BRASILIA: Brazil is primed to show a return to growth, the Central Bank indicated Monday, raising hopes that Latin America’s biggest economy could be inching out of a two-year recession.

The official gross domestic product (GDP) statistic is not published until June 1 but the bank issues a preview called the economic activity index. It showed 1.12 percent growth in the first quarter from the last quarter of 2016.

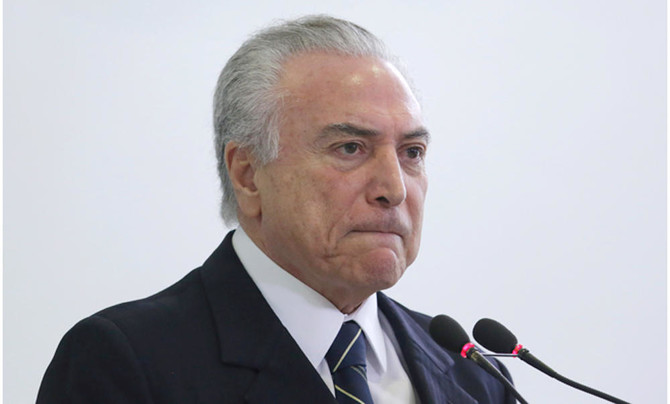

Center-right President Michel Temer’s government has been talking up a slow easing of the economic crisis with a return to growth this year.

“The worst is behind us but I do not want to say that it is over,” said Ignacio Crespo, an economist at Guide Investimentos in Sao Paulo.

The Brazilian economy plunged by 3.8 percent in 2015 and 3.6 percent in 2016, the worst recession on record. This year GDP should grow overall by 0.5 percent, the government says.

Crespo said agriculture would be the mainstay of that tepid recovery, “because the services sector is still very weak and industry has a long way to go.”

Temer, who took over last year after leftist president Dilma Rousseff was impeached, is pushing through reforms to shrink the budget and bring finances under control. His centerpiece, a raising of the minimum retirement age, faces strong opposition.

Despite signs of hope in the economy, unemployment remains at a record 13.7 percent, with more than 14 million people out of work.

Brazil economy expected to show exit from recession

Brazil economy expected to show exit from recession

Closing Bell: Saudi main market sheds 85 points to finish at 11,098

RIYADH: Saudi Arabia’s Tadawul All Share Index closed lower in the latest session, falling 85.79 points, or 0.77 percent, to finish at 11,098.06.

The MSCI Tadawul 30 Index declined 0.63 percent to close at 1,495.23, while the parallel market index Nomu dropped 0.91 percent to 23,548.56.

Market breadth was firmly negative, with 42 gainers against 218 decliners on the main market. Trading activity saw 226 million shares exchanged, with total turnover reaching SR4.5 billion ($1.19 billion).

Among the session’s gainers, Tourism Enterprise Co. rose 9.40 percent to SR15.02. SHL Finance Co. advanced 4.51 percent to SR16.00, while Almasar Alshamil for Education Co. gained 3.56 percent to SR23.88.

Dar Alarkan Real Estate Development Co. added 3.03 percent to SR19.70, and Banque Saudi Fransi climbed 2.61 percent to SR19.30.

On the losing side, Almasane Alkobra Mining Co. recorded the steepest decline, falling 6.61 percent to SR96.

Al Moammar Information Systems Co. dropped 5.14 percent to SR164.20, while National Company for Learning and Education declined 4.60 percent to SR124.30. Saudi Ceramic Co. slipped 4.14 percent to SR27.30, and Arabian Contracting Services Co. fell 4.12 percent to SR116.50.

On the announcement front, Saudi Telecom Co. announced the distribution of interim cash dividends for the fourth quarter of 2025 in line with its approved dividend policy.

The company will distribute SR2.74 billion, equivalent to SR0.55 per share, to shareholders for the quarter.

The number of shares eligible for dividends stands at approximately 4.99 billion shares. The eligibility date has been set for Feb. 23, with distribution scheduled for March 12.

The company noted that treasury shares are not entitled to dividends and that payments will be made through Riyad Bank via direct transfer to shareholders’ bank accounts. stc shares last traded at SR44.80, unchanged on the session.

Separately, National Environmental Recycling Co., known as Tadweer, reported its annual financial results for the year ended Dec. 31, 2025, posting significant growth in revenue and profit.

Revenue rose 53.5 percent year on year to SR1.24 billion, compared with SR806 million in the previous year. Net profit attributable to shareholders increased 68.4 percent to SR60.9 million, up from SR36.2 million a year earlier, driven by higher sales volumes and operational expansion.

Tadweer shares last traded at SR3.80, up 2.70 percent.