LONDON: A new online shopping platform is about to launch in the Kingdom to rival Amazon.

The $1 billion noon.com online shopping platform has just arrived in the UAE and Saudi Arabia will be next.

But which will offer the best value for bargain-deprived Saudi shoppers?

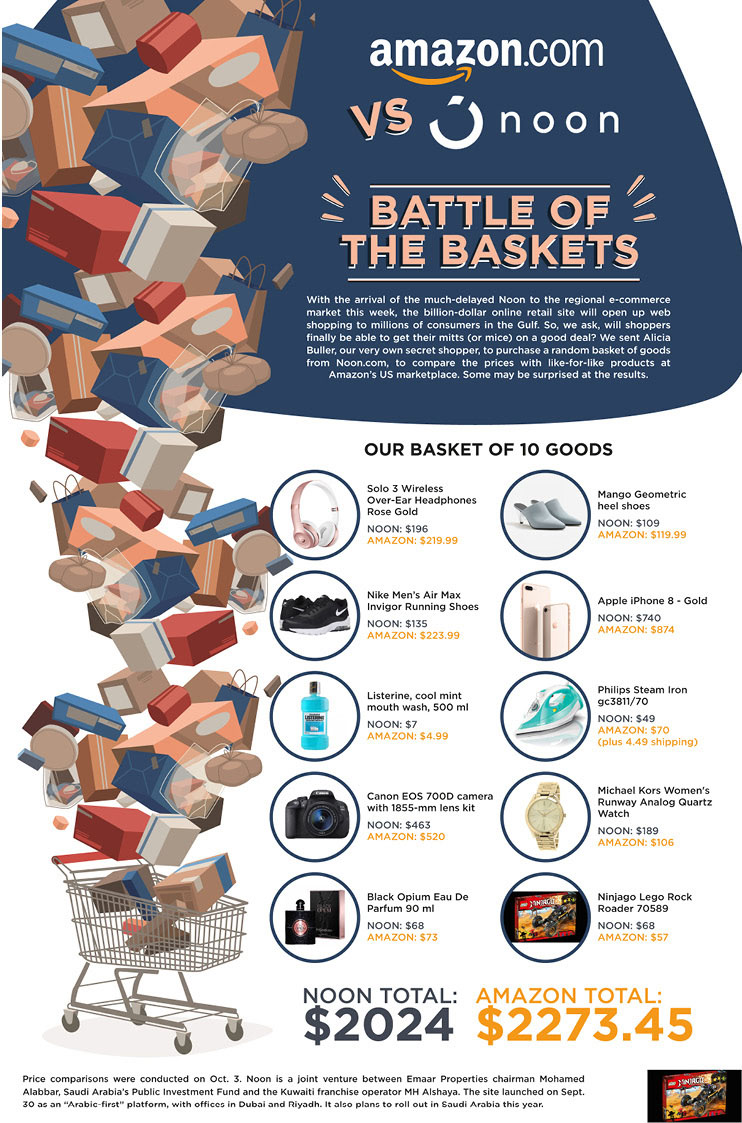

We sent our very own secret shopper to purchase a basket of goods from Noon.com, and compare the prices with like-for-like products at Amazon’s US marketplace.

The Arab News online shopping trolley included 10 items picked at random and including electronics, footwear, phones and toys.

The results reveal that the upstart noon basket came to $2,024 compared — more than 10 percent cheaper than rival Amazon with a total cost of $2,273.45.

But analysts say the difference may be about noon.com stealing a march on its more established global competitor by offering attractive launch discounts.

Still, the arrival of fresh competition is expected to benefit shoppers across the region that have long been denied the online shopping choice of their counterparts in Europe, Asia and North America.

Noon is a joint venture between Emaar Properties chairman Mohamed Alabbar, Saudi Arabia’s Public Investment Fund and the Kuwaiti franchise operator MH Alshaya.

The new site launched on Sept. 30 with offices in Dubai and Riyadh.

Our secret shopper reveals best online bargains for Saudis

Our secret shopper reveals best online bargains for Saudis

Closing Bell: Saudi equities continue 4-day upward trend

RIYADH: Saudi equities closed higher on Wednesday, with the Tadawul All Share Index rising 51.52 points, or 0.47 percent, to finish at 10,945.15.

Trading activity was robust, with 373.9 million shares exchanged and total turnover reaching SR6.81 billion.

The MT30 Index also ended the session in positive territory, advancing 11.93 points, or 0.82 percent, to 1,472.82, while the Nomu Parallel Market Index declined 116.82 points, or 0.49 percent, to 23,551.47, reflecting continued volatility in the parallel market.

The main market saw 90 gainers against 171 decliners, indicating selective buying.

On the upside, Al Kathiri Holding Co. led gainers, closing at SR2.18, up SR0.12, or 5.83 percent. Wafrah for Industry and Development Co. advanced to SR23, gaining SR0.99, or 4.5 percent, while Al Ramz Real Estate Co. rose 4.35 percent to close at SR60.

SABIC Agri-Nutrients Co. added 4.21 percent to SR118.70, and Al Jouf Agricultural Development Co. climbed 4.12 percent to SR45.

Meanwhile, losses were led by Saudi Industrial Export Co., which fell 9.73 percent to SR2.69. United Cooperative Assurance Co. declined 5.08 percent to SR3.74, while Thimar Development Holding Co. dropped 4.54 percent to SR35.30.

Abdullah Saad Mohammed Abo Moati for Bookstores Co. retreated 4.15 percent to SR48.50, and Gulf Union Alahlia Cooperative Insurance Co. slipped 3.96 percent to SR10.44.

On the announcement front, Saudi National Bank announced its intention to issue US dollar-denominated Additional Tier 1 capital notes under its existing international capital programe, with the final size and terms to be determined subject to market conditions and regulatory approvals.

The planned issuance aims to strengthen Tier 1 capital and support the bank’s broader financial and strategic objectives.

The stock closed at SR42.70, gaining SR0.70, or 1.67 percent, reflecting positive investor reaction to the capital management move.

Separately, Almasane Alkobra Mining Co. said its board approved the establishment of a wholly owned simplified joint stock company to provide drilling, exploration and related support services, with a share capital of SR100 million and headquarters in Najran, subject to regulatory approvals.

The new subsidiary aligns with the company’s strategy to enhance operational efficiency and expand its role in the Kingdom’s mining sector.

Shares of Almasane Alkobra Mining closed at SR98.70, up SR0.30, or 0.3 percent, by the end of the session.