JEDDAH: The private sector was able to improve annual hiring of Saudi nationals from an average of 64,000 between 2006 and 2010, to 92,000 between 2011 and 2014, according to a report from Jadwa Investment.

Between 2006 and 2014, the number of total jobs created in the private sector (for both Saudis and non-Saudis) was, on average, 214,000 per year, it added.

“This excludes 2010 as we believe the employment growth from that year to be inconsistent with the long-term trend,” said the Jadwa researchers, who compiled the report titled — Saudi labor market outlook: Current and long-term challenges.

The report looks into data for the period 2005 — H1 2015 and analyzes the dynamic trends in the Saudi labor market.

The Saudi unemployment rate fell slightly to 11.6 percent during the first half of 2015, despite year-on-year growth in total Saudi employment continuing to fall to 1.1 percent, said the report.

The slower growth in total Saudi employment was mainly due to slower hiring levels in the public sector, while Saudi employment growth in the private sector remained healthy, added the Jadwa report.

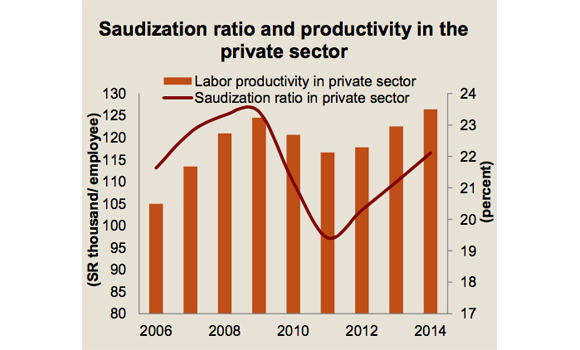

It said that 2014 full year data showed that the increase in Saudi employment and Saudization in the private sector was associated with positive growth in labor productivity in the sector.

Looking forward, the economists forecast three scenarios for employment of Saudi nationals in the private sector These three scenarios correspond to three different Saudi unemployment rates by 2025:

* A high Saudi employment growth scenario yielding zero percent Saudi unemployment, which corresponds to the Ministry of Economy and Planning’s (MEP) long-term strategy.

* A baseline Saudi employment growth scenario yielding 6 percent Saudi unemployment by 2025.

* A no-action scenario yielding 16.9 percent Saudi unemployment rate.

The report also said that 2014 data from the General Organization for Social Insurance (GOSI) showed a narrowing gap in wage differentials between Saudis and non-Saudis in the private sector. However, the differential remains sub-standard.

According to the data, average monthly wages for Saudis in the private sector increased from SR5,171 in 2013 to SR5,519 in 2014 (6.7 percent, year-on-year), while wages for non-Saudis increased from SR1,489 to SR1,636 (12.2 percent, year-on-year) during the same period. Data from the Ministry of Labor (MOL) shows a similar trend.

Official data shows that while private sector employment growth of Saudi nationals slowed slightly from 7.3 percent in 2013 to 6.8 percent in 2014, growth in public sector employment of Saudis fell from 7.2 percent to 3.3 percent during the same period, its lowest in six years.

The number of Saudi workers in the public sector reached 3.3 million in 2014, up from 3.2 million in 2013. However, the slower employment growth relative to the private sector has led to a falling proportion in public sector employment of Saudi nationals. This slower growth has also meant that the sector’s contribution toward overall employment growth of Saudis was now lower than that of the private sector.

As for the private sector, the Saudization ratio stood at 22.1 percent in 2014, meaning that the remaining 77.9 percent of jobs were held by non-Saudis.

Between 2006 and 2014, the number of total jobs created in the private sector (for both Saudis and non-Saudis) was, on average, 214,000 per year.

“This excludes 2010 as we believe the employment growth from that year to be inconsistent with the long-term trend,” said the report.

“As for our forecasted period, we assume the annual number of jobs to be created by the private sector (for both Saudis and non-Saudis) to reach 265,000,” it added.

Despite the higher forecast number of annual jobs, the growth rate is actually lower. This is in part due to a higher base.

“Our forecast for lower growth in private sector employment (for both Saudis and non-Saudis) is because we believe the actual employment from the period 2006-2014 to be on the high end,” said the report.

We believe this is in part due to the sweeping labor market measures undertaken by the Ministry of Labor between 2011 and 2013.

Saudi employment growth in private sector remains healthy

Saudi employment growth in private sector remains healthy

Closing Bell: Saudi main index closes higher at 10,596

RIYADH: Saudi equities closed higher on Tuesday, with the Tadawul All Share Index rising 43.59 points, or 0.41 percent, to finish at 10,595.85, supported by broad-based buying and strength in select mid-cap stocks.

Market breadth was firmly positive, with 170 stocks advancing against 90 decliners, while trading activity saw 161.96 million shares change hands, generating a total value of SR3.39 billion.

Meanwhile, the MT30 Index closed higher, gaining 6.52 points, or 0.47 percent, to 1,399.11, while the Nomu Parallel Market Index edged marginally lower, slipping 3.33 points, or 0.01 percent, to 23,267.77.

Among the session’s top gainers, Al Masar Al Shamil Education Co. surged 9.99 percent to close at SR26.20, while Saudi Cable Co. jumped 9.98 percent to SR147.70.

Cherry Trading Co. rose 4.18 percent to SR25.44, and United Carton Industries Co. advanced 4.09 percent to SR26.46.

Al Yamamah Steel Industries Co. also posted solid gains, climbing 4.07 percent to end at SR32.70.

On the downside, Emaar The Economic City led losses, slipping 3.55 percent to SR10.32, followed by Derayah REIT Fund, which fell 2.92 percent to SR5.31.

Derayah Financial Co. declined 2.13 percent to SR26.62, while United International Holding Co. retreated 1.96 percent to SR155.20, and Gulf Union Alahlia Cooperative Insurance Co. eased 1.92 percent to SR10.70.

On the announcements front, Red Sea International Co. said it signed a SR202.8 million contract with Webuild S.P.A. to provide integrated facilities management services for the Trojena project at Neom.

The agreement covers operations and maintenance for the project’s Main Camp and Spike Camp, including accommodation and housekeeping, catering, security, IT and communications, utilities, waste management, fire safety and emergency response, as well as other supporting services.

The contract runs for two years, with the financial impact expected to begin in the first quarter of 2026. Shares of Red Sea International closed up 0.99 percent at SR34.74.

Al Moammar Information Systems Co. disclosed that it received an award notification from Humain to design and build a data center dedicated to artificial intelligence technologies, with a total value exceeding 155 percent of the company’s 2024 revenue, inclusive of VAT.

The contract is expected to be formally signed in February 2026, underscoring the scale of the project and its potential impact on the company’s future revenues.

MIS shares ended the session 2.82 percent higher at SR156.70, reflecting positive investor sentiment following the announcement.