian blue-chip index gaining about 80 percent since then.

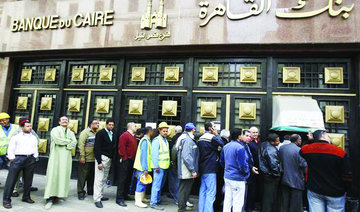

The government has said previously it plans to offer 20 percent of state-owned Banque du Caire as well as a 40 percent stake in the Arab African International Bank (AAIB), in which the central bank owns a stake.

The state owns vast swathes of Egypt’s economy, including three of its largest banks — National Bank of Egypt, Banque Du Caire, the United Bank of Egypt — along with much of its oil industry and real estate sector.

The last time state-owned companies were listed on the exchange was in 2005 when shares of Telecom Egypt, the state’s landline monopoly, and oil companies Sidi Kerir Petrochemicals and AMOC were floated.