DUBAI: Middle East stock markets fell on Tuesday as a tumble by real estate developer DAMAC caused Dubai to break a seven-session rising streak and weak corporate earnings helped to pull down Egypt’s bourse.

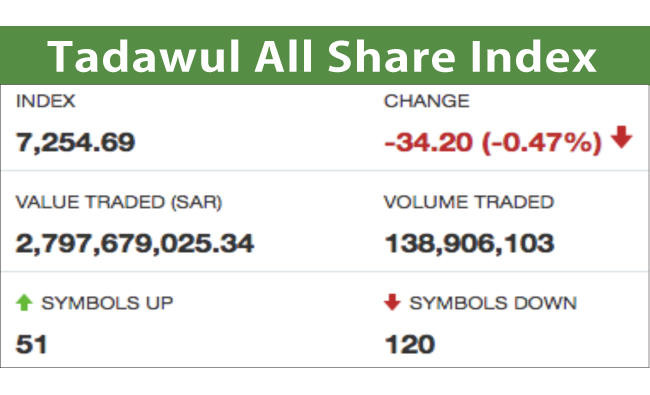

The Tadawul All Share Index (TASI) slipped 0.5 percent. Saudi Kayan rose in early trade but closed 2.1 percent lower after reporting its second-quarter net profit climbed to SR242 million ($64.5 million) from SR97.3 million a year ago; analysts had on average predicted SR212 million.

Qassim Cement fell 0.4 percent after it reported a quarterly profit of SR53.2 million versus SR113.9 million; analysts had on average expected SR66 million.

But National Company for Glass Industries jumped its 10 percent daily limit after reporting a 224 percent leap in quarterly net profit, although operating profit actually fell sharply.

Jouf Cement gained 4.8 percent after shareholders approved a 10 percent capital increase via an issue of bonus shares, to be paid for with the company’s retained earnings.

The Egyptian blue chip index, which had closed at a record high on Monday, sank 1.7 percent in rising turnover — a negative technical sign. The broader EGX100 dropped 1.6 percent.

Ezz Steel plunged 10 percent after it reported a quarterly consolidated net loss after tax and minority interests of 521 million Egyptian pounds ($29.2 million), versus a loss of 137 million pounds a year ago.

The company said it had suffered from a very low rate of capacity utilization because of a working capital shortage after the devaluation of the Egyptian pound; it expects to cover the working capital gap gradually in coming quarters.

Arabian Food Industries slid 5.6 percent after reporting a second-quarter net profit of 12 million pounds, below some analysts’ estimates.

Large-cap Orascom Telecom Media slipped 4.2 percent as its subsidiary Beltone Financial lost 3.6 percent.

In Dubai, the index dropped 0.7 percent to 3,578 points after rising for seven straight sessions through Monday, but it held technical support at 3,573 points, the April peak. DAMAC, which had led the rally, fell back 9 percent in heavy profit-taking.

Qatar’s index slipped 0.5 percent as Masraf Al-Rayan, the second-largest bank by market value, dropped 1.4 percent.

It reported flat quarterly net profit, in line with analysts’ forecasts, suggesting the impact of Qatar’s diplomatic crisis has so far been minor. Customer deposits were 61.21 billion riyals ($16.8 billion) at the end of June, up 5.9 percent from a year earlier but down 3 percent from the previous quarter.

Al-Khalij Commercial Bank, which reported flat first-half earnings, slipped 1.8 percent and Ahli Bank, which reported a 3 percent rise in net profit for the first half, closed flat.

Middle East stock markets slip

Middle East stock markets slip

Saudi minister at Davos urges collaboration on minerals

- The reason of the tension of geopolitics is actually the criticality of the minerals

LONDON: Countries need to collaborate on mining and resources to help avoid geopolitical tensions, Saudi Arabia’s minister of industry and mineral resources told the World Economic Forum on Tuesday.

“The reason of the tension of geopolitics is actually the criticality of the minerals, the concentration in different areas of the world,” Bandar Alkhorayef told a panel discussion on the geopolitics of materials.

“The rational thing to do is to collaborate, and that’s what we are doing,” he added. “We are creating a platform of collaboration in Saudi Arabia.”

The Kingdom last week hosted the Future Minerals Forum in Riyadh. Alkhorayef said the platform was launched by the government in 2022 as a contribution to the global community. “It’s very important to have a global movement, and that’s why we launched the Future Minerals Forum,” he said. “It is the most important platform of global mining leaders.”

The Kingdom has made mining one of the key pillars of its economy, rapidly expanding the sector under the Vision 2030 reform program with an eye on diversification. Saudi Arabia has an estimated $2.5 trillion in mineral wealth and the ramping up of extraction comes at a time of intense global competition for resources to drive technological development in areas like AI and renewables.

“We realized that unlocking the value that we have in our natural resources, of the different minerals that we have, will definitely help our economy to grow to diversify,” Alkhorayef said. The Kingdom has worked to reduce the timelines required to set up mines while also protecting local communities, he added. Obtaining mining permits in Saudi Arabia has been reduced to just 30 to 90 days compared to the many years required in other countries, Alkhorayef said.

“We learned very, very early that permitting is a bottleneck in the system,” he added. “We all know, and we have to be very, very frank about this, that mining doesn’t have a good reputation globally.

“We are trying to change this and cutting down the licensing process doesn’t only solve it. You need also to show the communities the impact of the mining on their lives.”

Saudi Arabia’s new mining investment laws have placed great emphasis on the development of society and local communities, along with protecting the environment and incorporating new technologies, Alkhorayef said. “We want to build the future mines; we don’t want to build old mines.”