ISLAMABAD: Pakistan will allow the Chinese yuan to be used for imports, exports and financing transactions for bilateral trade and investment activities, in a move economists said Wednesday would simplify a massive Chinese investment project.

Both public and private sector enterprises may use the yuan for bilateral trade and investment, the central State Bank of Pakistan said in a statement issued Tuesday.

“As per current foreign exchange regulations, Chinese Yuan (CNY) is an approved foreign currency for denominating foreign currency transactions in Pakistan,” it said.

“In terms of regulations in Pakistan, CNY is at par with other international currencies such as USD, Euro and JPY,” it added.

The bank said that in light of a massive Chinese infrastructure project in Pakistan, the move would “yield long-term benefits for both the countries.”

The China-Pakistan Economic Corridor (CPEC), a $54 billion (SR202.50 billion) project launched in 2013 linking western China to the Indian Ocean via Pakistan, has been hailed as a “game changer” by Pakistani officials.

They hope the power stations and transmission lines built as part of the project will help ease Pakistan’s chronic power crisis.

Economic analyst and former government adviser on finance Salman Shah welcomed the State Bank’s move, saying that avoiding dollar transactions in the implementation of CPEC would “simplify matters very considerably.”

The Chinese economy is now one of the biggest in the world, he said, justifying the use of the Chinese currency of choice.

Pakistan allows use of Chinese yuan for trade and investment

Pakistan allows use of Chinese yuan for trade and investment

3.51 billion phone app downloads in Pakistan in 2023 amid spending surge — report

- After two years of being fastest growing major market, new app downloads from Pakistan tapered off in 2023

- Decline was in line with global slowdown that included many peer countries such as Egypt, Indonesia, Vietnam

KARACHI: Mobile app downloads in Pakistan declined to 3.51 billion in 2023 from 3.52 billion downloads last year while consumer spending rose to over $87 million from $82 million, according to a report released on Thursday.

Globally, the mobile app industry witnessed some recalibration where growth in new installs moderated 0.8 percent to reach 257 billion while consumer spending edged up 2.4 percent to $171 billion, according to a report by Data Darbar, a data and market intelligence platform, and Emirati streaming platform Begin.

“After two years of being the fastest growing major market, new app downloads from Pakistan tapered off slightly in 2023,” Natasha Uderani, co-founder of Data Darbar, said in a statement issued on Thursday.

The decline was in line with the global slowdown where many peer countries, such as Egypt, Indonesia and Vietnam, experienced similar trends, Uderani said.

Just over a third of all Pakistani downloads during 2023 were games while the share of apps stood at 64 percent. This aligned with the global trend where 34 percent of the installs were for apps and the remaining 66 percent for games.

However, with continuous decline in the cost of broadband, Pakistanis were now consuming more mobile data than ever, which meant that apps would take center stage for the country’s digitalization wave and the growth in downloads will reaccelerate in the coming years.

Meta and ByteDance dominated the most downloaded apps chart, with Tiktok comfortably taking the lead at almost 32 million installs during 2023 while WhatsApp Business followed behind, the data showed.

This was in line with the global trend where the two big tech giants remained the top publishers. Among games, the offline habits replicated in the online realm as three of the five most downloaded games in Pakistan were Ludo apps.

Among categories where publishers performed well, entertainment and finance stood out with downloads of 172 million and 144 million, respectively. The former featured Jazz-owned Tamasha in the top spot while Telenor’s Easypaisa led in the latter.

“The rise of streaming and finance apps in Pakistan underscores the underlying shift toward mobile for the delivery of not only entertainment but also banking services,” said Jonathan Mark, chief commercial officer of Begin, a UAE-headquartered streaming service launching in the GCC region and South Asia.

“As consumers become more tech-savvy and their demand for digital services increases, we expect to see further growth and innovation in these and other app categories.”

Pakistanis spent about 99 billion hours using mobile apps where 7.5GB average data was consumed by the users per month. This translates into a jump of 13.8 percent compared to 87 billion hours in 2022, meaning Pakistanis spent an additional 12 billion hours on their mobiles during the year, the report added.

The South Asian nation, in line with the global trends, also experienced a continuous decline in the average cost of one gigabyte (GB) of data. Compared to the FY18 levels, cost has plunged by 71.4 percent to Rs32.8. However, over the last two years, the rate of decline has moderated noticeably and is now in just single digits.

The total cellular subscriptions in Pakistan fell annually to close FY23 at 190.9 million, down 1.9 percent from 194.6 million, first instance of decline in at least six years, and possibly on record.

Both Jazz and Telenor, the two largest telecoms, contributed to the downward trend with their subscriptions falling by 4.1 million and 3.1 million, respectively, according to the report.

On the supply side, the total apps published by Pakistani developers continued its downward slide and hit just over 4,800 in 2023, down 11.4 percent. This was almost singularly driven by Google Play, where the count of Android apps fell by 600. Consequently, the share of iOS in the aggregate edged up to 22.3 percent.

Chasing 5th straight win, Nelly Korda is 2 shots back at Chevron Championship after a first-round 68

Chasing 5th straight win, Nelly Korda is 2 shots back at Chevron Championship after a first-round 68

- She could join Nancy Lopez (1978) and Annika Sorenstam (2004-05) as the only players to win five consecutive LPGA events

- Defending champion and world No. 2 Lilia Vu withdrew because of a back injury

THE WOODLANDS, Texas: Nelly Korda, who is looking to tie an LPGA Tour record with her fifth straight win, shot a 4-under 68 on Thursday in the opening round of the Chevron Championship, leaving her two shots behind leader Lauren Coughlin in the year’s first major.

Coughlin shot a bogey-free 66 in windy conditions at Carlton Woods, which is hosting the event for the second time.

The top-ranked Korda is seeking her second major after winning the Women’s PGA Championship in 2021. She could join Nancy Lopez (1978) and Annika Sorenstam (2004-05) as the only players to win five consecutive LPGA events.

Korda said she was battling fatigue from recent tournaments at the beginning of her round. She bogeyed her first hole, the par-4 10th.

“I (could) definitely still feel maybe a little bit of tiredness, so it took me a while to get going,” she said. “I felt the nerves definitely at the start of the round. Once I made the turn, I was just playing free golf.”

She made her first birdie on the par-4 14th hole, something she half-jokingly credited to a snack.

“I actually had an apple on 13, and that gave me actually a nice boost,” she said. “I felt a lot better after that. Maybe I should have apples more often.”

The 25-year-old finished with six birdies, including four in the final six holes.

“Two of them were par 5s, so I got to take advantage of that with my length,” she said. “Hit a really good tee shot, and then I was just on the front of the green on 17, and the other one I was just on the fringe, too. I two-putted pretty much for birdie on those. Then I had wedge shots in on the other two, too. Taking advantage of my length and hitting good tee shots.”

Marina Alex and Japan’s Minami Katsu also shot 68. Lydia Ko was one of five players at 69.

The 31-year-old Coughlin, who played in college at Virginia and has never won on the LPGA Tour, made three birdies in a four-hole span from Nos. 2-5. She believes her game has benefited from her recent decision to make husband John Pond her full-time caddie.

“He’s really good at talking through everything when I want to get really fast and make a decision really quickly,” Coughlin said. “He is really good at putting all the work in, all the extra work, all the extra walking ... making sure the strategy is really good and double checking everything. But ... he’s always been really good with how he talks to me and communicates what he thinks I need to do and how I need to do it.”

Defending champion and world No. 2 Lilia Vu withdrew because of a back injury. She issued a statement on Instagram saying she had “severe discomfort” in her back during warmups.

“I have been dealing with a back injury for a while now,” Vu said in the statement. “Some days are better than others, and today was unfortunately not a good day. During my normal warmup routine, I had severe discomfort in my back and I felt that I could not compete up to my standards and made the decision to withdraw from the tournament ahead of my tee time.”

She added that she was returning home to see her doctors and determine the next steps.

Later in the day, last year’s runner-up Angel Yin withdrew because of an injury after shooting 78.

A win by Ko would put her in the LPGA Hall of Fame. She won the Hilton Grand Vacations Tournament of Champions in January for her 20th LPGA title.

The 26-year-old New Zealander admitted that she still gets nervous before tournaments despite all her experience and success.

“It doesn’t matter what event we’re playing or what circumstances, when you’re younger you want to get away from the nerves,” Ko said. “To some extent as long as you can control it the nerves are good for you and you’re able to excel and get the adrenaline to hit some shots that you may not be able to execute when you’re just practicing.”

Defending champion Swiatek sails into Stuttgart quarterfinals

- The top seed will face former US Open champion Emma Raducanu for a place in the semifinals

- Ukraine’s Marta Kostyuk saved five match points at 5-4 in the final set to defeat fifth seed Zheng Qinwen of China, 6-2, 4-6, 7-5

BERLIN: World No. 1 and defending champion Iga Swiatek progressed to the quarterfinals of the WTA Stuttgart clay court tournament by beating Elize Mertens in straight sets on Thursday, her ninth win in nine career matches at the French Open warm-up event.

Swiatek beat the unseeded Belgian 6-3, 6-4 to maintain her bid to capture a third successive title in the German city and be handed the keys to a third luxury car from the sponsors after also winning the tournament in 2022.

“There’s always space for a Porsche. If not, we’ll make it. I’ll build an underground garage,” said Swiatek after playing her first clay-court match since lifting the French Open title last June.

The Pole burst out of the blocks to set up a 5-1 lead in the first set, before going 0-30 down but recovering to serve out the set.

Swiatek was broken early in the second but served her way back into the set, winning with a forehand on her fourth match point after Mertens had saved the previous three.

“This is not an easy tournament. Everyone is really motivated to win that car,” Swiatek added.

The top seed will face former US Open champion Emma Raducanu for a place in the semifinals.

Raducanu, who helped Britain qualify for the Billie Jean King Cup finals last weekend, took down Czech teenager Linda Noskova 6-0, 7-5.

It will be a first quarterfinal appearance for Raducanu in 19 months. She has been plagued by a raft of injuries since her 2021 Grand Slam breakthrough and missed much of last season.

Ukraine’s Marta Kostyuk saved five match points at 5-4 in the final set to defeat fifth seed Zheng Qinwen of China, 6-2, 4-6, 7-5.

World No. 27 Kostyuk will face US Open champion Coco Gauff on Friday for a place in the semifinals.

Elena Rybakina beat Veronika Kudermetova 7-6 (7/3), 1-6, 6-4, continuing her strong form in 2024.

The Kazakh world No. 4, who has already claimed titles at Brisbane and Abu Dhabi this year, beat the Russian in two hours 33 minutes.

“I know I have my weapon, my serve. I know I can always serve it out in tough moments. Not always, but this is a strength,” Rybakina said.

Rybakina will be playing in her seventh quarterfinal of the season on Friday where she will face Jasmine Paolini who put out Ons Jabeur 7-6 (10/8), 6-4.

Wimbledon champion Marketa Vondrousova defeated Anastasia Potapova 7-6 (7/5), 6-1 in her last 16 clash.

Israeli missiles hit site in Iran in apparent retaliatory attack

DUBAI/WASHINGTON: Israeli missiles have hit a site in Iran, ABC News reported late on Thursday, citing a US official, while Iranian state media reported an explosion in the center of the country, days after Iran launched a retaliatory drone strike on Israel.

Commercial flights began diverting their routes early Friday morning over western Iran without explanation as one semiofficial news agency in the Islamic Republic claimed there had been “explosions” heard over the city of Isfahan.

Some Emirates and Flydubai flights that were flying over Iran early on Friday made sudden sharp turns away from the airspace, according to flight paths shown on tracking website Flightradar24.

“Flights over Isfahan, Shiraz and Tehran cities have been suspended,” state media reported.

Israel had said it would retaliate against Iran’s weekend attack, which involved hundreds of drones and missiles in retaliation for a suspected Israeli strike on its embassy compound in Syria. Most of the Iranian drones and missiles were downed before reaching Israeli territory.

The semiofficial Fars news agency reported on the sound of explosions over Isfahan near its international airport. It offered no explanation for the blast.

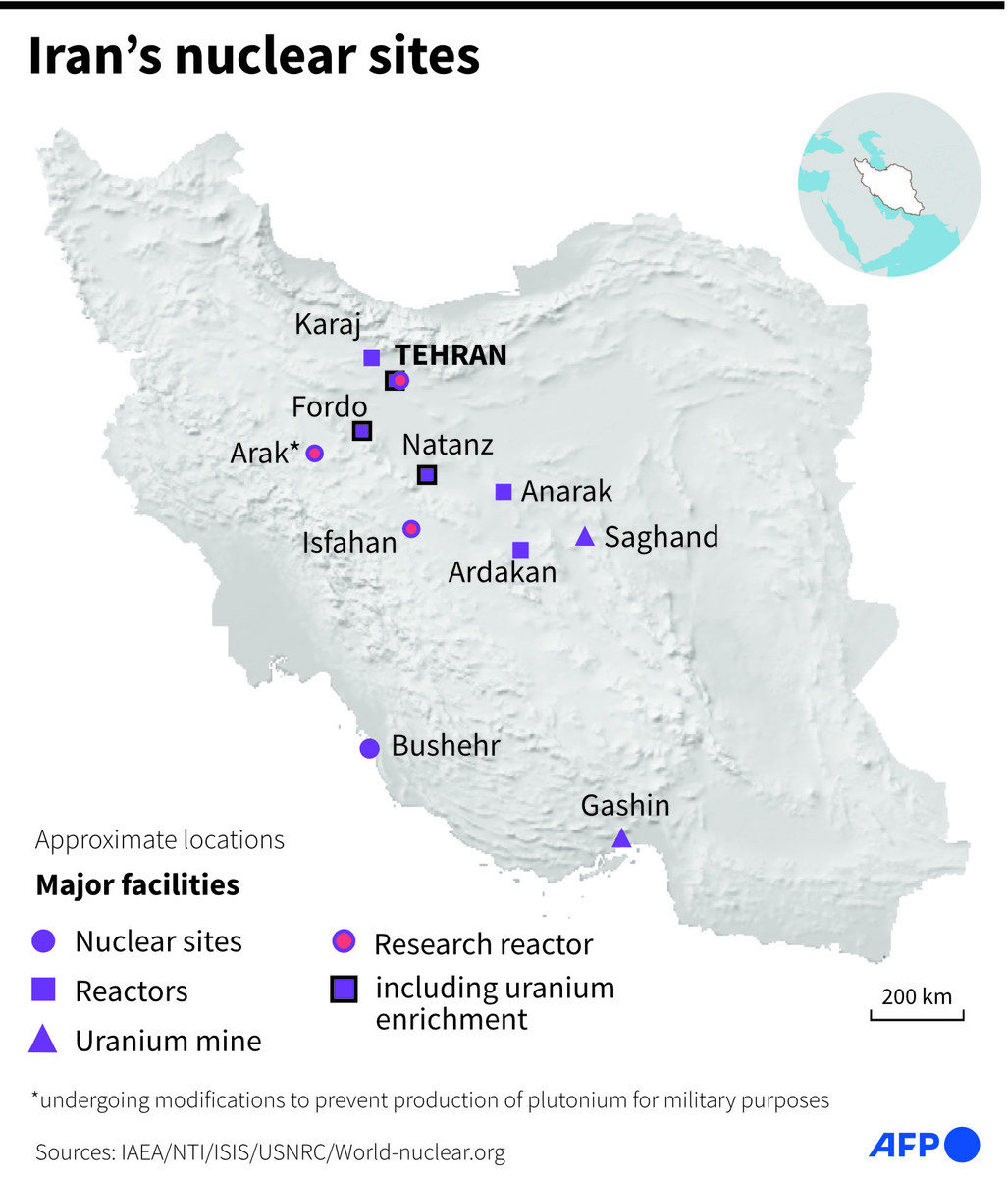

Several Iranian nuclear sites are located in Isfahan province, including Natanz, centerpiece of Iran’s uranium enrichment program. Isfahan, Isome 350 kilometers (215 miles) south of Iran’s capital, Tehran, is also home to a major air base for the Iranian military.

Unconfirmed posts on social media were saying at least seven Iranian cities were hit by strikes.

Iran’s government offered no immediate comment. The Israeli military did not immediately respond to a request for comment.

The state-run IRNA news agency reported that Iran fired air defense batteries early Friday morning across several provinces after reports of explosions near the city of Isfahan.

It did not elaborate on what caused the batteries to fire, though people across the area reported hearing the sounds.

The semiofficial Fars and Tasnim news agencies reported the sound of blasts, without giving a cause. State television acknowledged “loud noise” in the area.

Hossein Dalirian, a spokesman for Iran’s civilian space program, said on the X social media platform that several small “quadcopter” drones had been shot down. It wasn’t immediately clear where that happened or if it was part of the ongoing incident in Iran.

Meanwhile in Iraq where a number of Iranian-backed militias are based, residents in Baghdad reported hearing sounds of explosions, but the source of the noise was not immediately clear.

In Syria, a local activist group said strikes hit an army position in the south of the country Friday.

“There were strikes on a Syrian army radar position,” said Rayan Maarouf, who runs the Suwayda24 anti-government website that covers news from Sweida province in the south.

Iranian military positions in Syria had been frequently targetted by Israeli air strikes over the past years. Early this month, an Israeli strike demolished a consular building annex of the Iranian Embassy in Sydia's capital Damascus, killing 13 people, including two generals of Iran's Revolutionary Guards, triggering the Iranian missiles and drones attack on Israel on April 13.

At the United Nations Security Council on Thursday, Iran urged member nations that Israel “must be compelled to stop any further military adventurism against our interests” as the UN secretary-general warned that the Middle East was in a “moment of maximum peril.”

Israel had said it was going to retaliate against Iran’s April 13 missile and drone attack.

Analysts and observers have been raising concerns about the risks of the Israel-Gaza war spreading into the rest of the region.

Oil prices and jumped on the reports of the Israeli strike. Brent crude futures rose 2 percent to $88.86 a barrel, the dollar gained broadly, gold rose 1 percent and S&P 500 futures dropped 1 percent.

Israel’s assault on Gaza began after Palestinian Islamist group Hamas attacked Israel on Oct. 7, killing 1,200, according to Israeli tallies.

Israel’s military offensive has killed over 33,000 Palestinians in Gaza, according to the local health ministry.

Iran-backed groups have declared support for Palestinians, launching attacks from Lebanon, Yemen and Iraq.

Authors withdraw from PEN America Literary Awards in protest against stance on Gaza

- 30 writers sign open letter criticizing organization for its ‘failure to confront the genocide of the Palestinian people and defend our fellow writers in Gaza’

- They call on its CEO, Suzanne Nossel, its president, Jennifer Finney Boylan, and the entire executive committee to resign

DUBAI: Thirty authors and translators have signed an open letter to PEN America in which they declined, or withdrew their work from consideration for, the organization’s 2024 Literary Awards, in protest against its “failure to confront the genocide of the Palestinian people and defend our fellow writers in Gaza.”

In the letter, sent to the board of trustees this week, the writers said they “wholeheartedly reject PEN America and its failure to confront the genocide in Gaza” and demanded the resignations of the organization’s CEO, Suzanne Nossel, its president, Jennifer Finney Boylan, and its entire executive committee.

The signatories include the co-founder of the PEN World Voices Festival, Esther Allen, as well as Joseph Earl Thomas, Kelly X. Hui, Nick Mandernach, Alejandro Varela, Maya Binyam and Julia Sanches.

Allen this month said she had declined the PEN/Ralph Manheim Award for Translation. She posted a message on social media platform X on April 5 in which she said she had done so in solidarity with more than 1,300 writers who had criticized PEN America for its silence “on the genocidal murder of Palestinians,” and “in celebration and memory of, and in mourning for, all the Palestinians silenced forever by US-backed Israeli forces.”

Similarly, Binyam recently withdrew her debut novel “Hangman” from consideration for the PEN/Jean Stein and PEN/Hemingway awards.

In an email to PEN America, a copy of which she posted on X on April 11, she said she considered it “shameful that this recognition (of her work) should exist under the banner of PEN America, whose leadership has been steadfast in its dismissal of the ongoing genocide, and of the historic struggle for Palestinian liberation.”

In their open letter this week, the signatories said: “Writers have a responsibility to be good stewards of history in order to be good stewards of our communities.”

They added that they “stand in solidarity with a free Palestine,” and refuse “to be honored by an organization that acts as a cultural front for American imperialism” or “take part in celebrations that will serve to overshadow PEN’s complicity in normalizing genocide.”

In response, PEN America said: “Words matter and this letter deserves close scrutiny for its alarming language and characterizations.

“The current war in Gaza is horrific. But we cannot agree that the answer to its wrenching dilemmas and consequences lies in a shutting down of conversation and the closing down of viewpoints.

“We respect all writers for acting out of their consciences and will continue in our mission to defend their freedom to express themselves.”

The awards are due to be handed out during a ceremony on April 29 in Manhattan.