WASHINGTON: As the US Presidential race heads into the final stretch less than a week before the vote on Tuesday, excitement and organizational strengths are reshaping the Arab-American vote. However, the question remains if they could tip the balance in the race between Republican nominee Donald Trump and Democratic rival Hillary Clinton in key battleground states.

From phone banking to canvassing and participating in state, and legislative races, the Arab-American vote is no longer a dormant block in US politics. The “Yalla Vote” (Let’s Vote) campaign, “Ammu Sam” (Uncle Sam) wearing a Kaffiyah poster, and a signature “Arab American” logo from the Clinton campaign embody the level of organization and turnout push among more than a million and a half Arab-Americans living the US today.

High visibility and participation

The visibility and increased participation by Arab-Americans in this election is no surprise for James Zogby, the founder and president of the Arab American Institute that has launched the “Yalla Vote” campaign in 1998, with repeated successes in 2008, 2012 and today. Zogby tells Arab News that percentage of Arab-Americans voting and getting involved in the election is “higher than the average population as a whole.”

This year especially, Zogby points out to a robust effort in Michigan where Dearborn could get its first Arab-American state representative. He says that with Arab-Americans making 5 percent of the population in Michigan, and in a tight race between Clinton and Trump in the state, the participation and turnout could tip the scale for either candidate on Tuesday.

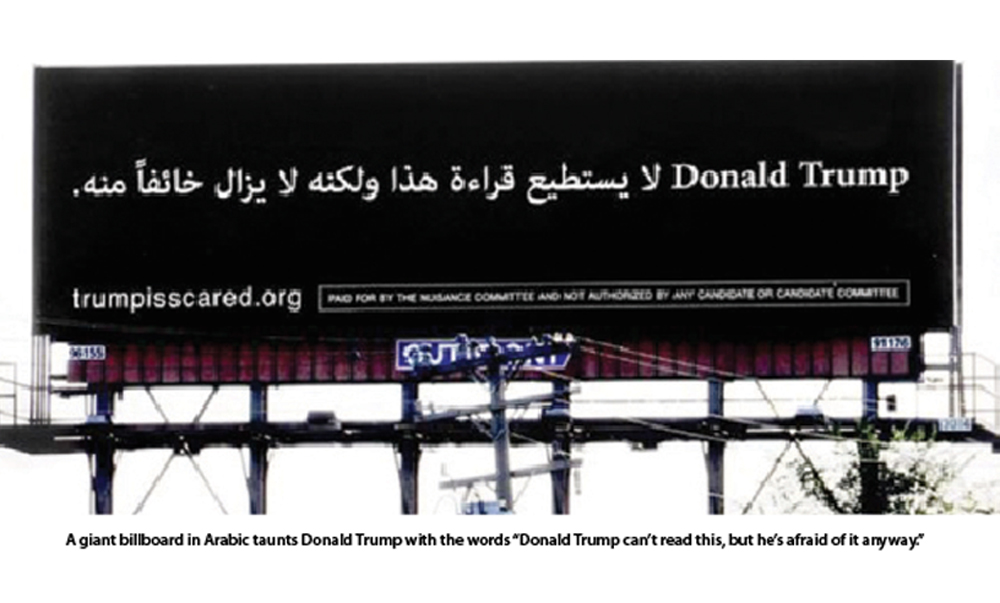

Illustrating the significance of the Arab-American vote in Michigan, a giant billboard in Arabic taunting Trump with the words “Donald Trump can’t read this, but he’s afraid of it anyway” is over a major Dearborn highway. In an election that was interjected by the Republican nominee Donald Trump’s suggested ban on Muslims and incidents of discrimination and rising anti-Arab and Islamophobic sentiment, the community sees a lot at stake in the outcome.

Advantage Democrats

Zogby who has closely studied the Arab-American vote over the last three decades, sees the shift from voting Republican (2000 and prior) to a ratio of 2-1 for Democrats today as the most interesting phenomena when discussing the community’s impact in 2016.

In a survey conducted by Zogby Analytics earlier this month, this shift toward Democrats is evident. Hillary Clinton tops Donald Trump among likely Arab-American voters 60 percent to 26 percent. Zogby reads these numbers as consolidating the trend for Democrats in the community and that “it is not a fluke” after the Obama years. In the same poll, 88 percent of Arab-American millennials say they are planning to vote, favoring Clinton to Trump in a 57 percent-26 percent ratio.

This support is not particularly driven by enthusiasm toward Clinton, with one-third supporting the former secretary of state as a way of casting a ballot against Trump. Nevertheless, the issues that take priority in the community, explains why it has leaned for Democrats. Jobs and the economy lead Arab-Americans’ priorities in this race, followed by gun violence. The issue of discrimination is also front and center in polling the community, whereby 8 out of 10 Arab-Americans of Muslim background voice concerns. This is also visible in the ground participation of Arab-Americans in the Democratic campaigns.

While former Democratic candidate Bernie Sanders has brought forward a strong outreach to the community with a more pro-Palestinian and anti-war message, an army of Arab-American and Muslim volunteers has continued the outreach in the Clinton campaign.

Zogby underscores the importance of geography when noting the Arab-American influence in this race. He estimates, besides the 5 percent in Michigan, a 1.5 percent-2 percent in Ohio and Pennsylvania, and a concentrated number in Florida, Virginia, and Minnesota. It is highly unlikely that either candidate can clinch the Presidency without winning some of these states.

More than anything, the 2016 race will be decided by turnout. “It is a turnout game,” says Zogby, and in that game, the “Yalla Vote” T-shirts and Arabic logos will be a testimony to the community’s engagement and participation which will continue beyond next Tuesday.

Arab-Americans shout ‘Yalla Vote,’ but will they make a difference?

Arab-Americans shout ‘Yalla Vote,’ but will they make a difference?

India’s wealthy embrace a new luxury symbol: water

- Tap water in India is not fit for human consumption

- Wealthy opt for premium water as wellness craze boosts industry

NEW DELHI: At an Indian gourmet food store, Avanti Mehta is organizing a blind tasting of drinks sourced from France, Italy and India. No, this isn’t wine, it’s water.

Participants use tiny shot glasses to check the minerality, carbonation and salinity in samples of Evian from the French Alps, Perrier from southern France, San Pellegrino from Italy and India’s Aava from the foothills of the Aravalli mountains.

“They will all taste different ... you should be choosing a water that can give you some sort of nutritional value,” said Mehta, who is 32 and calls herself India’s youngest water sommelier, a term usually associated with premium wine. Her family owns the Aava mineral water brand. Premium water is a $400 million business in the world’s most populous nation and is growing bigger as its wealthy see it as a new status symbol that fits in with a spreading wellness craze.

Premium Indian mineral water costs around $1 for a one-liter bottle, while imported brands are upwards of $3, or 15 times the price of the country’s lowest-priced basic bottled water.

Clean water is a privilege in the country of 1.4 billion people where researchers say 70 percent of the groundwater is contaminated. Tap water remains unfit to drink, and 16 people died in Indore city after consuming contaminated tap water in December.

Many in India see bottled water as a necessity and standard 20 US-cent bottles are available widely at convenience stores, restaurants and hotels. The market is worth nearly $5 billion annually and is set to grow 24 percent a year — among the fastest in the world.

Bottled water demand in United States or China is driven by convenience, making it a $30 billion-plus market in each country which will grow just 4-5 percent each year, Euromonitor says.

In India, the premium water segment is leading the surge in demand, accounting for 8 percent of the bottled water market last year compared to just 1 percent in 2021, Euromonitor said.

“Distrust of municipal water in some areas has escalated the demand for bottled water. Now, people understand how mineral water has more health benefits. It’s expensive, but the category will boom,” said Amulya Pandit, a senior consultant at Euromonitor specializing in the drinks market.

Among its consumers are New Delhi-based real estate developer B.S. Batra, who says his family uses only premium water at home to get more minerals and safeguard health.

“You feel different, more energetic during the day,” said Batra, 49, an avid badminton player.

“I consume mineral water even with whisky at home, and kids use it for their smoothies.”

WATER LURES BOLLYWOOD STAR, WEALTHY

The popular 20-cent plastic bottled water is mainly made by Pepsi, Coca-Cola and Indian market leader Bisleri. In addition, Indians who can afford it, install purifiers in their homes which clean the water but also remove most minerals.

Imported and local premium waters are luring wealthy consumers and businesses alike.

Bollywood star Bhumi Pednekar and her sister have launched Backbay — selling 750 ml cartons of mineral water for $2.2; Indian conglomerate Tata is expanding its premium water portfolio, and retailers and businesses are reporting higher sales.

Tata Consumer Products, also Starbucks’ partner in India, sells 20-cent bottled water, but premium water is its priority as it sees affluent, health-focused consumers willing to spend on the drink without worrying about the price, CEO Sunil D’Souza said in an interview.

“I don’t have to push water uphill...I see a long, long, long runway for the business,” he said.

Tata’s premium “Himalayan” mineral water factory — which a Reuters photographer visited — is located in the foothills of the Himalayan range in Himachal Pradesh state. Workers there largely keep a hands-free watch on machines filling plastic and glass bottles with water sourced from a natural underground aquifer.

LOOKING FOR SPRINGS

Most Indians prefer still water, and the sparkling variant remains niche. Tata said it plans to launch a sparkling Himalayan water, and is also scouting for natural springs for expanding its other offerings. At three Foodstories Indian gourmet stores, sales of premium waters tripled in 2025. Customer demand prompted the chain to import “light and creamy” Saratoga Spring Water from New York, which costs 799 rupees ($9) for a 355-milliliter (12-fluid-ounce) bottle, and stocks sold out within days, said co-founder Avni Biyani.

Indian mineral water brand Aava’s sales touched a record 805 million rupees ($9 million) last year, growing 40 percent a year since 2021. Tata said its basic and premium water portfolio will grow 30 percent a year, after growing tenfold to $65 million in six years.

Imported waters, which attract an over 30 percent tax, are pricier than Indian brands. Nestle’s Perrier and San Pellegrino, and Danone’s Evian retail for over 300 rupees, or $3.20, for a 750 ml bottle.

Nestle declined to comment, while Danone said the Indian bottled water market was growing at a “robust” pace but imported waters “tend to be niche and boutique.”

“When you open your tap, you’re not getting an Aava, Evian ... And that is what you’re essentially paying for,” said water sommelier Mehta.

At the water tasting session, some participants said they enjoyed the experience but many found the price hard to swallow.

“To be honest, it is kind of expensive,” said executive Hoshini Vallabhaneni, one of 14 people at the event. “For everyday use — it will burn a hole in the pocket.” (Reporting by Aditya Kalra in New Delhi and Rishika Sadam in Hyderabad; Additional reporting by Alexander Marrow in London and Anushree Fadnavis in Himachal Pradesh; Editing by Raju Gopalakrishnan)

Participants use tiny shot glasses to check the minerality, carbonation and salinity in samples of Evian from the French Alps, Perrier from southern France, San Pellegrino from Italy and India’s Aava from the foothills of the Aravalli mountains.

“They will all taste different ... you should be choosing a water that can give you some sort of nutritional value,” said Mehta, who is 32 and calls herself India’s youngest water sommelier, a term usually associated with premium wine. Her family owns the Aava mineral water brand. Premium water is a $400 million business in the world’s most populous nation and is growing bigger as its wealthy see it as a new status symbol that fits in with a spreading wellness craze.

Premium Indian mineral water costs around $1 for a one-liter bottle, while imported brands are upwards of $3, or 15 times the price of the country’s lowest-priced basic bottled water.

Clean water is a privilege in the country of 1.4 billion people where researchers say 70 percent of the groundwater is contaminated. Tap water remains unfit to drink, and 16 people died in Indore city after consuming contaminated tap water in December.

Many in India see bottled water as a necessity and standard 20 US-cent bottles are available widely at convenience stores, restaurants and hotels. The market is worth nearly $5 billion annually and is set to grow 24 percent a year — among the fastest in the world.

Bottled water demand in United States or China is driven by convenience, making it a $30 billion-plus market in each country which will grow just 4-5 percent each year, Euromonitor says.

In India, the premium water segment is leading the surge in demand, accounting for 8 percent of the bottled water market last year compared to just 1 percent in 2021, Euromonitor said.

“Distrust of municipal water in some areas has escalated the demand for bottled water. Now, people understand how mineral water has more health benefits. It’s expensive, but the category will boom,” said Amulya Pandit, a senior consultant at Euromonitor specializing in the drinks market.

Among its consumers are New Delhi-based real estate developer B.S. Batra, who says his family uses only premium water at home to get more minerals and safeguard health.

“You feel different, more energetic during the day,” said Batra, 49, an avid badminton player.

“I consume mineral water even with whisky at home, and kids use it for their smoothies.”

WATER LURES BOLLYWOOD STAR, WEALTHY

The popular 20-cent plastic bottled water is mainly made by Pepsi, Coca-Cola and Indian market leader Bisleri. In addition, Indians who can afford it, install purifiers in their homes which clean the water but also remove most minerals.

Imported and local premium waters are luring wealthy consumers and businesses alike.

Bollywood star Bhumi Pednekar and her sister have launched Backbay — selling 750 ml cartons of mineral water for $2.2; Indian conglomerate Tata is expanding its premium water portfolio, and retailers and businesses are reporting higher sales.

Tata Consumer Products, also Starbucks’ partner in India, sells 20-cent bottled water, but premium water is its priority as it sees affluent, health-focused consumers willing to spend on the drink without worrying about the price, CEO Sunil D’Souza said in an interview.

“I don’t have to push water uphill...I see a long, long, long runway for the business,” he said.

Tata’s premium “Himalayan” mineral water factory — which a Reuters photographer visited — is located in the foothills of the Himalayan range in Himachal Pradesh state. Workers there largely keep a hands-free watch on machines filling plastic and glass bottles with water sourced from a natural underground aquifer.

LOOKING FOR SPRINGS

Most Indians prefer still water, and the sparkling variant remains niche. Tata said it plans to launch a sparkling Himalayan water, and is also scouting for natural springs for expanding its other offerings. At three Foodstories Indian gourmet stores, sales of premium waters tripled in 2025. Customer demand prompted the chain to import “light and creamy” Saratoga Spring Water from New York, which costs 799 rupees ($9) for a 355-milliliter (12-fluid-ounce) bottle, and stocks sold out within days, said co-founder Avni Biyani.

Indian mineral water brand Aava’s sales touched a record 805 million rupees ($9 million) last year, growing 40 percent a year since 2021. Tata said its basic and premium water portfolio will grow 30 percent a year, after growing tenfold to $65 million in six years.

Imported waters, which attract an over 30 percent tax, are pricier than Indian brands. Nestle’s Perrier and San Pellegrino, and Danone’s Evian retail for over 300 rupees, or $3.20, for a 750 ml bottle.

Nestle declined to comment, while Danone said the Indian bottled water market was growing at a “robust” pace but imported waters “tend to be niche and boutique.”

“When you open your tap, you’re not getting an Aava, Evian ... And that is what you’re essentially paying for,” said water sommelier Mehta.

At the water tasting session, some participants said they enjoyed the experience but many found the price hard to swallow.

“To be honest, it is kind of expensive,” said executive Hoshini Vallabhaneni, one of 14 people at the event. “For everyday use — it will burn a hole in the pocket.” (Reporting by Aditya Kalra in New Delhi and Rishika Sadam in Hyderabad; Additional reporting by Alexander Marrow in London and Anushree Fadnavis in Himachal Pradesh; Editing by Raju Gopalakrishnan)

© 2026 SAUDI RESEARCH & PUBLISHING COMPANY, All Rights Reserved And subject to Terms of Use Agreement.