WASHINGTON: The US has formally told the World Trade Organization (WTO) that it opposes granting China market economy status, a position that if upheld would allow Washington to maintain high anti-dumping duties on Chinese goods.

The statement of opposition, made public on Thursday, was submitted as a third-party brief in support of the EU in a dispute with China that could have major repercussions for the trade body’s future.

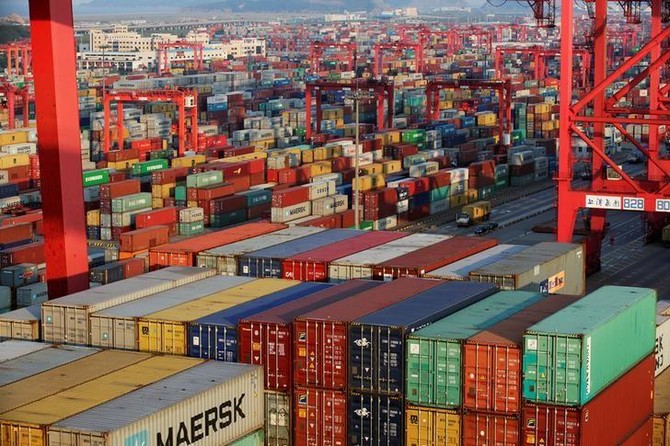

China is fighting the EU for recognition as a market economy, a designation that would lead to dramatically lower anti-dumping duties on Chinese goods by prohibiting the use of third-country price comparisons.

The US and EU argue that the state’s pervasive role in the Chinese economy, including rampant granting of subsidies, mean that domestic prices are deeply distorted and not market-determined.

A victory for China before the WTO would weaken many countries’ trade defenses against a flood of cheap Chinese goods, putting the viability of more western industries at risk.

US Trade Representative Robert Lighthizer told Congress in June that the case was “the most serious litigation we have at the WTO right now” and a decision in China’s favor “would be cataclysmic for the WTO.”

Lighthizer has repeatedly expressed frustration with the WTO’s dispute settlement body and has called for major changes at the organization.

The USTR brief, which follows a Commerce Department finding in October that China fails the tests for a market economy, argues that China should not automatically be granted market economy by virtue of the expiration of its 2001 accession protocol last year.

“The evidence is overwhelming that WTO members have not surrendered their longstanding rights ... to reject prices or costs that are not determined under market economy conditions in determining price comparability for purposes of anti-dumping comparisons,” the brief concludes.

The move comes as trade tensions between Washington and Beijing are increasing as the Trump administration prepares several possible major trade actions, including broad tariffs or quotas on steel and aluminum and an investigation into Chinese intellectual property misappropriation.

Chinese Foreign Ministry spokesman Geng Shuang told a regular news briefing on Friday that some countries were trying to “skirt their responsibility” under WTO rules.

“We again urge relevant countries to strictly honor their commitment to international principles and laws, and fulfill their agreed upon international pacts,” Geng said.

The Commerce Department on Tuesday launched the first government-initiated anti-dumping and anti-subsidy investigations in decades on Chinese aluminum sheet imports.

US officials say that 16 years of WTO membership has failed to end China’s market-distorting state practices.

“We are concerned that China’s economic liberalization seems to have slowed or reversed, with the role of the state increasing” David Malpass, US Treasury undersecretary for international affairs, told an event in New York on Thursday.

“State-owned enterprises have not faced hard budget constraints and China’s industrial policy has become more and more problematic for foreign firms. Huge exports credits are flowing in non-economic ways that distort markets,” Malpass said.

The brief submitted to the WTO also argues that China should be treated the same way as communist eastern European countries, including Poland, Romania and Hungary were when they joined the WTO’s predecessor organization, the General Agreement on Tariffs and Trade, in the late 1960s and early 1970s.

A senior US official said those countries eventually earned market economy status as evidence of state subsidies and state distortions waned. He added that going forward, WTO members wishing to use third-country price comparisons against Chinese imports would need to keep presenting evidence of economic distortions.

US formally opposes China market economy status at WTO

US formally opposes China market economy status at WTO

Closing Bell: Saudi stocks slip as Tadawul falls 1% amid broad market weakness

RIYADH: Saudi stocks fell sharply on Tuesday, with the Tadawul All Share Index closing down 108.14 points, or 1.03 percent, at 10,381.51.

The broader decline was reflected across major indices. The MSCI Tadawul 30 Index slipped 0.78 percent to 1,378.00, while Nomu, the parallel market index, fell 1 percent to 23,040.79.

Market breadth was strongly negative on the main board, with 237 stocks falling compared to just 24 gainers. Trading activity remained robust, with 164.7 million shares changing hands and a total traded value of SR3.19 billion ($850.6 million).

Among the gainers, SEDCO Capital REIT Fund led, rising 2.73 percent to SR6.77, followed by Chubb Arabia Cooperative Insurance Co., which gained 2.69 percent to SR20.20.

National Medical Care Co. added 1.72 percent to close at SR141.60, while Alyamamah Steel Industries Co. and Thimar Advertising, Public Relations and Marketing Co. advanced 1.57 percent and 1.13 percent, respectively.

Losses were led by Al Masar Al Shamil Education Co., which tumbled 8.36 percent to SR24.65. Raoom Trading Co.fell 6.75 percent to SR64.20, while Alkhaleej Training and Education Co. dropped 6.60 percent to SR18.12 and Naqi Water Co. declined 5.51 percent to SR54.00. Gulf General Cooperative Insurance Co. closed 5.44 percent lower at SR3.65.

On the announcement front, Chubb Arabia Cooperative Insurance Co. signed a multiyear insurance agreement with Saudi Electricity Co. to provide various coverages, expected to positively impact its financial results over the 2025–2026 period. The deal will run for three years and two months and is within the company’s normal course of business.

Meanwhile, Bupa Arabia for Cooperative Insurance Co. announced a one-year health insurance contract with Saudi National Bank, valued at SR330.2 million, covering the bank’s employees and their families from January 2026. Despite the sizable contract, Bupa Arabia shares fell 0.8 percent to close at SR137, weighed down by the broader market weakness.

In contrast, United Cooperative Assurance Co. revealed an extension of its engineering insurance agreement with Saudi Binladin Group for the Grand Mosque expansion in Makkah. The contract value exceeds 20 percent of the company’s gross written premiums based on its latest audited financials and is expected to support results through 2026. However, the stock came under selling pressure, ending the session down 4.51 percent at SR3.39.