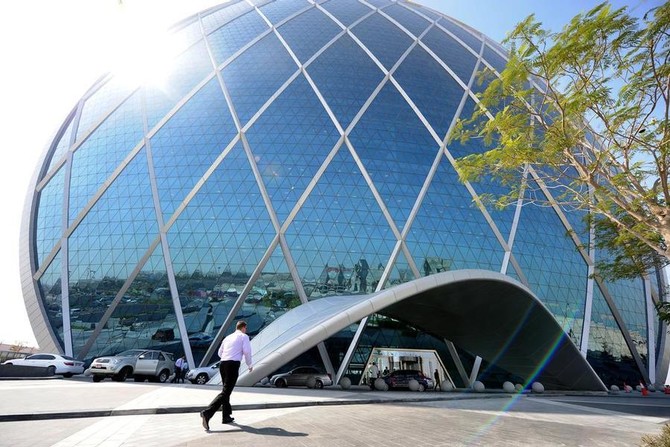

ABU DHABI: Aldar Properties, the builder of Abu Dhabi’s Formula One circuit, reported a 5.6 percent drop in second-quarter profit on Thursday amid a double-digit drop in revenue.

The results come against a backdrop of a slowing economy and property market in the UAE.

Aldar made a net profit attributable to owners of Dh620 million (SR633 million) in the three months to June 30 compared to Dh657.4 million in the same period a year ago, its full financial statement showed.

Earlier in a statement on the company website, Aldar said it made a net profit of Dh620 million in the three months to June 30 compared to Dh654 million in the prior-year period.

SICO Bahrain and EFG Hermes had forecast Aldar would make a quarterly a profit of Dh631.72 million and Dh600 million, respectively.

Aldar’s second-quarter revenues totaled Dh1.35 billion versus Dh1.7 billion in second quarter 2016, down roughly 20 percent.

Four new investments were committed during the first six months of 2017, completing Aldar’s Dh3 billion investment program. Aldar continues to assess opportunities for high-quality assets to grow recurring revenues, it said in a statement.

The company booked lower impairments of Dh6.84 million in second quarter compared to Dh26 million a year ago.

Aldar said it appointed a developer for the Dh1 billion media and entertainment free zone project on Abu Dhabi’s Yas island.

UAE developer Aldar Properties reports lower second-quarter net profit as revenue falls

UAE developer Aldar Properties reports lower second-quarter net profit as revenue falls

Second firm ends DP World investments over CEO’s Epstein ties

- British International Investment ‘shocked’ by allegations surrounding Sultan Ahmed bin Sulayem

- Decision follows in footsteps of Canadian pension fund La Caisse

LONDON: A second financial firm has axed future investments in Dubai logistics giant DP World after emails surfaced revealing close ties between its CEO and Jeffrey Epstein, Bloomberg reported.

British International Investment, a $13.6 billion UK government-owned development finance institution, followed in the footsteps of La Caisse, a major Canadian pension fund.

“We are shocked by the allegations emerging in the Epstein files regarding (DP World CEO) Sultan Ahmed bin Sulayem,” a BII spokesman said in a statement.

“In light of the allegations, we will not be making any new investments with DP World until the required actions have been taken by the company.”

The move follows the release by the US Department of Justice of a trove of emails highlighting personal ties between the CEO and Epstein.

The pair discussed the details of useful contacts in business and finance, proposed deals and made explicit reference to sexual encounters, the email exchanges show.

In 2021, BII — formerly CDC Group — said it would invest with DP World in an African platform, with initial ports in Senegal, Egypt and Somaliland. It committed $320 million to the project, with $400 million to be invested over several years.