JEDDAH: Following a series of rights issues during 2014 and 2015, many local insurers are now actively choosing to operate at a stronger level of capitalization than in the past, according to a top rating agency.

“We believe gross premiums in Saudi Arabia could rise by nearly 25 percent in 2015, principally fueled by tariff increases, to over SR35 billion ($9.3 billion) for the full year,” said a press release from Standard and Poors Ratings Services.

“We expect the third quarter and 2015 year-end results to confirm the generally improving earnings trend of the past 18 months,” it stated.

“There are still no signs of any of the 34 companies in Saudi Arabia’s crowded insurance sector attempting to overcome legal and financial impediments to mergers and acquisitions,” said the agency.

“Although performance varies considerably among the 34 companies, Standard & Poor’s Ratings Services considers that the general trend is a positive one, encompassing improving tariffs, increasing earnings, enhanced capitalization, and growing total premium volumes,” said the report.

The S&P team explained they they expect the sector’s full-year 2015 gross premiums to be about 25 percent higher than those in 2014, largely because of price increases on the main insurance lines — group medical and motor.

“Growing demand for insurance in the near term, combined with regulatory encouragement of highly prudential “actuarial pricing” after the price war of 2012-2013, means that Saudi Arabia’s insurers are showing few signs of being affected by the fall in oil prices, though the subject of oil revenues remains a central concern at sovereign and macroeconomic levels,” said the report.

“Oil prices may have fallen well below $50 per barrel over the past 12 months — they routinely reached $115 per barrel (Brent Index) in mid-2014 — but Saudi insurers write relatively little commercial or industrial risk business, and retain less,” the report pointed out.

“Consequently, we consider that the strong growth in sector premiums is likely being driven by the demographics of an expanding population. There are some 30 million to 20 million Saudi nationals, plus 10 million foreign workers and dependents, who increasingly require insurance cover for their possessions and travel,” said the S&P report.

“Additionally, many local employers are now offering their Saudi staff access to the same group medical cover that is compulsory for their foreign colleagues,” it added.

Nearly all Saudi insurers are experiencing clear earnings benefits from the improved pricing environment in their single, domestic market.

The often underpriced business written during the 2012-2013 price war is running off and the more attractive margins on more recent business are emerging as profit. This takes time in Saudi Arabia because insurers typically hold sizeable unearned premium reserves and it is compulsory, but often technically redundant, to hold bad and doubtful debt provisions on all premium income deferred by more than 90 days from contract inception, S&P added.

Total results for H2 2015 are likely to comfortably exceed the SR183.2 million of post-tax comprehensive earnings reported for H1 2015, although performance will continue to vary greatly from company to company, according to S&P.

“Many insurers have told us that they have seen robust rate rises of 15 percent — 20 percent or more in 2015. Of Saudi Arabia’s 34 local insurers, 21 reported positive comprehensive net income for the first half of 2015 totaling SR602.0 million, while 13 reported cumulative first half losses of SR418.8 million,” added the report.

In most cases, those companies reporting losses despite the increasingly attractive pricing environment are relatively recent start-up companies such as MetLife, AIG & ANB Cooperative Insurance Co., which commenced active trading in 2014, or health insurance specialist, Saudi Enaya Cooperative Insurance Co., which became operational in 2013 but only wrote SR36.3 million of gross premiums during the first half of 2015.

In such cases, the high fixed costs, charges, and taxes associated with operating in Saudi Arabia will continue to consume pretax income until business volumes and margins rise sufficiently to help generate an overall profit. That said, internal operational and administrative issues have also affected some companies, leading to losses at several longer-established insurers, where the underlying book f business could normally be expected to generate robust earnings in current market conditions.

The report said that Tawuniya, BUPA Arabia, and MedGulf booked a full 52.4 percent of all the premium written in Saudi Arabia during the first half of 2015.

Over the same period, the top 15 insurers wrote SR16.2 billion or 85.2 percent of the sector’s total gross premiums of SR19.0 billion. Little premium was left for the sector’s other 19 companies.

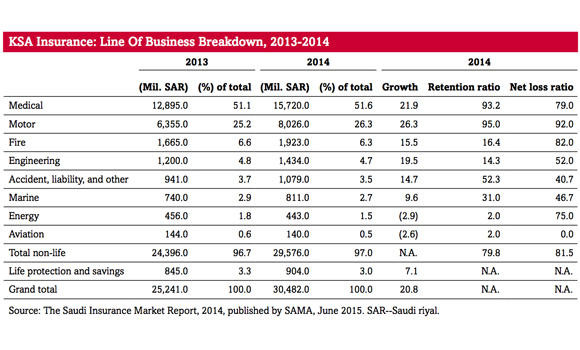

“We do not expect the business breakdown to change much in 2015 and 2016, compared with 2014. In 2014, medical insurance comprised 51.6 percent of the sector’s GPW and 60.2 percent of net premium written, and motor accounted for 26.3 percent of gross and 31.2 percent of net premiums. Thus, these two lines together represented over 90 percent of all net retained business in Saudi Arabia. In our view, primary insurers will continue to cede most of their commercial and industrial exposure to international reinsurers, given the attractive rates and commissions available in the current soft reinsurance market,” S&P said.

Tariff increases and new business to boost Saudi insurance sector

Tariff increases and new business to boost Saudi insurance sector

Open Forum Riyadh to discuss digital currency, AI, and mental health

- The event will run in parallel to the WEF’s Special Meeting on Global Collaboration

LONDON: The Open Forum Riyadh — a series of public sessions taking place in the Saudi capital on Sunday and Monday — will “spotlight global challenges and opportunities,” according to the organizers.

The event, a collaboration between the World Economic Forum and the Saudi Ministry of Economy and Planning, will run in parallel to the WEF’s Special Meeting on Global Collaboration, Growth and Energy for Development, taking place in Riyadh on April 28 and 29.

“Under Saudi Vision 2030, Riyadh has become a global capital for thought leadership, action and solutions, fostering the exchange of knowledge and innovative ideas,” Faisal F. Alibrahim, Saudi minister of economy and planning, said in a press release, adding that this year’s Open Forum being hosted in Riyadh “is a testament to the city’s growing influence and role on the international stage.”

The forum is open to the public and “aims to facilitate dialogue between thought leaders and the broader public on a range of topics, including environmental challenges, mental health, digital currencies, artificial intelligence, the role of the arts in society, modern-day entrepreneurship, and smart cities,” according to a statement.

The agenda includes sessions addressing the impact of digital currencies in the Middle East, the role of culture in public diplomacy, urban development for smart cities, and actions to enhance mental wellbeing worldwide.

The annual Open Forum was established in 2003 with the goal of enabling a broader audience to participate in the activities of the WEF, and has been hosted in several different countries, including Cambodia, India, Jordan and Vietnam.

The panels will feature government officials, artists, civil-society leaders, entrepreneurs, and CEOs of multinationals.

This year’s speakers include Yazeed A. Al-Humied, deputy governor and head of MENA investments at the Saudi Pubic Investment Fund; Princess Reema Bandar Al-Saud, Saudi Arabia’s ambassador to the US; and Princess Beatrice, founder of the Big Change Charitable Trust and a member of the British royal family.

Michele Mischler, head of Swiss public affairs and sustainability at the WEF, said in a press release that the participation of the public in Open Forum sessions “fosters diverse perspectives, enriches global dialogue, and empowers collective solutions for a more inclusive and sustainable future.”

Meituan looks to hire in Saudi Arabia, indicating food delivery expansion

SHANGHAI: Chinese food delivery giant Meituan is seeking to hire staff for at least eight positions based in Riyadh, in a sign it may be looking to Saudi Arabia to further its global expansion ambitions, according to Reuters.

The jobs ads, which is hiring for KeeTa, the brand name Meituan uses for its food delivery operations in Hong Kong, is seeking candidates with expertise in business development, user acquisition, and customer retention, according to posts seen by Reuters on Linkedin and on Middle Eastern jobs site Bayt.com.

Meituan did not immediately respond to a request for comment by Reuters on its plans for Saudi expansion.

Bloomberg reported earlier on Friday that the Beijing-based firm would make its Middle East debut with Riyadh as the first stop.

Since expanding to Hong Kong in May 2023, Meituan’s first foray outside of mainland China, speculation has persisted that its overseas march would continue as the firm searches for growth opportunities, with the Middle East rumored since last year to be one area of possible expansion.

“We are actively evaluating opportunities in other markets,“ Meituan CEO Wang Xing said during a post-earnings call with analysts last month.

“We have the tech know-how and operational know-how, so we are quietly confident we can enter a new market and find an approach that works for consumers there.”

IMF opens first MENA office in Riyadh

RIYADH: The International Monetary Fund has opened its first office the Middle East and North Africa region in Riyadh.

The office was launched during the Joint Regional Conference on Industrial Policy for Diversification, jointly organized by the IMF and the Ministry of Finance, on April 24.

The new office aims to strengthen capacity building, regional surveillance, and outreach to foster stability, growth, and regional integration, thereby promoting partnerships in the Middle East and beyond, according to the Saudi Press Agency.

Additionally, the office will facilitate closer collaboration between the IMF and regional institutions, governments, and other stakeholders, the SPA report noted, adding that the IMF expressed its appreciation to Saudi Arabia for its financial contribution aimed at enhancing capacity development in its member countries, including fragile states.

Abdoul Aziz Wane, a seasoned IMF director with an extensive understanding of the institution and a broad network of policymakers and academics worldwide, will serve as the first director of the Riyadh office.

Saudi minister to deliver keynote speech at Automechanika Riyadh conference

RIYADH: Saudi Arabia’s Deputy Minister of Investment Transaction Saleh Al-Khabti is set to deliver the keynote speech at a global automotive aftermarket industry conference in Riyadh.

Set to be held from April 30 April to May 2 in the Saudi capital’s International Convention and Exhibition Center, Automechanika Riyadh will welcome more than 340 exhibitors from over 25 countries.

Al-Khabti will make the marquee address on the first day of the event, which will also see participation from Aftab Ahmed, chief advisor for the Automotive Cluster at the National Industrial Development Centre, Ministry of Industry and Mineral Resources.

Saudi Arabia’s automotive sector is undergoing a transformation, with the Kingdom’s Public Investment Fund becoming the major shareholder in US-based electric vehicle manufacturer Lucid, and also striking a deal with Hyundai to collaborate on the construction of a $500 million-manufacturing facility.

Alongside this, Saudi Arabia’s Crown Prince Mohammed bin Salman launched the Kingdom’s first electric vehicle brand in November 2022.

Commenting on the upcoming trade show, Bilal Al-Barmawi, CEO and founder of 1st Arabia Trade Shows & Conferences, said: “It is a great honor for Automechanika Riyadh to be held under the patronage of the Saudi Arabian Ministry of Investment, and we’re grateful for their continued support as the event goes from strength-to-strength.

“The insights and support we’ve already received have been invaluable, and we look forward to continuing this relationship throughout the event and beyond.”

This edition of Automechanika Riyadh will feature seven product focus areas, including parts and components, tyres and batteries, and oils and lubricants.

Accessories and customizing, diagnostics and repairs, and body and paint will also be discussed, as well as care and wash.

Aly Hefny, show manager for Automechanika Riyadh, Messe Frankfurt Middle East, said: “The caliber of speakers confirmed to take part at Automechanika Riyadh is a testament to the event’s growth and prominence within the regional automotive market.

“We have developed a show that goes beyond the norm by providing a platform that supports knowledge sharing and networking while promoting the opportunity to engage with key industry experts and hear the latest developments, trends and innovations changing the dynamics of the automotive sector.”

Aramco-backed S-Oil expects Q2 refining margins to remain steady then trend upward

SEOUL: South Korea’s S-Oil forecast on Friday that second-quarter refining margins will be steady, supported by regular maintenance in the region, then trend upward in tandem with higher demand as the summer season gets underway, according to Reuters.

Over the January-March period, the refiner said it operated the crude distillation units at its 669,000-barrel-per-day oil refinery in the southeastern city of Ulsan at 91.9 percent of capacity, compared with 94 percent in October-December.

S-Oil, whose main shareholder is Saudi Aramco, plans to shut its No. 1 crude distillation unit sometime this year for maintenance, the company said in an earnings presentation, without specifying the time.