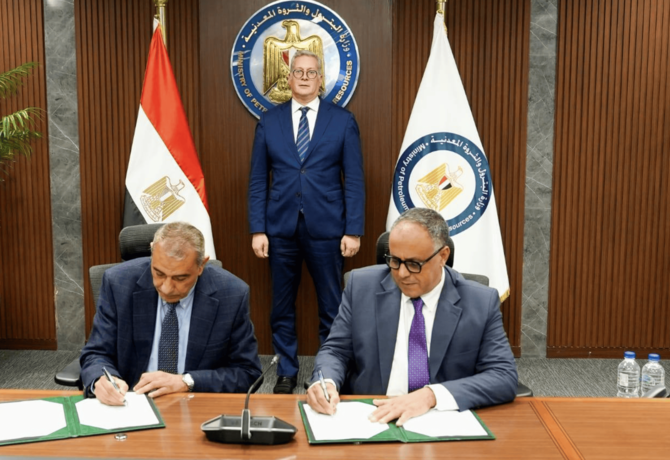

RIYADH: The Egyptian General Petroleum Corp. has signed a $6.5 million oil and gas exploration agreement with UK-based Terra Petroleum, marking the company’s first operations in Egypt.

The agreement aims to drill three wells in the Northwestern El Moghra concession area of the Western Desert, in addition to conducting 2D and 3D seismic surveys, according to a statement.

The deal aligns with Egypt’s Ministry of Petroleum and Mineral Resources’ strategy to boost exploration and production.

It also follows Egypt’s signing of three oil and gas agreements worth more than $121 million with international firms in September, aimed at strengthening the energy sector through new exploration and drilling projects across key hydrocarbon zones

A Facebook post on the official Egyptian Cabinet Presidency page stated: “Following the signing of the agreement, the Minister of Petroleum and Mineral Resources Karim Badawi welcomed the leaders of Terra Petroleum and stressed that this step reflects the confidence of international companies in the investment climate of the Egyptian petroleum sector, given its stability and continuous development.”

It added: “The Ministry is working to provide all aspects of support to serious companies and to provide a stimulating investment environment that contributes to accelerating exploration and production activities and increasing production rates.”

In August 2024, Egypt uncovered a significant new oil deposit in the Western Desert, which officials said could substantially boost the country’s energy production.

The discovery, made at the West Fewebs-1 well in the Kalabsha Development Area, revealed a substantial reserve of high-quality oil.

The find highlighted Egypt’s ongoing efforts to tap its energy potential, particularly in the Western Desert, a region long recognized for its oil and gas prospects.

According to a statement issued at the time, Badawi emphasized the importance of the discovery, noting that the well had already shown promising results.

During the same month, Egypt unveiled a new set of incentives aimed at stimulating exploration and development, increasing output, and reducing the gap between domestic supply and demand.

More than 60 international companies currently operate across 183 exploration and production sites in the Mediterranean Sea, Nile Delta, and Western and Eastern Deserts, as well as Sinai and Upper Egypt, under the oversight of companies affiliated with the Ministry of Petroleum.